by Calculated Risk on 12/30/2011 08:54:00 AM

Friday, December 30, 2011

Fannie Mae and Freddie Mac Serious Delinquency Rates: Slight increase for Freddie in November

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.00% in November. This is down from 4.50% in November of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.57% in November, up from 3.54% in October. This is down from 3.85% in November 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The increase in November (unchanged for Fannie) is probably seasonal. The serious delinquency rates have been declining, but declining very slowly. The reason for the slow decline is most likely the backlog of homes in the foreclosure process.

The "normal" serious delinquency rate is under 1%, and at this pace of decline, the delinquency rate will not be back to "normal" for a long time.

Early in 2012, a mortgage settlement agreement with the servicers might be reached, and that might lead to more modifications and foreclosures - so the delinquency rate might decline faster. Also Fannie and Freddie are expected to announce a bulk sale of REO to investors (and possible rental program) early next year - and that might also lead to more foreclosures.

Thursday, December 29, 2011

Gasoline Prices and Brent WTI Spread

by Calculated Risk on 12/29/2011 07:53:00 PM

The year is almost over and once again a key downside risk for the economy is high gasoline prices. According to Bloomberg, Brent Crude is up to $108.10 per barrel, while WTI is up to $99.76. These prices have kept gasoline prices high, and pushed down vehicle miles driven in the US.

Although prices were higher in the first half of 2008, it is possible that the average annual price for oil and gasoline in 2012 will see a new record high.

If the global economy really slows, oil and gasoline prices will probably fall - and probably offset some of the impact from lower exports. Unfortunately turmoil in the Middle East (this time with Iran) might be pushing up oil prices.

This following graph shows the prices for Brent and WTI over the last few years. Usually the prices track pretty closely, but the "glut" of oil at Cushing pushed down WTI prices relative to Brent.

Click on graph for larger image.

Click on graph for larger image.

The spread has narrowed over the last couple of months following the announcement of a partial reversal of the Seaway pipeline to transport crude oil from Cushing, Oklahoma, to the Gulf Coast (the pipeline is scheduled to be reversed in Q2 2012).

And below is a graph of gasoline prices. Gasoline prices have been slowly moving down since peaking in early May. Note: The graph below shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Labor Force Participation: The Kids are Alright Part 2

by Calculated Risk on 12/29/2011 04:13:00 PM

A few weeks ago, I posted: Labor Force Participation Rate: The Kids are Alright

Catherine Rampell at the NY Times adds some more data: Instead of Work, Younger Women Head to School

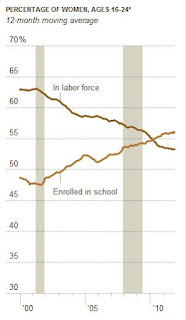

Workers are dropping out of the labor force in droves, and they are mostly women. In fact, many are young women. But they are not dropping out forever; instead, these young women seem to be postponing their working lives to get more education.

[M]any of the workers on the sidelines are young people upgrading their skills, which could portend something like the postwar economic boom, when millions of World War II veterans went to college through the G.I. Bill instead of immediately entering, and overwhelming, the job market.The flip side is that many older workers are also going back to school and getting student loans, see: Middle-aged borrowers piling on student debt (ht Ann)

Both men and women are going back to school, but the growth in enrollment is significantly larger for women (who dominated college campuses even before the financial crisis). In the last two years, the number of women ages 18 to 24 in school rose by 130,000, compared with a gain of 53,000 for young men.

...

The main risk in going back to school is the accompanying student loan debt.

Middle-aged borrowers are piling up student debt faster than any other age group, according to a new analysis obtained by Reuters.That is deeply concerning.

But in the long run, more education is a positive for the economy - and Rampell's article suggests the kids (well, young adults) are alright!

Kansas City Fed manufacturing index "eased slightly" in December

by Calculated Risk on 12/29/2011 11:45:00 AM

This is the last of the regional Fed surveys for December. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were mixed in December although they showed some improvement in the aggregate.

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Slightly

According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased slightly, but expectations for future months improved somewhat.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

“We saw a slight moderation in factory activity in our region in December,” said Wilkerson. “But plant managers continue to expect solid growth in the months ahead and are planning to increase employment and capital spending accordingly.”

...

The month-over-month composite index was -4 in December, down from 4 in November and 8 in October, and the first negative reading since December 2009 ... Most other month-over-month indexes also fell somewhat in December. The production and shipments indexes moved into negative territory, and the new orders and order backlog indexes fell further. The employment index dropped to its lowest level since mid-2009, and the new orders for exports index edged down.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

The ISM index for December will be released Tuesday, Jan 3rd and the regional surveys suggest another reading in the low to mid 50s. for December.

Misc: Chicago PMI at 62.5, Pending Home Sales increase

by Calculated Risk on 12/29/2011 10:10:00 AM

• Chicago PMI: The overall index declined slightly to 62.5 in December from 62.6 in November. This was above consensus expectations of 60.1. Note: any number above 50 shows expansion.

• From the NAR: Pending Home Sales Highest in a Year-and-a-Half

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 7.3 percent to 100.1 in November from an upwardly revised 93.3 in October and is 5.9 percent above November 2010 when it stood at 94.5. The October upward revision resulted in a 10.4 percent monthly gain.

The last time the index was higher was in April 2010 when it reached 111.5 as buyers rushed to beat the deadline for the home buyer tax credit.

...

The PHSI in the Northeast rose 8.1 percent to 77.1 in November but is 0.3 percent below November 2010. In the Midwest the index increased 3.3 percent to 91.6 in November and is 9.5 percent above a year ago. Pending home sales in the South rose 4.3 percent in November to an index of 103.8 and remain 8.7 percent above November 2010. In the West the index surged 14.9 percent to 121.2 in November and is 2.9 percent higher than a year ago.