by Calculated Risk on 3/19/2012 07:01:00 PM

Monday, March 19, 2012

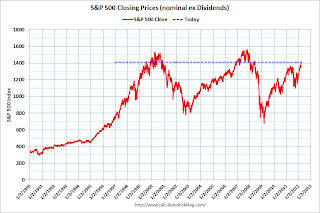

Market Update: Still a Lost Decade

Click on graph for larger image.

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 1999; almost 13 years ago.

The second graph (click on graph for larger image) from Doug Short shows the sharp increase over the last few months.

Lawler on FHA: Number of Seriously Delinquent SF Loans Down Slightly in February, Way Up from Year Ago

by Calculated Risk on 3/19/2012 03:53:00 PM

Some interesting data from economist Tom Lawler (the FHA remains a significant problem):

Updated data from the FHA’s early warning system shows that the number of FHA-insured SF loans serviced by entities with a combined FHA SF servicing portfolio of almost 7.4 million loans totaled 722,030 at the end of February, down from 732,775 in January. While this report doesn’t always exactly match other FHA reports, it tracks the “official” numbers pretty closely. Here, e.g., are the reported number of seriously delinquent FHA-insured SF loans from the EWS and from the FHA’s monthly Outlook Report.

| Seriously Delinquent FHA-Insured SF Loans | ||

|---|---|---|

| EWS | Outlook | |

| Oct-11 | 657,552 | 661,554 |

| Nov-11 | 690,271 | 689,346 |

| Dec-11 | 713,793 | 711,082 |

| Jan-12 | 732,775 | 733,844 |

| Feb-12 | 722,030 | |

Assuming the EWS numbers are reasonable estimates for February’s SDQ total, here is some historical data. In the table on the next page, the FHA insurance in force is number of loans, and is from the Monthly Report to the FHA Commissioner. These numbers differ from those in the FHA Outlook Report, for reasons unclear to me. The data on the number of SDQ loans in the Commissioner report and the Outlook report are the same save for March 2011, and I believe the Commissioner report has an incorrect number, so I used the March 2011 number from the Outlook report (aarrgh!).

| FHA SF Insured Portfolio | Seriously Delinquent | SDQ Rate | |

|---|---|---|---|

| 10/31/2010 | 6,658,560 | 532,938 | 8.00% |

| 11/30/2010 | 6,724,304 | 588,947 | 8.76% |

| 12/31/2010 | 6,813,888 | 598,140 | 8.78% |

| 1/31/2011 | 6,889,701 | 612,443 | 8.89% |

| 2/28/2011 | 6,933,260 | 619,712 | 8.94% |

| 3/31/2011 | 6,984,580 | 580,480 | 8.31% |

| 4/30/2011 | 7,036,153 | 575,950 | 8.19% |

| 5/31/2011 | 7,079,820 | 578,933 | 8.18% |

| 6/30/2011 | 7,152,140 | 584,822 | 8.18% |

| 7/31/2011 | 7,203,809 | 598,921 | 8.31% |

| 8/31/2011 | 7,260,598 | 611,822 | 8.43% |

| 9/30/2011 | 7,288,440 | 635,096 | 8.71% |

| 10/31/2011 | 7,342,712 | 661,554 | 9.01% |

| 11/30/2011 | 7,378,126 | 689,346 | 9.34% |

| 12/31/2011 | 7,415,002 | 711,082 | 9.59% |

| 1/31/2012 | 7,464,533 | 733,844 | 9.83% |

| 2/29/2012 | 7,499,802 | 722,030 | 9.63% |

CR Note: Fannie and Freddie serious delinquencies are down year-over-year, but the FHA delinquencies are up from 8.94% in Feb 2011 to 9.63%.

Desktop Underwriter® Refi Plus and Wells Fargo

by Calculated Risk on 3/19/2012 01:08:00 PM

Over the weekend I noted that Fannie Mae has updated Desktop Underwriter® (DU) so that lenders can now use the automated system. There are several advantages to the automated system, one was that borrowers would now be able to apply for a "HARP 2.0" refinance with lenders other than the lender for their original mortgage.

This morning I read the Wells Fargo "Amended DU Refi PlusTM Policy and Effective Dates".

First, Wells Fargo has decided to limit HARP 2.0 to loans that Wells services. If Wells is not the current servicer, then Wells will limit LTV to 105% - the same as HARP 1.0 guidelines. Well Fargo wrote:

"After further assessment of the new parameters for DU Refi Plus transactions, and the current market environment, Wells Fargo has reconsidered our policy regarding loans not currently serviced by Wells Fargo. As a result we will not offer unlimited LTV/CLTV options for Loans not currently serviced by Wells Fargo."This is a significant change from just a few weeks ago.

On timing of DU Refi Plus:

"Loans with the expanded parameters defined above may not be submitted for Prior Approval underwriting until April 23, 2012, when loans can be delivered to Wells Fargo."So any increase in refinance activity associated with the automated DU system, will start in late April for Wells Fargo.

NAHB Builder Confidence index unchanged in March

by Calculated Risk on 3/19/2012 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was unchanged in March at 28 (February was revised dwon from 29). Any number under 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Unchanged in March

Builder confidence in the market for newly built, single-family homes was unchanged in March from a revised level of 28 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. This means that following five consecutive months of gains, the HMI is now holding at its highest level since June of 2007.

“While builders are still very cautious at this time, there is a sense that many local housing markets have started to move in the right direction and that prospects for future sales are improving,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB) and a home builder from Gainesville, Florida. “This is demonstrated by the fact that the HMI component measuring builder expectations continued climbing for a sixth straight month in March, to its highest level in more than four years.”

“Builder confidence is now twice as strong as it was six months ago, and the West was the only region to experience a decline this month following an unusual spike in February,” observed NAHB Chief Economist David Crowe. “That said, many of our members continue to cite obstacles on the road to recovery, including persistently tight builder and buyer credit and the ongoing inventory of distressed properties in some markets.”

While the HMI component gauging current sales conditions declined one point to 29 in March, the component gauging sales expectations in the next six months gained two points to 36 and the component gauging traffic of prospective buyers held unchanged at 22.

Click on graph for larger image.

Click on graph for larger image.This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the March release for the HMI and the January data for starts (February housing starts will be released tomorrow).

Both confidence and housing starts had been moving sideways at a very depressed level for several years - but confidence has been moving up recently, and it appears starts are increasing a little too.

This is still very low, but this is the highest level since June 2007.

Residential Remodeling Index increases 11% year-over-year in January

by Calculated Risk on 3/19/2012 08:35:00 AM

From BuildFax:

Residential remodels authorized by building permits in the United States in January were at a seasonally-adjusted annual rate of 2,998,000. This is 13 percent above the revised December rate of 2,653,000 and is 11 percent above the January 2011 estimate of 2,705,000.

“Residential remodeling this winter is as strong as it has been in more than five years. We expect residential remodeling to continue to grow throughout 2012,” said Joe Emison, Vice President of Research and Development at BuildFax.

The BuildFax Remodeling Index (BFRI) is based on construction permits for residential remodeling projects filed with local building departments across the country. The index estimates the number of properties permitted. The national and regional indexes are based upon a subset of representative building departments in the U.S. and population estimates from the U.S. Census.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Remodeling Index since January 2000 on a seasonally adjusted basis. Earlier release were not seasonally adjusted.

Remodeling is below the peak levels of the housing boom - with all the equity extraction - but up 29% from the bottom in May 2009.

Note: Permits are not adjusted by value, so this doesn't mean there is more money being spent, just more permit activity. Also some smaller remodeling projects are done without permits and the index will miss that activity.

For residential investment, multi-family construction and home improvement have already picked up, and it appears single family construction will increase in 2012.