by Calculated Risk on 8/10/2011 01:01:00 PM

Wednesday, August 10, 2011

The QE3 Watch

It was obvious the Fed would not announce QE3 yesterday. Instead they announced an extended "extended period". But they also hinted at QE3 in the last couple of sentences of the statement:

The Committee discussed the range of policy tools available to promote a stronger economic recovery in a context of price stability. It will continue to assess the economic outlook in light of incoming information and is prepared to employ these tools as appropriate.That led Goldman Sachs chief economist Jan Hatzius to write last night: "QE3 Now Our Base Case"

We now see a greater-than-even chance that the FOMC will resume quantitative easing later this year or in early 2012.Last year, Fed Chairman Ben Bernanke paved the way for QE2 at the Jackson Hole economic symposium. Here is his speech from last August.

This year Bernanke will speak on August 26th at the Kansas City Economic Symposium in Jackson Hole, Wymong.

More from Hatzius:

Although QE3 is now our base case, it is not a certainty. We see three main ways in which our revised call could turn out to be incorrect. First, of course, the economy may turn out to be stronger than our forecast. ... Second, inflation might pose a higher hurdle to additional easing than we have allowed. ... Third, the anti-Fed backlash late last year might argue against further QE.Earlier Bernanke made it clear that further accommodation would require both a weaker economy and a renewed threat of deflation. Although the economy is weaker than the Fed expected, I think the Fed will wait for more evidence of a threat of deflation.

BLS: Job Openings "essentially unchanged" in June

by Calculated Risk on 8/10/2011 10:15:00 AM

From the BLS: Job Openings and Labor Turnover Summary

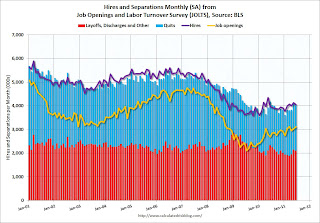

The number of job openings in June was 3.1 million, essentially unchanged from May. Although the number of job openings in June was 997,000 higher than in July 2009 (the series trough), it has been relatively flat since February 2011 and remains well below the 4.4 million openings when the recession began in December 2007.The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in June - and are up about 16% year-over-year compared to June 2010.

Overall turnover is increasing too, but remains low. Quits decreased slightly in June, but have been trending up - and quits are now up about 4% year-over-year.

Ceridian-UCLA: Diesel Fuel index decreased slightly in July

by Calculated Risk on 8/10/2011 09:00:00 AM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in July

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation dipped 0.2 percent in July on a seasonally and workday adjusted basis, offsetting some of the relatively strong 1.0 percent gain posted in June.

“In July, the U.S. economy remained in ‘she loves me, she loves me not’ mode,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “July’s result falls in the ‘she loves me not’ category and represents a continuation of the idling economic conditions that have persisted for over a year. Over this time period, bad news has been alternating with good, leaving investors and forecasters nervous and unable to identify sustainable trends.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

“Over time, the PCI has also proven to be a leading and amplified indicator of Industrial Production”, explained Craig Manson, senior vice president and Index expert for Ceridian. “For June, the PCI was anticipating Industrial Production to show modest growth of 0.17 percent. The government’s subsequent release on July 15, 2011 turned out to be 0.19 percent, which was almost identical to our forecast. This represented the fifth time in the past six months in which the monthly PCI forecast for U.S. Industrial Production was right in-line with the government’s subsequent report. Based on the weakness evident in the PCI over the last several months, our forecast calls for a flat performance in July Industrial Production when the government estimate is released on August 16.”This index has mostly been moving sideways all year. Note: This index does appear to track Industrial Production over time (with plenty of noise).

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

MBA: Mortgage Refinance Applications Increase Significantly

by Calculated Risk on 8/10/2011 07:41:00 AM

The MBA reports: Mortgage Applications Increase Significantly, Driven by Surge in Refinance Activity

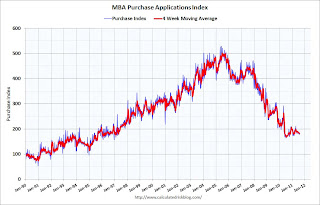

The Refinance Index increased 30.4 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Amid substantial market turmoil last week, mortgage rates dropped to their lowest levels of the year, and refinance applications jumped more than 30 percent to their highest levels of the year," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Over the past month, refinance application volume has increased by 63 percent. Refinance applications for jumbo loans increased by almost 75 percent relative to last week. Despite these low mortgage rates, applications for home purchase have remained little changed through the summer."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.37 percent from 4.45 percent, with points increasing to 1.07 from 0.78 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is at best moving sideways at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

But refinance activity is picking up again!

Tuesday, August 09, 2011

Update: ECB Bond Buying

by Calculated Risk on 8/09/2011 07:27:00 PM

A little calmer in the European debt markets.

Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany.

The Italian spread is at 281, down from 371 last week, and the Spanish spread is at 271 down from 387. The yield on the Spanish Ten year bond is down to 5.1%, and the Italian 10 year is down to 5.2%. From the WSJ: ECB Move on Italy, Spain Calms Market

The ECB will disclose its total purchases for the week on Monday, but some analysts estimate the ECB bought at least €3.5 billion ($5 billion) on Monday and billions more Tuesday—however, a small fraction relative to the size of Spain and Italy's debt markets.The yield on the Portuguese 2 year is down to 11.8%. From the NY Times: Portugal Faces Challenges in Meeting Bailout Terms

Three months after approving a €78 billion, or $111 billion, bailout for Portugal, officials from the International Monetary Fund, the European Commission and the European Central Bank are conducting their first review of progress toward meeting conditions set for emergency financing. Those include budget cuts and an economic overhaul intended to stimulate growth.The Irish 2 year yield is down sharply to 10.8%. However the yield on the Greek 2 year is up to 34.6%!

Portuguese officials and business executives expect a broadly favorable assessment ...

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |