by Calculated Risk on 7/17/2010 11:48:00 AM

Saturday, July 17, 2010

Another example of state and local government distress

From Lauren Etter at the WSJ: Roads to Ruin: Towns Rip Up the Pavement

Paved roads ... are being torn up across rural America and replaced with gravel or other rough surfaces as counties struggle with tight budgets and dwindling state and federal revenue. State money for local roads was cut in many places amid budget shortfalls.Back to the stone age ...

Sovereign Debt Series Summary

by Calculated Risk on 7/17/2010 08:24:00 AM

For those that missed any part of the series ...

Part 1: How Large is the Outstanding Value of Sovereign Bonds?

Part 2. How Often Have Sovereign Countries Defaulted in the Past?

Part 2B: More on Historic Sovereign Default Research

Part 3. What are the Market Estimates of the Probabilities of Default?

Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

UPDATE on Sunday: Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

Coming soon: Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange.

Friday, July 16, 2010

A quick summary of the week

by Calculated Risk on 7/16/2010 11:59:00 PM

I'll have the weekly summary on Sunday, but the news flow was definitely downbeat.

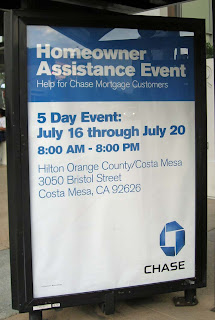

Chase Homeowner Assistance Event comes to Orange County

by Calculated Risk on 7/16/2010 09:33:00 PM

I think this is a traveling road show, but the size is pretty amazing ... I'll try to drop by next week. From the O.C. Register: 5-day loan mod event starts Friday

From the O.C. Register: 5-day loan mod event starts Friday

Chase is having a 5-day event in Costa Mesa to help struggling homeowners who have Chase, EMC or WaMu-serviced mortgages.Local Sign at bus stop, photo credit: Bill

...

More than 50 of Chase’s home loan counselors will be available ...

Bill writes: "There must be a lot of troubled

Bank Failures #92 to #96: Florida, Michigan, South Carolina

by Calculated Risk on 7/16/2010 06:13:00 PM

Grim Reaper scythes down the weeds

Only stubble left

by Soylent Green is People

From the FDIC: NAFH National Bank, Miami, Florida, Acquires All the Deposits of Two Institutions in Florida and One Institution in South Carolina

Metro Bank of Dade County, Miami, Turnberry Bank, Aventura, Florida, and First National Bank of the South, Spartanburg, South Carolina

As of March 31, 2010, Metro Bank of Dade County had total assets of $442.3 million and total deposits of $391.3 million; Turnberry Bank had total assets of $263.9 million and total deposits of $196.9 million; and First National Bank of the South had total assets of $682.0 million and total deposits of $610.1 million.From the FDIC: CenterState Bank of Florida, National Association, Winter Haven, Florida, Assumes All of the Deposits of Olde Cypress Community Bank, Clewiston, Florida

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Metro Bank of Dade County will be $67.6 million; for Turnberry Bank, $34.4 million; and for First National Bank of the South, $74.9 million.

...

These closings bring the total for the year to 94 banks in the nation, and the fifteenth and sixteenth in Florida and the third in South Carolina. Prior to these failures, the last bank closed in Florida was Peninsula Bank, Englewood, on June 25, 2010, and the last bank closed in South Carolina was Woodlands Bank, Bluffton, earlier today.

As of March 31, 2010, Olde Cypress Community Bank had approximately $168.7 million in total assets and $162.4 million in total deposits.From the FDIC: Commercial Bank, Alma, Michigan, Assumes All of the Deposits of Mainstreet Savings Bank, FSB

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.5 million. ... Olde Cypress Community Bank is the 95th FDIC-insured institution to fail in the nation this year, and the seventeenth in Florida. The last FDIC-insured institution closed in the state was Turnberry Bank, Aventura, earlier today.

As of March 31, 2010, Mainstreet Savings Bank, FSB had approximately $97.4 million in total assets and $63.7 million in total deposits.Will we see 100 today?

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.4 million. ... Mainstreet Savings Bank, FSB is the 96th FDIC-insured institution to fail in the nation this year, and the fourth in Michigan. The last FDIC-insured institution closed in the state was New Liberty Bank, Plymouth, on May 14, 2010.