by Calculated Risk on 8/13/2011 07:32:00 PM

Saturday, August 13, 2011

Unofficial Problem Bank list at 988 Institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 13, 2011.

Changes and comments from surferdude808:

The total number of institutions on the Unofficial Problem Bank Lists remains unchanged from last week at 988. However, there were two removals and two additions. Aggregate assets declined slightly by $391 million to $411.3 billion.It seems like the number of mergers has increased recently.

The removals include the failed The First National Bank of Olathe, Olathe, KS ($572 million) and Citizens Bank of Spencer, Tenn., Spencer, TN ($46 million), which merged on an unassisted basis. The additions were State Bank of Herscher, Herscher, IL ($195 million) and Texas Coastal Bank, Pasadena, TX ($32 million).

The other change is the issuance of a Prompt Corrective Action order by the Federal Reserve against Bank of the Eastern Shore, Cambridge, MD ($190 million). Next week, we anticipate the OCC releasing its actions through the middle of July. This will be the first monthly release after the merger of the OCC with the OTS.

Earlier:

• Summary for Week Ending August 12th

• Schedule for Week of August 14th

Schedule for Week of August 14th

by Calculated Risk on 8/13/2011 02:47:00 PM

Earlier: Summary for Week Ending August 12th

Three key housing reports will be released this week: August homebuilder confidence on Monday, July housing starts on Tuesday, and July existing home sales on Thursday.

For manufacturing, the August NY Fed (Empire state) survey will be released on Monday, the August Philly Fed survey on Thursday, and the July Industrial Production and Capacity Utilization report on Tuesday.

On inflation, the July Producer Price index (PPI) will be released Wednesday and CPI will be released Thursday.

8:30 AM ET: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 1.0, up slightly from -3.8 in July (above zero is expansion).

10 AM ET: The August NAHB homebuilder survey. The consensus is for a reading of 15, unchanged from July. Any number below 50 indicates that more builders view sales conditions as poor than good. This index has been below 25 for four years.

10:00 AM ET: NY Fed Q2 Report on Household Debt and Credit

8:30 AM: Housing Starts for July. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years.

8:30 AM: Housing Starts for July. After collapsing following the housing bubble, housing starts have mostly been moving sideways for over two years. Total housing starts were at 629 thousand (SAAR) in June, up 14.6% from the revised May rate of 549 thousand. Single-family starts increased 9.4% to 453 thousand in June.

The consensus is for a decrease to 600,000 (SAAR) in July.

8:30 AM: Import and Export Prices for July. The consensus is a for a 0.1% decrease in import prices.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for July. This graph shows industrial production since 1967. Industrial production increased in June to 93.1.

The consensus is for a 0.5% increase in Industrial Production in July, and an increase to 77.0% (from 76.7%) for Capacity Utilization. The Ceridian index suggests Industrial Production was flat in July.

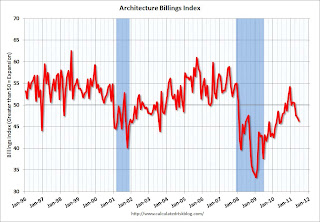

Early: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

Early: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).This graph shows the Architecture Billings Index since 1996. The index decreased in June to 46.3 from 47.2 in May. Anything below 50 indicates a contraction in demand for architects' services.

This index usually leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been very weak over the last several months, although refinance activity has picked up recently.

8:30 AM: Producer Price Index for July. The consensus is for no change in producer prices (0.2% increase in core).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 400,000 from 395,000 last week.

8:30 AM: Consumer Price Index for July. The consensus is for a 0.2% increase in prices. The consensus for core CPI is an increase of 0.2%.

10:00 AM: Philly Fed Survey for August. The consensus is for a reading of 4.0 (above zero indicates expansion), up from 3.2 last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July, up from 4.77 million SAAR in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July, up from 4.77 million SAAR in June.Note: the NAR is working on benchmarking existing home sales for previous years with other industry data (expectations are for large downward revisions). These revisions are expected this fall.

10:00 AM: Conference Board Leading Indicators for July. The consensus is for a 0.2% increase for this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2011

Summary for Week Ending August 12th

by Calculated Risk on 8/13/2011 08:31:00 AM

This was another wild and crazy week with significant volatility in the stock market. The two key concerns this week were the European financial crisis and the weaker economic outlook (not new concerns, just more worrisome). In Europe there were growing concerns about France and French banks, and this led to several countries banning some stock short selling by the end of the week. (short-selling bans always seems like desperation).

In the U.S., the debate of a “double dip” recession really picked up. In response to the weaker outlook, the Fed significantly extended the “extended period” language. The FOMC “anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013." This statement put many analysts on “QE3 watch”.

While the market was on a roller-coaster, there was little economic data last week. Retail sales were solid in July – a bit surprising since there were so many reports of the economy freezing for almost two weeks during the debt ceiling debate. And initial weekly unemployment claims were under 400 thousand for the first time since early April.

The trade deficit was larger than expected in June, suggesting Q2 GDP will be revised down, possibly below 1%. Consumer sentiment was very weak in early August – the lowest level in 30 years – probably because of the debt ceiling debate. And small business optimism declined further in July.

Here is a summary in graphs:

• Retail Sales increased 0.5% in July

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales seemed to stall in March, but are now moving higher again.

On a monthly basis, retail sales increased 0.5% from June to July (seasonally adjusted, after revisions), and sales were up 8.5% from July 2010. Retail sales excluding auto also increased 0.5% in July.

The increase was slightly below expectations for total retail sales, however, including the upward revision for June, this was a solid report.

• Trade Deficit increased in June

The Department of Commerce reports:

[T]otal June exports of $170.9 billion and imports of $223.9 billion resulted in a goods and services deficit of $53.1 billion, up from $50.8 billion in May, revised. June exports were $4.1 billion less than May exports of $175.0 billion. June imports were $1.9 billion less than May imports of $225.8 billion.The trade deficit was well above the consensus forecast of $48 billion.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.

This graph shows the monthly U.S. exports and imports in dollars through June 2011.Both exports and imports decreased in June (seasonally adjusted). Exports are well above the pre-recession peak and up 13% compared to June 2010; imports are almost back to the pre-recession peak, and up about 13% compared to June 2010.

Oil averaged $106.00 per barrel in June, down from $108.70 per barrel in May. There is a bit of a lag with prices, and import prices will fall further in July.

The trade deficit with China increased to $26.7 billion; trade with China remains a significant issue.

• Weekly Initial Unemployment Claims declined to 395,000

The DOL reports:

In the week ending August 6, the advance figure for seasonally adjusted initial claims was 395,000, a decrease of 7,000 from the previous week's revised figure of 402,000. The 4-week moving average was 405,000, a decrease of 3,250 from the previous week's revised average of 408,250.

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

This graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 405,000.

The 4-week average is still elevated, but has been moving down since mid-May. This is the lowest level for the 4-week average since early April and the first week under 400,000 since April 2nd.

• Consumer Sentiment declines sharply in August

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July.

The preliminary August Reuters / University of Michigan consumer sentiment index declined sharply to 54.9 from 63.7 in July. In general consumer sentiment is a coincident indicator and is usually impacted by employment (and the unemployment rate) and gasoline prices. However I think this month was different. I think consumer sentiment declined sharply because of the heavy coverage of the debt ceiling debate.

• BLS: Job Openings "essentially unchanged" in June

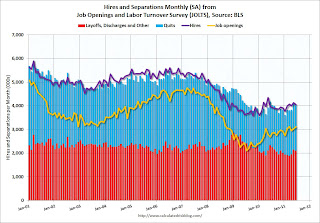

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. This report is for June, the most recent employment report was for July.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.In general job openings (yellow) have been trending up - and job openings increased slightly again in June - and are up about 16% year-over-year compared to June 2010.

Overall turnover is increasing too, but remains low. Quits decreased slightly in June, but have been trending up - and quits are now up about 4% year-over-year.

• Ceridian-UCLA: Diesel Fuel index decreased slightly in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in July

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Idles – Down 0.2 Percent in JulyThis graph shows the index since January 2000.

This index has mostly been moving sideways all year. Note: This index does appear to track Industrial Production over time (with plenty of noise).

• NFIB: Small Business Optimism Index declines in July

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward Trajectory

From the National Federation of Independent Business (NFIB): Small Business Optimism Index Continues Downward TrajectoryThis graph shows the small business optimism index since 1986. The index decreased to 89.9 in July from 90.8 in June.

Optimism has declined for five consecutive months now.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

• Other Economic Stories ...

• FOMC Statement: "exceptionally low levels for the federal funds rate at least through mid-2013"

• The QE3 Watch

• FHFA, Treasury, HUD Seek Input on Disposition of REOs

Have a great weekend!

Friday, August 12, 2011

Comparisons to Japan

by Calculated Risk on 8/12/2011 09:28:00 PM

I'm sure we will see more comparisons to Japan like this one (ht jb).

From Matt Phillips and Justin Lahart at the WSJ: This Time, Maybe the U.S. Is Japan

Since Standard & Poor's stripped the U.S. of its triple-A credit rating on Aug. 5 and the Federal Reserve followed on Tuesday with a statement that interest rates will be at near-zero until at least mid-2013, bond traders have been recasting their models. Many have been using the experience of Japan, which was first downgraded from triple-A in 1998 and has had near-zero rates for the better part of a decade.There are differences - like a growing population, but it does look more and more like ... Bernanke-san!

...

As an economist at the New York Federal Reserve, Kenneth Kuttner wrote a paper explaining why, in the aftermath of the dot-com bust, the U.S. was decidedly not like Japan. The stock market decline paled in comparison to the bursting of Japan's real estate bubble, the financial system was strong and the U.S. government had the fiscal leeway to boost spending if the economy weakened. "It was very easy to be smug at that point," says Mr. Kuttner, now a professor at Williams College. "Now, I'm running out of reasons to say the U.S. is all that different."

Earlier:

• Retail Sales increased 0.5% in July

• Consumer Sentiment declines sharply in August

Bank Failure #64 in 2011: First National Bank of Olathe, Olathe, Kansas

by Calculated Risk on 8/12/2011 06:14:00 PM

Dehydrated Kansas Bank

Feds tilling under

by Soylent Green is People

From the FDIC: Enterprise Bank & Trust, Clayton, Missouri, Assumes All of the Deposits of First National Bank of Olathe, Olathe, Kansas

As of June 30, 2011, First National Bank of Olathe had approximately $538.1 million in total assets and $524.3 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $116.6 million. ... First National Bank of Olathe is the 64th FDIC-insured institution to fail in the nation this year, and the first in Kansas."It's Friday, Friday ... Everybody's lookin' forward to the weekend, weekend ..." Rebecca Black