by Calculated Risk on 1/08/2012 10:13:00 AM

Sunday, January 08, 2012

Housing Policy Changes

It appears there are several major housing policy changes coming in the next two to three months, and that the overall goal will be to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

Currently, according to LPS, there are 1.81 million loans 90+ days delinquent and an additional 2.21 million loans in the foreclosure process.

• HARP Refinance: Back in October, the FHFA announced some changes to HARP to allow homeowners with GSE loans and with negative or near negative equity - and who are current on their mortgages - to refinance into lower interest rate loans.

The key to this program for the lenders was that the lender was not responsible for any of the representations and warranties associated with the original loan (this is huge for the lenders). The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until March.

So I expect HARP refinance activity to pickup significantly in March.

• Mortgage Settlement: It sounds like this will be announced in late January or possibly in February (if at all). Some of the details have leaked, and there will probably be some mortgage modifications that include principal reduction. It is possible that there will be a refinance program for non-GSEs borrowers with negative equity (similar to HARP), although this hasn't been announced.

• REO to Rental Program: This rental program for Fannie and Freddie REO is being pushed by several agencies, and was discussed last week in the Fed white paper "The U.S. Housing Market: Current Conditions and Policy Considerations" and by NY Fed President William Dudley: Housing and the Economic Recovery

This program could include bulk REO sales to investors, but might also include Fannie and Freddie renting out more REOs. (Fannie and Freddie already have a program to keep tenants in place if they foreclose on a rented property).

There will be a similar effort for non-GSE properties. From the Fed white paper:

In light of the current unusually difficult circumstances in many housing markets across the nation, the Federal Reserve is contemplating issuing guidance to banking organizations and examiners to clarify supervisory expectations regarding rental of residential REO properties by such organizations while such circumstances continue (and within relevant federal and statutory and regulatory limits). If finalized and adopted, such guidance would explain how rental of a residential REO property within applicable holding-period time limits could meet the supervisory expectation for ongoing good faith efforts to sell that property. Relatedly, if a successful model is developed for the GSEs to transition REO properties to the rental market, banks may wish to participate in such a program or adopt some of its features.Look for this guidance to be issued soon, and to relax the rules on how banks can manage rented REOs.

There are some minor programs too (like the Freddie Mac program to allow 12 months of forbearance for unemployed borrowers) and there could be more programs coming. But the key policy changes will probably be 1) the mortgage settlement, 2) the HARP refinance program, and 3) the REO to rental program.

It sounds like all of these program will be in place by the end of Q1.

Saturday, January 07, 2012

Residential Construction Employment: First increase since 2005

by Calculated Risk on 1/07/2012 08:25:00 PM

The graph below shows the number of total construction payroll jobs in the U.S. including both residential and non-residential since 1969.

Construction employment increased by 17 thousand jobs in December, and is now down 2.18 million jobs from the peak in April 2006.

Total construction employment increased by 46 thousand jobs in 2011. This was the first increase for construction employment since 2006, and the first increase for residential construction employment since 2005.

Unfortunately this graph is a combination of both residential and non-residential construction employment. The BLS only started breaking out residential construction employment fairly recently (residential specialty trade contractors in 2001).

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment (and residential construction) lead the economy out of recession, and non-residential construction usually lags the economy. Because this graph is a blend, it masks the usual pickup in residential construction following previous recessions. Of course there was no pickup for residential construction this time because of the large excess supply of vacant homes.

Construction employment is mostly moving sideways, but at least it was not a drag on employment and GDP in 2011.

This table below shows the annual change in construction jobs (total, residential and non-residential) and through 2011.

| Annual Change in Payroll jobs (000s) | |||

|---|---|---|---|

| Year | Total Construction Jobs | Residential Construction Jobs | Non-Residential |

| 2002 | -85 | 88 | -173 |

| 2003 | 127 | 161 | -34 |

| 2004 | 290 | 230 | 60 |

| 2005 | 416 | 268 | 148 |

| 2006 | 152 | -62 | 214 |

| 2007 | -198 | -273 | 75 |

| 2008 | -787 | -510 | -277 |

| 2009 | -1053 | -431 | -622 |

| 2010 | -149 | -113 | -36 |

| 2011 | 46 | 20 | 26 |

After five consecutive years of job losses for residential construction (and four years for total construction), construction employment increased in 2011.

In addition residential investment has made a small positive contribution to GDP in 2011 - also for the first time since 2005.

Earlier:

• Summary for Week Ending January 6th

• Schedule for Week of Jan 8th

Unofficial Problem Bank list declines to 970 institutions

by Calculated Risk on 1/07/2012 05:32:00 PM

Update: Comments are back.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 6, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

At year-end 2011, the Unofficial Problem Bank List included 970 institutions with assets of $391.2. Changes since December 23rd include 11 removals and eight additions. At year-end 2010, the list included 935 institutions with assets of $412.4 billion. During December 2011, changes included 10 additions, eight action terminations, seven unassisted mergers, three voluntary liquidations, and two failures. It was the six consecutive month that the total number of institutions on the list declined.Earlier:

Actions were terminated against Santa Barbara Bank & Trust, National Association, Santa Barbara, CA ($5.8 billion Ticker: PCBC); Access 1st Capital Bank, Denton, TX ($109 million); Lake Region Bank, New London, MN ($98 million); Tomahawk Community Bank S.S.B., Tomahawk, WI ($81 million); Evansville Commerce Bank, Evansville, IN ($53 million); Commerce Bank of Temecula Valley, Murrieta, CA ($52 million); and The Tampa State Bank, Tampa, KS ($45 million).

Two institutions -- CenterBank of Jacksonville, National Association, Jacksonville, FL ($133 million) and Nebraska Bankers' Bank, Lincoln, NE ($34 million) found merger partners. The two other removals were voluntary liquidations of Woodlands Commercial Bank, Salt Lake City, UT ($1.6 billion) and Main Street Bank, Kingwood, TX ($240 million).

Among the eight additions are Kaw Valley Bank, Topeka, KS ($498 million); International Bank, Raton, NM ($314 million); The Citizens Bank, Nashville, GA ($287 million); and Peoples State Bank of Commerce, Nolensville, TN ($242 million). Other new actions include a Prompt Corrective Action order against First Capital Bank, Kingfisher, OK ($55 million).

There were no changes to the list during the first week of 2012. We will update the transition matrix on the next iteration as it should be a light week for any changes.

• Summary for Week Ending January 6th

• Schedule for Week of Jan 8th

Schedule for Week of Jan 8th

by Calculated Risk on 1/07/2012 01:16:00 PM

Earlier:

• Summary for Week Ending January 6th

Retail sales and the trade balance report are the key economic releases this week. Consumer sentiment might recover some more in early January.

Also several regional Fed presidents are scheduled to speak this week.

Note: Reis is expected to release their Q4 Mall vacancy rate report this week.

Note: German Chancellor Angela Merkel and French President Nicolas Sarkozy meet in Berlin.

3:00 PM: Consumer Credit for November. The consensus is for a $7.6 billion increase in consumer credit.

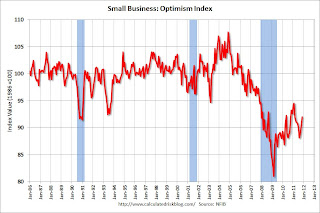

7:30 AM: NFIB Small Business Optimism Index for December.

7:30 AM: NFIB Small Business Optimism Index for December. Click on graph for larger image in graph gallery.

This graph shows the small business optimism index since 1986. The index increased to 92.0 in November from 90.2 in October. This was the third increase in a row after declining for six consecutive months.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.5% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In general, the number of job openings (yellow) has been trending up, and are up about 13% year-over-year compared to October 2010.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index was especially weak last year, although this doesn't include cash buyers.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 375,000 from 372,000 last week.

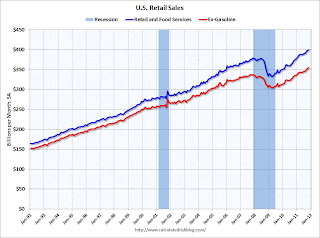

8:30 AM: Retail Sales for December.

8:30 AM: Retail Sales for December. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 20.0% from the bottom, and now 5.5% above the pre-recession peak (not inflation adjusted) .

The consensus is for retail sales to increase 0.4% in December, and for retail sales ex-autos to increase 0.4%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for November. The consensus is for a 0.5% increase in inventories.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. Both exports and imports decreased in October. Imports have been mostly moving sideways for the past six months (seasonally adjusted). Exports are well above the pre-recession peak and up 12% compared to October 2010; imports have stalled recently but are still up about 11% compared to October 2010.

The consensus is for the U.S. trade deficit to increase to $45.0 billion in November, up from from $43.5 billion in October. Export activity to Europe will be closely watched.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January.

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for January. Consumer sentiment declined sharply in July and August - from 71.5 in June to 55.7 in August, but has mostly rebounded since then.

The consensus is for an increase in January to 71.5 from 69.9 in December.

Summary for Week ending January 6th

by Calculated Risk on 1/07/2012 08:05:00 AM

A month ago I wrote: "Expectations are so low that the U.S. economic data last week looked 'good'." Not much has changed.

There were only 200,000 payroll jobs added in December. This is better than recent reports, but still weak for a recovery.

The unemployment rate fell again, but that was partially related to another decline in the labor force. There were other signs in the report of sluggish employment growth. The average workweek increased slightly to 34.4 hours, and average hourly earnings increased 0.2%. This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

For the year, the economy added 1.64 million total non-farm jobs or just 137 thousand per month. This is a better pace of payroll job creation than in 2010, but the economy still has 6.0 million fewer payroll jobs than at the beginning of the 2007 recession. There were 1.92 million private sector jobs added in 2011, or about 160 thousand per month.

At a pace of 137 thousand jobs per month, it would take about 3 1/2 more years just to get back to the pre-recession level of payroll jobs. And that doesn’t include population growth. At this stage in a recovery, we’d like to see 300+ thousand jobs added per month.

Another example of “low expectations” was the ISM manufacturing survey. The survey was at 53.9% in December, the highest level since June – but this is still weak manufacturing growth during a recovery and some of the improvement was probably due to seasonal factors.

Even a 'bright spot' is still weak: Auto sales have been increasing sharply, and were at 13.6 million on a seasonally adjusted annual rate (SAAR) basis in December. That is solid compared to recent months and years, but still below the average of over 15 million SAAR from 1984 through 2002 (leaving out the bubble years).

The US economy is growing, but the growth remains sluggish.

Here is a summary in graphs:

• December Employment Report: 200,000 Jobs, 8.5% Unemployment Rate

There were 200,000 payroll jobs added in December. This included 212,000 private sector jobs added, and 12,000 government jobs lost.

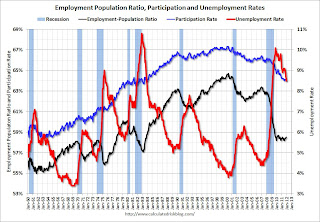

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

Click on graph for larger image.

Click on graph for larger image.

The unemployment rate declined to 8.5% (red line).

The Labor Force Participation Rate was unchanged 64.0% in December (blue line). This is the percentage of the working age population in the labor force.

The Employment-Population ratio was unchanged at 58.5% in December (black line).

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

This is the worst post WWII employment recession. However, as bad as this is, the Great Depression would be way off the chart. At the worst, employment fell a little over 6% during the recent employment recession - although the data is a little uncertain - employment probably fell by around 22% during the Great Depression.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

All categories are moving down (the less than 5 week category is back to normal levels). The other categories are still high.

The the long term unemployed declined to 3.6% of the labor force - this is still very high, but the lowest since September 2009.

• ISM Manufacturing index indicates faster expansion in December

PMI was at 53.9% in December, up from 52.7% in November. The employment index was at 55.1%, up from 51.8%, and new orders index was at 57.6%, up from 56.7%.

PMI was at 53.9% in December, up from 52.7% in November. The employment index was at 55.1%, up from 51.8%, and new orders index was at 57.6%, up from 56.7%. From the Institute for Supply Management: December 2011 Manufacturing ISM Report On Business®

Here is a long term graph of the ISM manufacturing index. This was above expectations of 53.2%, and suggests manufacturing expanded at a faster rate in December than in November.

• U.S. Light Vehicle Sales at 13.56 million SAAR in December

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.56 million SAAR in December. That is up 8.9% from December 2010, and down 0.3% from the sales rate last month (13.60 million SAAR in Nov 2011).

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.56 million SAAR in December. That is up 8.9% from December 2010, and down 0.3% from the sales rate last month (13.60 million SAAR in Nov 2011).This was at the consensus forecast of 13.6 million SAAR. Note: dashed line is current estimated sales rate.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and sales averaged 13.46 million SAAR in Q4, an increase of 8.1% over Q3.

• Construction Spending increased in November

"Construction spending during November 2011 was estimated at a seasonally adjusted annual rate of $807.1 billion, 1.2 percent above the revised October estimate of $797.4 billion."

"Construction spending during November 2011 was estimated at a seasonally adjusted annual rate of $807.1 billion, 1.2 percent above the revised October estimate of $797.4 billion."This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 64% below the peak in early 2006, and non-residential spending is 33% below the peak in January 2008.

Public construction spending is now 12% below the peak in March 2009.

This graph shows the year-over-year change in construction spending.

This graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

• ISM Non-Manufacturing Index indicates slightly faster expansion in December

The December ISM Non-manufacturing index was at 52.6%, up from 52.0% in November. The employment index increased in December to 49.4%, up from 48.9% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 52.6%, up from 52.0% in November. The employment index increased in December to 49.4%, up from 48.9% in November. Note: Above 50 indicates expansion, below 50 contraction. From the Institute for Supply Management: December 2011 Non-Manufacturing ISM Report On Business®

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 53.4% and indicates slightly faster expansion in December than in November.

• Weekly Initial Unemployment Claims decline to 372,000

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 373,250.

This is the lowest level for the 4-week average since June 2008.

• Reis: Apartment Vacancy Rate falls to 5.2% in Q4, Lowest since 2001

Reis reported that the apartment vacancy rate (82 markets) fell to 5.2% in Q4 from 5.6% in Q3. The vacancy rate was at 6.6% in Q4 2010 and peaked at 8.0% at the end of 2009.

Reis reported that the apartment vacancy rate (82 markets) fell to 5.2% in Q4 from 5.6% in Q3. The vacancy rate was at 6.6% in Q4 2010 and peaked at 8.0% at the end of 2009.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

• Reis: Office Vacancy Rate declines slightly in Q4 to 17.3%

This graph shows the office vacancy rate starting in 1991.

This graph shows the office vacancy rate starting in 1991.Reis is reporting the vacancy rate declined to 17.3% in Q4, down from 17.4% in Q3. The vacancy rate was at a cycle high of 17.6% in Q3 and Q4 2010. It appears the office vacancy rate peaked in 2010 and is declining very slowly.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

• Other Economic Stories ...

• From the Federal Reserve: The U.S. Housing Market: Current Conditions and Policy Considerations

• FOMC Minutes: Agreement to provide "projections of appropriate monetary policy" in January

• LPS on Mortgages: "Trend toward fewer loans becoming delinquent has halted"

• AAR: Rail Traffic increased 7.3 percent YoY in December

• A few key dates for Europe