by Calculated Risk on 8/05/2011 10:26:00 PM

Friday, August 05, 2011

AAR: Rail Traffic soft in July

Note: S&P downgraded U.S. debt to AA+. The regulatory agencies responded saying there would be no change for risk-based capital purposes for financial institutions.

Here are the earlier employment posts (with graphs):

• July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• More Employment (Duration, Education, Diffusion Index)

• Employment graph gallery

The Association of American Railroads (AAR) reports carload traffic in July 2011 decreased 1.0 percent compared with the same month last year, and intermodal traffic (using intermodal or shipping containers) increased 1.3 percent compared with July 2010. On a seasonally adjusted basis, carloads in July 2011 were up 0.7% from June 2011; intermodal in July 2011 was down 0.8% from June 2011.

On a non-seasonally adjusted basis, U.S. freight railroads averaged 277,921 carloads per week in July 2011, down 1.0% from July 2010’s 280,680 carloads per week and up 3.1% over July 2009’s 269,479 carloads per week. July 2011 was the fourth straight month in which carload traffic closely tracked year-earlier levels.

... July ... saw the biggest year-over-year monthly decline (and the second decline of any kind) in U.S. rail carload traffic in 16 months.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows U.S. average weekly rail carloads (NSA) excluding coal.

Rail carload traffic collapsed in November 2008, and now, 2 years into the recovery, carload traffic ex-coal is about half way back.

"Excluding coal, U.S. rail carloads in July 2011 were up 4.3% over July 2010."

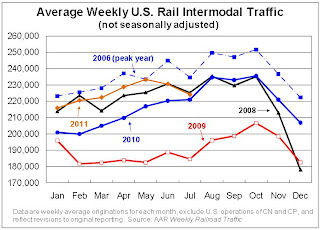

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 895,649 intermodal trailers and containers in July 2011, an average of 223,912 units and up 1.3% (11,724 units) over July 2010. That’s the lowest year-over-year increase since January 2010.Another soft month for rail traffic.

excerpts with permission

Bank Failure #63: Bank of Whitman, Colfax, Washington

by Calculated Risk on 8/05/2011 09:14:00 PM

Bankers yodel past graveyard

Siren song of doom

by Soylent Green is People

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of Bank of Whitman, Colfax, Washington

As of June 30, 2011, Bank of Whitman had approximately $548.6 million in total assets and $515.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $134.8 million. ... Bank of Whitman is the 63rd FDIC-insured institution to fail in the nation this year, and the third in Washington.Two today!

Bank Failure #62: Illinois

by Calculated Risk on 8/05/2011 08:30:00 PM

We Shorewood like more money

Heartland, Fed say no.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Bank of Shorewood, Shorewood, Illinois

As of June 30, 2011, Bank of Shorewood had approximately $110.7 million in total assets and $104.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $25.6 million. ... Bank of Shorewood is the 62nd FDIC-insured institution to fail in the nation this year, and the sixth in Illinois.

Misc: S&P Plans U.S. Downgrade, makes math error, ECB to Buy Italian Bonds

by Calculated Risk on 8/05/2011 07:41:00 PM

A few stories ...

• From CNN: S&P rethinking planned downgrade of U.S. after White House objects

• From CNBC: ECB Agrees to Start Buying Italian Bonds on Monday: Italian Minister

• From Reuters: Italy brings forward budget plans as crisis mounts

Q2 2011 Details: Investment in Office, Mall, and Lodging, Residential Components

by Calculated Risk on 8/05/2011 04:05:00 PM

Here are the earlier employment posts (with graphs):

• July Employment Report: 117,000 Jobs, 9.1% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• More Employment (Duration, Education, Diffusion Index)

• Employment graph gallery

The BEA released the underlying detail data today for the Q2 Advance GDP report. Here is a look at office, mall and lodging investment:

Click on graph for larger image in new graph gallery.

Click on graph for larger image in new graph gallery.

This graph shows investment in offices, malls and lodging as a percent of GDP. Office investment as a percent of GDP peaked at 0.46% in Q1 2008 and has declined sharply to a new series low as a percent of GDP (data series starts in 1959).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and has fallen by 66% (note that investment includes remodels, so this will not fall to zero). Mall investment increased slightly in Q2 (probably remodels).

The bubble boom in lodging investment was stunning. Lodging investment peaked at 0.32% of GDP in Q2 2008 and has fallen by 80%.

Notice that investment for all three categories typically falls for a year or two after the end of a recession, and then usually recovers very slowly (flat as a percent of GDP for 2 or 3 years). Something similar will probably happen again, and there will not be a recovery in these categories until the vacancy rates fall significantly.

The second graph is for Residential investment (RI) components. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories (dormitories, manufactured homes).

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

This graph shows the various components of RI as a percent of GDP for the last 50 years. Usually the most important components are investment in single family structures followed by home improvement.

Investment in single family structures was just above the record low set in Q2 2009.

Investment in home improvement was at a $153.1 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.0% of GDP), significantly above the level of investment in single family structures of $105.8 billion (SAAR) (or 0.7% of GDP).

Brokers' commissions increased slightly in Q2, and are near the lowest level (as a percent of GDP) since the early '80s.

And investment in multifamily structures has been bouncing along at a series low for the last few quarters, although this is expected to increase this year as starts increase.

These graphs show there is currently very little investment in offices, malls and lodging - and also very little investment in most components of residential investment. For Residential Investment, I expect RI to make a positive contribution to GDP this year for the first time since 2005 - mostly because of increases in multifamily investment and home improvement.