by Calculated Risk on 1/09/2012 10:05:00 AM

Monday, January 09, 2012

CoreLogic: House Price Index declined 1.4% in November

Notes: This CoreLogic Home Price Index report is for November. The Case-Shiller index released in late December was for October. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of September, October and November (November weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® November Home Price Index Shows Fourth Consecutive Monthly Decline

CoreLogic ...today released its November Home Price Index (HPI®) report ... which shows that home prices in the U.S. decreased 1.4 percent on a month-over-month basis, the fourth consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 4.3 percent on a year-over-year basis in November 2011 compared to November 2010. This follows a decline of 3.7 percent in October 2011 compared to October 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in November 2011 compared to November 2010 and by 1.6 percent in October 2011 compared to October 2010. Distressed sales include short sales and real estate owned (REO) transactions.

“With one month of data left to report, it appears that the healthy, non-distressed market will be very modestly down in 2011. Distressed sales continue to put downward pressure on prices, and is a factor that must be addressed in 2012 for a housing recovery to become a reality,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 1.4% in November, and is down 4.3% over the last year.

The index is off 32.8% from the peak - and up just 1.2% from the March 2011 low.

Some of this decrease is seasonal (the CoreLogic index is NSA). Month-to-month prices changes will probably remain negative through March 2012 and it is likely that there will be new post-bubble low for this index in the next month or two.

Herman Van Rompuy: Europe needs "job-friendly growth"

by Calculated Risk on 1/09/2012 09:01:00 AM

The EU meeting on January 30th will focus on the European "anti-recession strategy" (quoting Van Rompuy).

From Herman Van Rompuy, president of the European Council: Growth-friendly consolidation and job-friendly growth is what we need

Growth-friendly consolidation and job-friendly growth is what we need! I see 3 principles of action.Also German Chancellor Angela Merkel and French President Nicolas Sarkozy are meeting today in Berlin - and growth and employment are at the top of the agenda. From the Financial Times Eurozone Crisis Live Blog:

First, avoid to the extent possible that budget-cuts affect drivers for growth. Fiscal consolidation is necessary but should not hamper structural economic growth. Growth-oriented investments should be preserved. Think of energy infrastructure, research and innovation, education and training.

Second guiding principle: enhance growth both by strengthening supply and by stimulating demand. ....

Third principle of action: stimulate employment. We need more, better and new jobs. Today, over 23 million people are unemployed in Europe. The economic slowdown risks increasing this number. Many of them are young. They need to be able to join the labour market. We should focus on all aspects of the labour market, supply and demand of jobs. Our focus should be on youth employment and lifelong learning. The recent ‘Youth Opportunities’ Commission initiative offers perspectives for skills, training and job placements. Also our “green jobs” potential should be fully developed. In parallel, we need strong labour demand. Hiring people should be easier and more attractive. Through flexible labour legislation, structural reforms or fiscal instruments.

Action on those dimensions will bring us on the path towards growth and jobs.

It is the agenda that the French president wants to highlight as he starts his campaign for re-election, and the German chancellor seems to have agreed that it is time to stress a more positive policy response to the euro crisis.

Reis: Regional Mall Vacancy Rate declines slightly

by Calculated Risk on 1/09/2012 12:14:00 AM

From the WSJ: For Malls, Occupancy Firms Up

U.S. malls and shopping centers experienced a slight improvement in occupancy during the fourth quarter ... But data service Reis Inc. cautioned that any recovery remains precarious ... "It's too soon to pronounce a turnaround at this point," said Victor Calanog, chief economist at Reis ...

Malls in the top 80 U.S. markets posted an average vacancy rate of 9.2% in the quarter, down from the 11-year high of 9.4% in the third quarter, according to Reis, which began tracking [regional] mall data in 2000. ... vacancy [for strip malls] remained at 11% ...

Retail landlords also have been helped by a virtual shutdown in new store construction, meaning they face less competition for tenants. Only 4.5 million square feet of shopping-center space opened in 2010, the lowest figure in 31 years, according to Reis. Last year was slightly higher, with only 4.9 million square feet being delivered.

Click on graph for larger image.

Click on graph for larger image.The vacancy rate for regional malls is just below the record set last quarter, and the vacancy rate for strip malls is just below the record set in 1990. It is still very ugly for malls ... but the good news is new construction is at very low levels.

Yesterday:

• Summary for Week Ending January 6th

• Schedule for Week of Jan 8th

Sunday, January 08, 2012

Question #4 for 2012: U.S. Economic Growth

by Calculated Risk on 1/08/2012 06:36:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2012. I'm trying to add some thoughts, and a few predictions for each question.

4) Economic growth: It appeared GDP growth would increase a little in 2011, but then the economy was hit by a series of shocks including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August. Even with all these shocks, 2011 real GDP growth was still positive, but below trend.

Heading into 2012 there are significant downside risks from the European financial crisis and from U.S. fiscal tightening. Will the U.S. economy grow in 2012? Or will there be another recession?

First a look back. Heading into both 2010 and 2011 there were a number of forecasts for a "V-shaped" or strong recovery (4% to 6% real GDP growth range), and also a number of forecasts for a new recession. Both views were wrong for both years.

I took the boring middle ground in 2010 and 2011: sluggish and choppy growth, but no new recession. And once again - for 2012 - I'll take sluggish growth with no recession. There are still plenty of scars from the financial crisis (excessive debt, high unemployment, excess capacity, excess supply of housing, a large number of homeowners with negative equity, and high foreclosure activity), but the economy appears to be slowly healing.

Based on recent data there have been some upgrades to the 2012 forecasts. As an example, from Goldman Sachs on Friday:

In light of better recent data and the renewal (at least through February) of the payroll tax credit and emergency unemployment benefits, we upgraded our first-quarter forecast for real GDP growth to 2% [from 0.5%].Not much, but still growth.

As predicted, residential investment (RI) made a small positive contribution to GDP growth in 2011 for the first time since 2005. This was mostly due to a significant pickup in multifamily starts and partially due to an increase in home improvement. This trend should continue into 2012, and we will probably see some increase in single family investment this year too. Since RI is the best leading indicator for the economy (although not infallible) this also suggests further growth in 2012.

There are still plenty of downside risks: financial contagion from Europe, the slowdown in China, and falling house prices all could lead to slower U.S. growth. However my guess is growth will be sluggish relative to the slack in the system, but above the 2011 growth rate.

Earlier:

• Question #5 for 2012: Employment

• Question #6 for 2012: Unemployment Rate

• Question #7 for 2012: State and Local Governments

• Question #8 for 2012: Europe and the Euro

• Question #9 for 2012: Inflation

• Question #10 for 2012: Monetary Policy

Yesterday:

• Summary for Week Ending January 6th

• Schedule for Week of Jan 8th

Question #5 for 2012: Employment

by Calculated Risk on 1/08/2012 02:05:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2012. I'm trying to add some thoughts, and a few predictions for each question.

5) Employment: The U.S. economy added 1.64 million total non-farm jobs or just 137 thousand per month in 2011. There were 1.92 million private sector jobs added in 2011, or about 160 thousand per month. Although this was an improvement from 2010, this was still weak payroll growth for a recovery. How many payroll jobs will be added in 2012?

First a little "good" news. It appears that most of the state and local government job cuts will be over by mid year 2012. Just eliminating the employment drag from these job cuts will help.

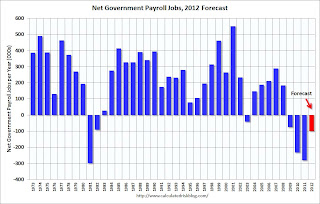

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of the annual change in government payrolls since 1970. Over the last 3 year government employment has decreased significantly (this is a combination of Federal, State and local government). It appears job cuts will slow in the first half of 2012, and government employment might be neutral in the 2nd half of this year.

For 2011, the BLS reported 280 thousand government jobs lost, and my guess is this will slow to around 100 thousand in 2012 and most of the jobs lost will be in the first half of the year.

As predicted a year ago, construction employment increased in 2011. Although the increase was small - just 46 thousand jobs - this was the first increase for construction employment since 2006, and the first increase for residential construction employment since 2005.

I expect construction employment to increase at a faster rate in 2012 - not a boom - but better than in 2011. Unfortunately employment growth will probably slow in some other sectors. As an example, although auto sales will probably continue to increase in 2012, the rate of increase will slow since most of the recovery in auto sales has already happened. This suggests that private job creation will probably be about the same in 2012 as in 2011, even with some pickup in construction.

Here is a graph of the annual change in private payrolls since 1970.

Here is a graph of the annual change in private payrolls since 1970.

Last year was disappointing given the high level of unemployment, but it was still the 2nd best year for private job creation since the 1990s.

My guess is private employment will increase around 150 to 200 thousand per month on average in 2012; about the same rate as in 2011.

With over 13 million unemployed workers - and 5.6 million unemployed for more than 26 weeks - adding 2 million private sector jobs will not seem like much of job recovery for many Americans. Hopefully I'm too pessimistic.

Earlier:

• Question #6 for 2012: Unemployment Rate

• Question #7 for 2012: State and Local Governments

• Question #8 for 2012: Europe and the Euro

• Question #9 for 2012: Inflation

• Question #10 for 2012: Monetary Policy

Yesterday:

• Summary for Week Ending January 6th

• Schedule for Week of Jan 8th