by Calculated Risk on 8/08/2011 11:06:00 PM

Monday, August 08, 2011

Monday Night Futures

The Asian markets are red tonight with the Nikkei down 4%. The Shanghai is down almost 7%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 is down about 27 points, and Dow futures are down about 250 points.

Oil: WTI futures are down to $76 and Brent is under $100.

Earlier:

• Dow Down 600+, S&P 500 down 6.66%

• Q2 REO Inventory Estimate

• FOMC Preview

Q2 REO Inventory Estimate

by Calculated Risk on 8/08/2011 07:14:00 PM

Important: REO inventories have declined over the last couple of quarters. This is a combination of more sales and fewer acquisitions due to the slowdown in the foreclosure process. There are many more foreclosures coming - see my post this weekend on Mortgage Delinquencies and REOs.

This is an important change from Freddie Mac: In Q1, Freddie Mac wrote: "We expect the pace of our REO acquisitions to increase in the remainder of 2011". Today Freddie Mac said the pace will remain low all year "The pace of REO acquisitions slowed in Q2 2011 due to delays in the foreclosure process. We expect these delays will likely continue through the remainder of 2011."

Freddie Mac reported today that REO dispositions (sales) were at a near record 29,000 units in Q2 and REO acquisitions were down to 24,799 units.

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA decreased to 250,982 at the end of Q2 from a record 288,341 units at the end of Q1. The "F's" REO inventory increased 6% compared to Q2 2010 (year-over-year comparison).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

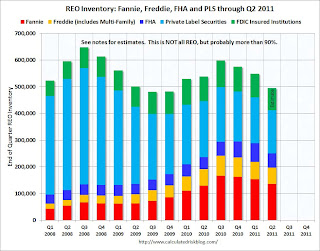

This graph shows the REO inventory for Fannie, Freddie and FHA through Q2 2011.

The REO inventory for the "Fs" increased sharply in 2010, but may have peaked in Q4 2010. However there may be a new peak when the foreclosure dam breaks.

The second graph shows REO inventory for Fannie, Freddie, FHA, Private Label Securities (PLS), and FDIC insured institutions. (economist Tom Lawler has provided some of this data).

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

Total REO decreased to 495,000 in Q2 from almost 550,000 in Q1.

As Tom Lawler has noted before, the FDIC does not collect data on the NUMBER of REO properties held, and there are different estimates of the average carrying value of 1-4-family REO properties at FDIC-insured institutions. This graph uses an an average carrying value of about $150,000 (Q2 2011 is estimated since the FDIC hasn't released the quarterly profile yet).

As Tom Lawler noted: "This is NOT an estimate of total residential REO, as it excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other lender categories." However this is the bulk of the REO - probably 90% or more. Rounding up the estimate (using 90%) suggests total REO is around 550,000 in Q2.

Dow Down 600+, S&P 500 down 6.66%

by Calculated Risk on 8/08/2011 04:03:00 PM

From CNBC: Dow Skids 600, Worst Day Since Credit Crisis

The S&P 500 and the tech-heavy Nasdaq were down 6 percent. August is already on track to be the worst month for both indexes since Oct. 2008.

The CBOE Volatility Index, widely considered the best gauge of fear in the market, spiked above 40 to touch its highest level since Mar. 2009.

All 10 S&P sectors were lower, led by banks, energy and materials. Financials have plunged more than 20 percent this year.

Click on graph for larger image.

Here is a table of the largest one day declines (in percentage terms) for the S&P 500 since January 1950. There were quite a few large down days in 2008 and early 2009 ... and now two in the last week (both in red).

| Largest S&P 500 One Day Percentage Declines since 1950 | ||||||

|---|---|---|---|---|---|---|

| Date | Percent Decline | Close | Previous Close | Six Months Later | ||

| 1 | 10/19/1987 | -20.5% | 224.84 | 282.70 | 15.3% | |

| 2 | 10/15/2008 | -9.0% | 907.84 | 998.01 | -4.7% | |

| 3 | 12/1/2008 | -8.9% | 816.21 | 896.24 | 15.7% | |

| 4 | 9/29/2008 | -8.8% | 1106.42 | 1213.27 | -28.8% | |

| 5 | 10/26/1987 | -8.3% | 227.67 | 248.22 | 15.3% | |

| 6 | 10/9/2008 | -7.6% | 909.92 | 984.94 | -5.9% | |

| 7 | 10/27/1997 | -6.9% | 876.99 | 941.64 | 23.7% | |

| 8 | 8/31/1998 | -6.8% | 957.28 | 1027.14 | 28.0% | |

| 9 | 1/8/1988 | -6.8% | 243.40 | 261.07 | 11.7% | |

| 10 | 11/20/2008 | -6.7% | 752.44 | 806.58 | 17.9% | |

| 11 | 5/28/1962 | -6.7% | 55.50 | 59.47 | 10.6% | |

| 12 | 8/8/2011 | -6.7% | 1,119.47 | 1199.38 | --- | |

| 13 | 9/26/1955 | -6.6% | 42.61 | 45.63 | 14.1% | |

| 14 | 10/13/1989 | -6.1% | 333.65 | 355.39 | 3.2% | |

| 15 | 11/19/2008 | -6.1% | 806.58 | 859.12 | 10.1% | |

| 16 | 10/22/2008 | -6.1% | 896.78 | 955.05 | -5.0% | |

| 17 | 4/14/2000 | -5.8% | 1356.56 | 1440.51 | -2.0% | |

| 18 | 10/7/2008 | -5.7% | 996.23 | 1056.89 | -18.1% | |

| 19 | 6/26/1950 | -5.4% | 18.11 | 19.14 | 10.0% | |

| 20 | 1/20/2009 | -5.3% | 805.22 | 850.12 | 18.1% | |

| 21 | 11/5/2008 | -5.3% | 952.77 | 1005.75 | -4.8% | |

| 22 | 11/12/2008 | -5.2% | 852.30 | 898.95 | 4.8% | |

| 23 | 10/16/1987 | -5.2% | 282.70 | 298.08 | -8.1% | |

| 24 | 11/6/2008 | -5.0% | 904.88 | 952.77 | 2.7% | |

| 25 | 9/17/2001 | -4.9% | 1038.77 | 1092.54 | 12.2% | |

| 26 | 2/10/2009 | -4.9% | 827.16 | 869.89 | 21.8% | |

| 27 | 9/11/1986 | -4.8% | 235.18 | 247.06 | 23.4% | |

| 28 | 8/4/2011 | -4.8% | 1200.07 | 1260.34 | --- | |

| 29 | 9/17/2008 | -4.7% | 1156.39 | 1213.60 | -31.3% | |

| 30 | 9/15/2008 | -4.7% | 1192.70 | 1251.70 | -36.8% | |

| 31 | 3/2/2009 | -4.7% | 700.82 | 735.09 | 47.1% | |

| 32 | 2/17/2009 | -4.6% | 789.17 | 826.84 | 27.2% | |

| 33 | 4/14/1988 | -4.4% | 259.75 | 271.58 | 7.0% | |

| 34 | 3/12/2001 | -4.3% | 1180.16 | 1233.42 | -8.0% | |

| 35 | 4/20/2009 | -4.3% | 832.39 | 869.60 | 31.7% | |

| 36 | 3/5/2009 | -4.3% | 682.55 | 712.87 | 46.2% | |

| 37 | 11/30/1987 | -4.2% | 230.30 | 240.34 | 10.0% | |

| 38 | 11/14/2008 | -4.2% | 873.29 | 911.29 | 4.2% | |

| 39 | 9/3/2002 | -4.2% | 878.02 | 916.07 | -6.4% | |

| 40 | 10/2/2008 | -4.0% | 1114.28 | 1161.06 | -25.1% | |

| 41 | 10/25/1982 | -4.0% | 133.32 | 138.83 | 20.3% | |

FOMC Preview

by Calculated Risk on 8/08/2011 02:01:00 PM

There is a one day meeting of the FOMC tomorrow and no press briefing. In light of recent developments, the FOMC statement to be released around 2:15 PM ET Tuesday might be interesting.

In July, during his Congressional testimony, Fed Chairman Ben Bernanke made it clear that another round of monetary accommodation (aka QE3) would depend on both a further deteriorating in the economic outlook and the renewed threat of deflation.

Clearly the economy is weaker than the Fed's forecast in June, and there have been some initial signs of disinflation (Core PCE increased 0.1% in June or 1.3% annualized). However, based on Bernanke's comments, I think the Fed will wait for further evidence on inflation, and I think a major announcement at the meeting tomorrow is unlikely.

However the FOMC statement will change. Here are a few key sentences from the June statement:

... the economic recovery is continuing at a moderate pace ... The slower pace of the recovery reflects in part factors that are likely to be temporary ... Inflation has picked up in recent months ..."Moderate", "temporary", and "picked up" will all probably change. Growth has been worse than "moderate", and inflation has subsided - but probably not enough for QE3. Still the Fed might make some changes as suggested by Jon Hilsenrath at the WSJ: Fed Has Some Tricks Left, but None Are Magic

The unemployment rate remains elevated; however, the Committee expects the pace of recovery to pick up over coming quarters and the unemployment rate to resume its gradual decline ... Inflation has moved up recently, but the Committee anticipates that inflation will subside to levels at or below those consistent with the Committee's dual mandate as the effects of past energy and other commodity price increases dissipate. ...

... The Committee continues to anticipate that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

Since 2008, the Fed has assured the public that it wouldn't raise short-term interest rates for an "extended period," that is, at least several more months. It has been vague about plans for its vast portfolio of securities. The Fed now has a strategy—which it has disclosed—for gradually dumping the securities someday. The Fed can use its end-of-meeting statement to define "someday," perhaps saying it will hold on to those securities for an extended period, too.So the Fed might change the "extended period" language to include maintaining the current level of security holdings for an extended period. Not a huge change. QE3 is unlikely, but not impossible - although I think the Fed will wait for further evidence of renewed deflation fears, and also try to communicate any plans in advance.

Misc: Market Sell-Off, Obama to Speak at 1 PM, S&P announces more downgrades

by Calculated Risk on 8/08/2011 11:21:00 AM

• Another down day for the stock market. Of course there is a flight to quality with the U.S. 10 year yield down to 2.38%.

• On Friday, S&P said they would announce thousands of downgrades based on lowering their view of the U.S. credit rating. From Reuters: S&P cuts Freddie Mac, Fannie Mae after U.S. downgrade. Any credible rating agency would have done it all at once.

• From USA Today: Obama to speak at 1 p.m. on downgrade.

Weekend:

• A long Summary for Week ending August 5th

• Mortgage Delinquencies and REOs

• Schedule for Week of August 7th

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |