by Calculated Risk on 8/17/2011 08:03:00 AM

Wednesday, August 17, 2011

MBA: Mortgage Refinance Activity Increases, Purchase Activity Declines "Sharply"

The MBA reports: Refinance Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 8.0 percent from the previous week, but was 16.3 percent lower than the same week last year. The seasonally adjusted Purchase Index decreased 9.1 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Unprecedented volatility in the stock market last week amid additional signs that the economy has slowed led to further drops in mortgage rates, with the 15-year rate reaching a new low for the MBA survey," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Purchase application activity fell sharply over the previous week, likely the result of potential homebuyers hesitant to purchase in this highly volatile and uncertain environment."

Fratantoni continued, "Refinance application volume increased substantially for the week, although there was substantial variation across the market. In September MBA's Weekly Applications Survey will transition to an expanded sample that covers 75% of the retail market rather than the current sample that covers roughly 50% of the retail market. That expanded sample showed a significantly larger increase in refinance applications than the current sample, with some lenders reporting increases in refinance applications in excess of 50 percent for the week. The big differences in refinance volumes were likely driven by the decisions of some lenders not to drop rates last week, largely due to the need to manage their pipelines."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.32 percent from 4.37 percent, with points decreasing to 0.87 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index has been moving down recently and is at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but purchase application activity was especially weak last week.

Tuesday, August 16, 2011

Europe Update

by Calculated Risk on 8/16/2011 08:11:00 PM

Just an update on the Merkel / Sarkozy meeting earlier today. As expected there was no annoucement of a "eurobond" and no expansion of the EFSF.

Merkel and Sarkozy proposed closer coordination of economic policy in the eurozone. The fear in Germany is that closer coordination means a step towards a fiscal union - and to many Germans that means a transfer union ... here are a few stories:

From the NY Times: Sarkozy and Merkel Call for More Fiscal Unity in Europe

France and Germany also proposed the creation of what Mr. Sarkozy called “a true economic government for the euro zone” that would be made up of heads of state of all of the 17 nations that share the European currency. This council, he said, would meet at least twice a year and would be led by a president who would serve for a term of two and a half years. He said he and Mrs. Merkel would jointly propose that Herman van Rompuy, a Belgian and the current president of the European Union, be the first to take on this role.From the WSJ: Fresh Plan for Europe Crisis

...

“What we are proposing here is the means with which we can solve the crisis right now and win back trust, step by step,” Mrs. Merkel said. “I do not think euro bonds will help us in this.”

...

“Euro bonds can be imagined one day, but at the end of the European integration process not at the beginning,” Mr. Sarkozy said.

From the Financial Times: Merkel and Sarkozy pledge to defend euro

Here are the bond yields as of Tuesday. Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 267, down from 389 on Aug 4th, and the Spanish spread is at 266, down from 398 on Aug 4th. The yield on the Spanish Ten and Italian 10 year bonds are under 5%.

Also the Irish 2 year yield is down sharply to 8.9%. And the French 10 year is under 3%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Earlier:

• Housing Starts decline slightly in July

• Industrial Production increased 0.9% in July, Capacity Utilization increases

• Multi-family Starts and Completions, and Quarterly Starts by Intent

• Lawler: Early Read on Existing Home Sales in July

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/16/2011 03:24:00 PM

From economist Tom Lawler (this is an update to the short note yesterday):

While national existing home sales last month were clearly up from last July’s post-tax-credit cycle low (on a seasonally adjusted basis), it appears as if national closed sales last month did not rebound on a seasonally adjusted basis from June’s level – despite the increase in May and June pending sales. Indeed, based on my regional tracking (though I’m missing a lot of areas), and taking into account the lower business-day count this July than last July (which lower [the July 2011] seasonal factor relative to [July 2010]), I estimate that US existing home sales as measured by the National Association of Realtors may have actually declined slightly on a seasonally adjusted basis in July from June. This surprises me, given the rebound in pending sales in May and June. However, in quite a few areas of the country closed sales fell considerably short of what one would have expected given contract signings over the previous several months, either reflecting increased cancellations or closing delays. And in other areas, including some Florida markets, continued delays in the foreclosure process resulting in sizable declines in foreclosure sales.

To be sure, for areas with associations/MLS that have reported July stats, the degree to which sales last month rebounded from last July’s really low levels has varied massively, even for areas relatively close to one another (and some areas saw no rebound at all).

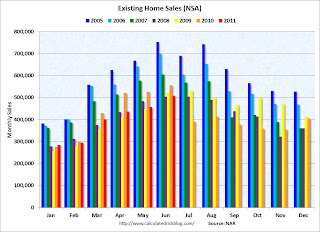

Just to remind folks, here are the NAR’s estimates of existing home sales (SF plus condo/coop) on both an unadjusted and a seasonally adjusted basis ...

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Note: CR graphs added.

Last July existing home sales on a seasonally adjusted basis plunged by 26.2% from June’s pace, and were down 25.2% from July 2009’s pace. Unadjusted sales were down 26.5% from July 2009.

[The following graph shows existing home sales Not Seasonally Adjusted (NSA).]

If existing home sales this July were to be flat on a seasonally adjusted basis to [June], they would have to be up 23.6% from last July’s pace. Given the calendar/lower business day count this July vs. [July 2010], I estimate that unadjusted sales this July would have to be up by around 20% from a year ago, and my regional tracking just doesn’t get that large an increase.

If existing home sales this July were to be flat on a seasonally adjusted basis to [June], they would have to be up 23.6% from last July’s pace. Given the calendar/lower business day count this July vs. [July 2010], I estimate that unadjusted sales this July would have to be up by around 20% from a year ago, and my regional tracking just doesn’t get that large an increase.

To be sure, there are many areas with YOY gains well above 20%, especially in the Midwest (where sales declined the sharpest last July). However, there are several large markets were this July’s sales were either little changed from last July (including the whole state of California and Northern Virginia) or even down from a year ago (including several Florida markets), and several more with only modest YOY gains (including Maryland, DC, South Carolina, Charlotte, Vegas, Long Island, and Albuquerque). Taken all the information I’ve seen so far, my “best” estimate (with a larger than normal forecast error) is that existing home sales (as measured by the NAR) ran at a SAAR of about 4.69 million in July, down 1.7% from June’s pace.

CR: This was from Tom Lawler. The NAR reported existing home sales at 4.77 million in June, and the consensus (from Bloomberg) is for sales of 4.92 million at a Seasonally Adjusted Annual Rate (SAAR) in July (the NAR will report on Thursday - take the under!).

Housing Starts and the Unemployment Rate

by Calculated Risk on 8/16/2011 02:26:00 PM

An update by request: The following graph shows single family housing starts (through July) and the unemployment rate (inverted) through July. Note: there are many other factors impacting unemployment, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) increased a little in 2009 with the homebuyer tax credit - and then declined again - but mostly starts have moved sideways for the last two and a half years. This is one of the reasons the unemployment rate has stayed elevated.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Usually near the end of a recession, residential investment (RI) picks up as the Fed lowers interest rates. This leads to job creation and also additional household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector hasn't been participating. This is what I expected when I first posted the above graph two years ago!

The good news is residential investment should increase modestly in 2011, mostly from multi-family and home improvement, but construction job growth will remain sluggish until the excess housing supply is absorbed.

Multi-family Starts and Completions, and Quarterly Starts by Intent

by Calculated Risk on 8/16/2011 11:45:00 AM

I've been forecasting that:

• Multi-family starts will be up significantly this year, but

• Multi-family completions will be at or near a record low.

Since it takes over a year on average to complete multi-family projects - and multi-family starts were at a record low last year - it makes sense that there will be a record low, or near record low, number of multi-family completions this year.

The following graph shows the lag between multi-family starts and completions using a 12 month rolling total.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The rolling 12 month total for starts (blue line) is now above the rolling 12 month for completions (red line), and they are heading in opposite directions. Starts are picking up and completions are declining.

It is important to note that even with a strong increase in multi-family construction, it is 1) from a very low level, and 2) multi-family is a small part of residential investment (RI). Still this is bright spot for construction.

Also today, the Census Bureau released the "Quarterly Starts and Completions by Purpose and Design" report for Q2 2011. Although this data is Not Seasonally Adjusted (NSA), it shows the trends for several key housing categories.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up seasonally in Q2. This was the 2nd weakest Q2 on record (slightly behind Q2 2009). Owner built starts were at a record low for a Q2, and condos built for sale are scrapping along the bottom.

Only the 'units built for rent' is showing any significant pickup. Some of the increase in 'built for rent' is seasonal, but this is almost a 30% increase from Q2 2010.

The largest category - starts of single family units, built for sale - is mostly moving sideways, and will remain weak until more of the excess vacant housing units are absorbed.

Earlier:

• Housing Starts decline slightly in July

• Industrial Production increased 0.9% in July, Capacity Utilization increases