by Calculated Risk on 1/11/2012 08:20:00 AM

Wednesday, January 11, 2012

MBA: Mortgage Purchase Application Index increased

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.5 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending January 6, 2012. The results include an adjustment to account for the New Year's Day holiday.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

The Refinance Index increased 3.3 percent from the previous week. The seasonally adjusted Purchase Index increased 8.1 percent from one week earlier. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 4.11 percent from 4.07 percent ...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.34 percent from 4.41 percent ...

Click on graph for larger image.

Click on graph for larger image.The purchase index increased last week, and the 4-week average decreased slightly. This index has mostly been sideways for the last 2 years - and at about the same level as in 1997.

Offices: The Rent Rollover Problem

by Calculated Risk on 1/11/2012 12:47:00 AM

From the WSJ: Trouble Is Brewing for Office Market

[M]any [office] owners who have been able to keep their heads above water are being undone by tenant contractions and the expiration of five-year leases that were signed at the peak of the boom.As these older leases expire, the tenants are demanding lower rents - or they are moving. Since some of these owners are barely "keeping their heads above water" with the old lease rates, lower rents or higher vacancies are leading to more defaults.

Rents in most markets are still well below what they were in 2007, with the drop in some areas as much as 26%, according to data firm Reis Inc. Because of the weak market, landlords with empty space or expiring leases also have to spend large amounts on incentives to attract tenants, like free rent and interior work.

Defaults and foreclosures are rising. The delinquency rate of office loans that were securitized hit 9% in December, up from 7.4% in June.

Even with a little improvement in the economy there is still more pain to come for commercial real estate, especially for offices and malls.

Tuesday, January 10, 2012

Jim the Realtor: Online Radio

by Calculated Risk on 1/10/2012 09:11:00 PM

North county San Diego Realtor Jim Klinge has asked me to be a guest on his online radio show tonight. The show starts at 8 PM PT (11 PM ET).

Here is the link for the show. There is a toll-free number for questions (877) 317-7373. This is a first for me, so please excuse any errors.

Here is a video from Jim tonight of Mitt Romney's house in La Jolla.

Fiscal Policy: Kind of a Drag

by Calculated Risk on 1/10/2012 04:54:00 PM

Cardiff Garcia at the Financial Times Alphaville has posted a new graph from economist Alec Phillips of Goldman Sachs: Fiscal flailing, continued

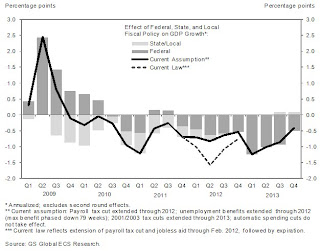

CR note: The following graph shows the estimated impact of Federal, state and local policy on GDP growth. The dark shaded rectangles are Federal policy and the light shaded rectangles are state and local policy. From Garcia:

Goldman Sachs has updated this chart, which shows the projected impact of fiscal policy on GDP growth, to reflect its latest assumptions (see the previous version here):

The dotted line that dips through 2012 is what would happen if, um, nothing happens — that is, no new fiscal measures are passed in 2012. The bars and the black line are Goldman’s forecast.

Click on graph for larger image.

Click on graph for larger image. Goldman’s assumptions include the payroll tax cut’s extension through the end of the year. Emergency unemployment benefits will also probably be extended, but the analysts expect that the maximum duration will be reduced from 99 weeks to 79 weeks.There is more discussion in Garcia's post.

A couple of key points:

1) In addition to the assumptions about 2012, this estimate assumes that the "2001/2003 tax cuts are extended through 2013, and that automatic spending cuts do not take effect." That isn't clear at this point, and the fiscal drag in 2013 could be significantly more than shown on the graph.

2) The good news, according to this estimate from Phillips, is that the drag from state and local governments will stop mid-year 2012, and be neutral for the following 12 months. That fits with my current outlook for State and Local Governments.

NFIB: Poor Sales remains top business problem for small business owners

by Calculated Risk on 1/10/2012 02:02:00 PM

Earlier the National Federation of Independent Business (NFIB) released their small business survey for December. The report included a typo in the "biggest problem" section that has now been corrected.

Twenty three percent of small business owners reported that weak sales continued to be their top business problem in December.

Currently 21% are reporting taxes as the most important problem, and 20% are reporting regulations - just below the 23% reporting "poor sales".

Click on graph for larger image.

Click on graph for larger image.

In good times, small business owners usually report taxes and regulation as their biggest problems.

This is another small sign of improvement for small businesses, but lack of demand is still the key problem.