by Calculated Risk on 8/16/2011 09:15:00 AM

Tuesday, August 16, 2011

Industrial Production increased 0.9% in July, Capacity Utilization increases

From the Fed: Industrial production and Capacity Utilization

Industrial production advanced 0.9 percent in July. Although the index was revised down in April, primarily as a result of a downward revision to the output of utilities, stronger manufacturing output led to upward revisions to production in both May and June. Manufacturing output rose 0.6 percent in July, as the index for motor vehicles and parts jumped 5.2 percent and production elsewhere moved up 0.3 percent. The output of mines advanced 1.1 percent, and the output of utilities increased 2.8 percent, as the extreme heat during the month boosted air conditioning usage. At 94.2 percent of its 2007 average, total industrial production for July was 3.7 percentage points above its year-earlier level. The capacity utilization rate for total industry climbed to 77.5 percent, a rate 2.2 percentage points above the rate from a year earlier but 2.9 percentage points below its long-run (1972--2010) average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows Capacity Utilization. This series is up 10.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is still "2.9 percentage points below its average from 1972 to 2010" - and below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 94.2.

Both industrial production and capacity utilization had been moving sideways for a few months. This was a fairly strong increase, although partially related to the extreme heat (and an increase in utilities). This was above the consensus forecast of a 0.5% increase in Industrial Production, and an increase to 77.0% for Capacity Utilization.

Housing Starts decline slightly in July

by Calculated Risk on 8/16/2011 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 604 000 This is 1.5 percent (±10 7%)* below the revised June estimate of 613,000, but is 9.8 percent (±10.8%)* above the July 2010 rate of 550,000.

Single-family housing starts in July were at a rate of 425,000; this is 4.9 percent (±8.9%)* below the revised June figure of 447,000. The July rate for units in buildings with five units or more was 170,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 597,000. This is 3.2 percent (±1.2%) below the revised June rate of 617,000, but is 3.8 percent (±2.2%) above the July 2010 estimate of 575,000.

Single-family authorizations in July were at a rate of 404,000; this is 0.5 percent (±0.9%)* above the revised June figure of 402,000. Authorizations of units in buildings with five units or more were at a rate of 171,000 in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Total housing starts were at 604 thousand (SAAR) in July, down 1.5% from the revised June rate of 613 thousand.

Single-family starts declined 4.9% to 425 thousand in July.

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

This shows the huge collapse following the housing bubble, and that housing starts have been mostly moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.This was slightly above expectations of 600 thousand starts in July. Multi-family starts are increasing in 2011 - although from a very low level.

I'll have more on housing starts later.

Monday, August 15, 2011

Misc: Europe and Summary

by Calculated Risk on 8/15/2011 09:44:00 PM

• From the Financial Times: ECB buys €22bn in eurozone bonds

The European Central Bank spent €22bn on government bonds last week ... The larger-than-expected display of fire-power highlights the scale of the challenge the central bank faces in keeping official borrowing costs under control for Italy and Spain ...• So far it is working ... here is a graph of the 10 year spread (Italy to Germany) from Bloomberg (currently 270). And for Spain to Germany (267).

excerpt with permission

• From the NY Times: Debt in Europe Fuels a Bond Debate

President Nicolas Sarkozy of France and Chancellor Angela Merkel of Germany are scheduled to meet in Paris on Tuesday but have vowed to avoid the issue of euro bonds altogether.It doesn't sound like anything significant will be announced following the meeting tomorrow.

Earlier:

• NAHB Builder Confidence index unchanged in August, Still Depressed

• Residential Remodeling Index at new high in June

• From the NY Fed Empire State Manufacturing Survey indicates contraction

• NY Fed Q2 Report on Household Debt and Credit

• Lawler Forecast: Existing Home Sales may "dip" in July

Lawler Forecast: Existing Home Sales may "dip" in July

by Calculated Risk on 8/15/2011 06:47:00 PM

Usually economist Tom Lawler sends me his forecast for existing home sales (and his forcasts have been very close). Tom has been extremely busy this month, but he sent me this short update today:

My early read of local MLS/association data suggests that national existing home sales as measured by the NAR may actually dip a bit on a seasonally adjusted basis in July -- of course, taking into account the lower business day count this July vs. last July.The NAR reported existing home sales at 4.77 million in June, and the consensus (from Bloomberg) is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July (the NAR will report on Thursday).

LA Port Traffic in July

by Calculated Risk on 8/15/2011 05:15:00 PM

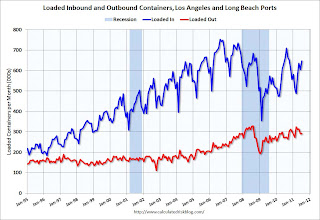

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported - and possible hints about the trade report for July. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

On a rolling 12 month basis, inbound traffic is down 0.2% from June, and outbound traffic is up 0.6%.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of July, loaded inbound traffic was down 2% compared to July 2010, and loaded outbound traffic was up 7% compared to July 2010.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Exports have been increasing, although bouncing around month-to-month. Exports are up from last year, but still below the peak in 2008.

Imports were down from last year, and are below the levels of July in 2006 and 2007 too. This is the 2nd month in a row with a year-over-year decline in imports - but there will probably be a surge in imports over the next couple of months as goods arrive for the holiday season.