by Calculated Risk on 7/26/2010 08:30:00 AM

Monday, July 26, 2010

Chicago Fed: Economic activity declined in June

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity declined in June

Led by deterioration in production- and employment-related indicators, the Chicago Fed National Activity Index declined to –0.63 in June, down from +0.31 in May. Three of the four broad categories of indicators that make up the index made negative contributions in June, while the sales, orders, and inventories category made the lone positive contribution.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.05 in June from +0.31 in May. The CFNAI-MA3 suggests that growth in national economic activity returned very close to its historical trend in June after reaching its highest level since March 2006 in May. With regard to inflation, it indicates subdued inflationary pressure from economic activity over the coming year.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This is a compositive of other indicators. June was definitely a weak month.

Sunday, July 25, 2010

European Stress Tests: Not very stressful

by Calculated Risk on 7/25/2010 07:32:00 PM

It was announced last week that the stress tests didn't consider a sovereign default, and here is more ...

From David Enrich at the WSJ: Europe's 'Stress Tests' Relied on Mild Assumptions (ht jb)

In some of the 20 countries that conducted the tests, regulators figured that property values would keep rising or hold steady in a worst-case economic scenario.These are the two assumptions that put the most stress on households - lost jobs and negative equity. I guess in some European countries property prices only go up, and the unemployment rate only goes down.

In other cases, unemployment rates in a double-dip recession crept up by as little as 0.1 percentage point from the tests' so-called benchmark scenario, which is based on current economic conditions.

Earlier today: Weekly Summary and Schedule, July 25th

Yesterday: Sovereign default Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

Private Investment?

by Calculated Risk on 7/25/2010 03:38:00 PM

The WSJ is quoting Treasury Secretary Timothy Geithner as saying it is time for private investment to take over from government stimulus:

“We need to make that transition now to a recovery led by private investment,” Mr. Geithner said Sunday on NBC’s “Meet the Press.”I discussed this last week - in most sectors of the economy there is over capacity or too much supply (housing), so there is no reason for significant new private investment.

...

“I think the most likely thing is you’ll see an economy that gradually strengthens over the next year or two, you’ll see job growth start to come back, investments expanding ... but we’ve got a long way to go still,” Mr. Geithner said.

Earlier today: Weekly Summary and Schedule, July 25th

Yesterday: Sovereign default Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

Weekly Summary and Schedule, July 25th

by Calculated Risk on 7/25/2010 11:29:00 AM

The focus this week will be on the Q2 GDP report to be released on Friday. There are also two key housing reports: New Home Sales on Monday and Case-Shiller house prices on Tuesday.

On Monday, the June Chicago Fed National Activity Index will be released at 8:30 AM. This is a composite index of other data.

At 10 AM on Monday, the Census Bureau will release the New Home Sales report for June. The consensus is for a slight increase to 310 thousand at a seasonally adjusted annual rate (SAAR) from the record low 300 thousand in May.

Also on Monday, the Dallas Fed Manufacturing survey for July will be released at 10:30 AM. This is one of several regional surveys that will be released this week. Usually I don't highlight the minor regional reports, but right now I'm looking for hints of a slowdown in industrial production.

On Tuesday, the May Case-Shiller house price index will be released at 9:00 AM. The consensus is for a slight increase in the house price index. At 10:00 AM, the Conference Board will release Consumer Confidence for July (consensus is for a slight decrease from June). Also at 10:00 AM, the Richmond Fed Manufacturing Survey for July will be released.

Also at 10 AM Tuesday, the Census Bureau will release the Q2 Housing Vacancies and Homeownership report. This report provides the homeownership rate and estimates of the homeowner and rental vacancy rates.

On Wednesday, the MBA mortgage purchase index will be released. The purchase index is at the same level as in 1996 – suggesting further weakness in housing. Also on Wednesday, the June Durable Goods Orders will be released at 8:30 AM. The consensus is for a 1.0% increase.

Also on Wednesday, at 2 PM ET, the Fed will release the Beige Book for July. This will be closely scrutinized for further evidence of a 2nd half slowdown.

On Thursday, the initial weekly unemployment claims will be released. Consensus is for a decline to 460 thousand from 464 thousand last week. Also on Thursday, the Kansas City Fed Manufacturing survey will be released at 11 AM.

And on Friday, at 8:30 AM, the BEA will release the Q2 GDP report. The consensus is for real annualized GDP growth of 2.5% in Q2, down from a sluggish 2.7% in Q1. Also on Friday, the Chicago Purchasing Manager index for July will be released at 9:45 AM. And the FDIC will probably be busy on Friday afternoon ...

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2010 (5.37 million SAAR) were 5.1% lower than last month, and were 9.8% higher than June 2009 (4.89 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.99 million in June from 3.89 million in May. The all time record high was 4.58 million homes for sale in July 2008.

Months of supply increased to 8.9 months in June from 8.3 months in May. A normal market has under 6 months of supply, so this is already high - and probably excludes some substantial shadow inventory.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 4.7% YoY in June. This is the third consecutive month of a year-over-year increases in inventory, and this is the largest YoY increase since early 2008.

Inventory increased 4.7% YoY in June. This is the third consecutive month of a year-over-year increases in inventory, and this is the largest YoY increase since early 2008. This increase in inventory is especially bad news because the reported inventory is already historically very high, and the 8.9 months of supply in June is well above normal.

The months-of-supply will jump in July as sales collapse - probably to double digits - and a double digit months-of-supply would be a really bad sign for house prices ...

This was another a weak report. Sales were slightly above expectations (5.37 million at a seasonally adjusted annual rate vs. expectations of 5.3 million), but the YoY increase in inventory and the increase in months-of-supply are the real stories.

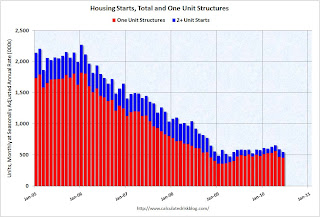

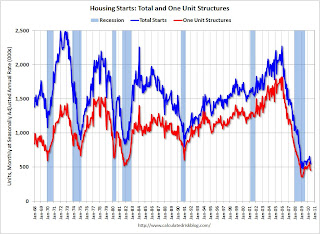

Total housing starts were at 549 thousand (SAAR) in June, down 5% from the revised May rate of 578,000 (revised down from 593 thousand), and up 15% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 549 thousand (SAAR) in June, down 5% from the revised May rate of 578,000 (revised down from 593 thousand), and up 15% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Single-family starts declined 0.7% to 454,000 in June. This is 26% above the record low in January 2009 (360 thousand).

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.This was way below expectations of 580 thousand (I took the under!), and is good news for the housing market longer term (there are already too many housing units), but bad news for the economy and employment short term.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 14 in June. This is the lowest level since April 2009.

The record low was 8 set in January 2009, but 14 is very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

This suggests the slump for commercial real estate design is ongoing. According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment into 2011.

Best wishes to all.

More State and Local Government Layoffs and the Pension Crisis

by Calculated Risk on 7/25/2010 08:36:00 AM

From Tom Abate at the San Fransicso Chronicle: Public pensions put state, cities in crisis

The recent layoff of 80 police officers in Oakland could be the harbinger of things to come ...The author argues that many of these layoffs are happening because pensions are straining state and local government budgets.

"This is not unique to Oakland," said Ron Cottingham, president of the Police Officers Research Association of California. "Stockton is having this happen. So is Sacramento."

The article contains some information on a recent scandal and the size of most pensions:

[T]he city of Bell (Los Angeles County) ... has been paying its city manager nearly $800,000 a year and setting him and other highly paid local officials up for huge pensions.The pension problem is a long term issue, but in the short term, the state and local government layoffs will contribute to the unemployment problem.

Scandals like this fuel public outrage and overshadow the reality that while abuses occur, and fatter pension payouts are on the rise, the average CalPERS beneficiary currently gets just over $24,000 a year, and 78 percent of all the fund's recipients get $36,000 or less.