by Calculated Risk on 3/22/2012 10:12:00 AM

Thursday, March 22, 2012

Misc: Merrill House prices"bottoming now", FHFA House price index unchanged in January

• Merill Lynch put out a research note this morning: Home price forecast update

We have ... updated our home price model and believe that prices are bottoming now. However, we continue to believe the recovery will not begin in earnest until 2014. ... we expect roughly flat home prices this year and next with modest growth in 2014.Merrill had expected a further decline, but now they expect prices to be mostly flat for the next two years.

• From the FHFA: FHFA House Price Index Unchanged in January

U.S. house prices were unchanged on a seasonally adjusted basis from December to January, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.7 percent increase in December was revised downward to reflect a 0.1 percent increase. For the 12 months ending in January, U.S. prices fell 0.8 percent.Note: the FHFA index is no longer closely followed.

• From MarketWatch: Leading economic indicators rise 0.7% in February

[T]he Conference Board ... reported that its index of leading economic indicators grew 0.7% in February, led by improving jobless claims. "Continued broad-based gains in the LEI for the United States confirm a more positive outlook for general economic activity in the first half of 2012," said Ataman Ozyildirim, a Conference Board economist.

Weekly Initial Unemployment Claims decline to 348,000

by Calculated Risk on 3/22/2012 08:30:00 AM

The DOL reports:

In the week ending March 17, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 5,000 from the previous week's revised figure of 353,000. The 4-week moving average was 355,000, a decrease of 1,250 from the previous week's revised average of 356,250.The previous week was revised up to 353,000 from 351,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was declined to 355,000.

The 4-week moving average is near the lowest level since early 2008.

And here is a long term graph of weekly claims:

The ongoing decline in initial weekly claims is good news. Even in "good times" weekly claims are usually just above 300 thousand, and claims are getting there.

Wednesday, March 21, 2012

Housing: "Signs of Life"

by Calculated Risk on 3/21/2012 09:35:00 PM

A couple of excerpts from an article by Neil Shah and Nick Timiraos at the WSJ: Housing Shows Signs of Life

For the first time since 2005, investment in residential real-estate, including home building and renovation, has contributed to U.S. economic output for the past three quarters.A few comments:

...

"Housing bottoming is going to surprise a lot of people," said Kenneth Rosen, a housing economist at the University of California, Berkeley. "Housing was pulling us down consistently, quarter after quarter, for years. That was really over in 2011."

...

Home-purchase contracts in January and February are up about 20% from a year earlier for HomeServices, a subsidiary of Berkshire Hathaway Inc., and Mr. [Ronald Peltier, chief executive of HomeServices of America Inc.] said the firm now expects sales growth of around 10% this year, upgrading its forecast last fall for flat sales levels in 2012.

• There are two bottoms for housing: 1) for residential investment, new home sales and housing starts, and 2) for house prices. (see my post on February on Housing: The Two Bottoms). With residential investment adding to GDP and employment growth over the last several quarters, it appears the first bottom has already happened.

• On prices (the 2nd bottom), I'll be looking closely at year-over-year changes in various price indexes. If we are at the housing price bottom on a national basis, then year-over-year price changes should start to get smaller soon - and eventually turn positive in early 2013.

• Professor Rosen was a "housing bear" back at the peak. See these comments from Rosen in February 2006: Barron's: Is It Crunch Time for Housing?

Rosen calls himself a real-estate bear who endorses the doom-and-gloom scenario of Yale University professor Robert Shiller ... We've already passed stage one, characterized by "a falloff in new sales and orders," says Rosen, and are just entering stage two, in which unsold inventories build up.Earlier:

That may be where the crunch begins.

...

The final phase is when we see massive defaults or delinquencies on mortgage loans. That's several years away, he says, and this time the damage could be worse because of the large number of exotic loans giddy lenders extended to desperate home buyers.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

CoreLogic: Existing Home Shadow Inventory remains at 1.6 million units

by Calculated Risk on 3/21/2012 06:12:00 PM

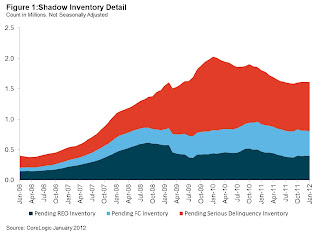

Note: there are different measures of "shadow" inventory. CoreLogic tries to add up the number of properties that are seriously delinquent, in the foreclosure process, and already REO (lender Real Estate Owned) that are NOT currently listed for sale. Obviously if a house is listed for sale, it is already included in the "visible supply" and cannot be counted as shadow inventory.

From CoreLogic: CoreLogic® Reports Shadow Inventory as of January 2012 Remains Flat

CoreLogic ... reported today that the current residential shadow inventory as of January 2012 was 1.6 million units (6-months’ supply), approximately the same level reported in October 2011. On a year-over-year basis, shadow inventory was down from January 2011, when it stood at 1.8 million units, or 8-months’ supply. Currently, the flow of new seriously delinquent (90 days or more) loans into the shadow inventory has been offset by the roughly equal flow of distressed sales (short and real estate owned).

“Almost half of the shadow inventory is not yet in the foreclosure process,” said Mark Fleming, chief economist for CoreLogic. “Shadow inventory also remains concentrated in states impacted by sharp price declines and states with long foreclosure timelines.”

...

CoreLogic estimates the current stock of properties in the shadow inventory, also known as pending supply, by calculating the number of distressed properties not currently listed on multiple listing services (MLSs) that are seriously delinquent, in foreclosure and real estate owned (REO) by lenders.

...

Of the 1.6 million properties currently in the shadow inventory, 800,000 units are seriously delinquent (3.1-months’ supply), 410,000 are in some stage of foreclosure (1.6-months’ supply) and 400,000 are already in REO (1.6-months’ supply).

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic shows the breakdown of "shadow inventory" by category. More from CoreLogic:

The highest concentration of shadow inventory is for loans with loan balances between $100,000 and $125,000. More importantly while the overall supply of homes in the shadow inventory is declining versus a year ago, the declines are being driven by higher balance loans. For loans with balances of $75,000 or less, however, the shadow is still growing and is up 3 percent from a year ago.So the key number in this report is that as of January, there were 1.6 million homes seriously delinquent, in the foreclosure process or REO that are not currently listed for sale.

...

Florida, California and Illinois account for more than a third of the shadow inventory. The top six states, which would also include New York, Texas and New Jersey, account for half of the shadow inventory.

The shadow inventory is approximately four times higher than its low point (380,000 properties) at the peak of the housing bubble in mid-2006.

Note: The unlisted REO still seems a little high since total REO has dropped sharply over the last couple of quarters.

Earlier:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Existing Home Sales: Inventory and NSA Sales Graph

by Calculated Risk on 3/21/2012 02:37:00 PM

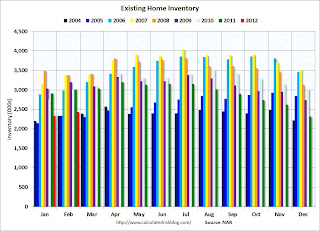

The NAR reported inventory increased seasonally to 2.43 million in February. This is down 19.3% from February 2011, and up 4% from the inventory level in February 2005 (mid-2005 was when inventory started increasing sharply). This decline in inventory has been a significant story over the last year.

There are several possible reasons for the decline:

• The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we comparing inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is down sharply year-over-year.

• There are probably a large number of sellers "waiting for a better market", and we could call this pent-up supply. When the market eventually improves, this pent-up supply will come on the market and probably keep prices from rising - but having less listed inventory now means less downward pressure on prices now.

• There is a seasonal pattern for inventory, and usually December and January have the lowest inventory levels for the year. Although there is some variability, usually inventory increases about 10% to 15% from January to mid-summer. That would put inventory at around 2.55 to 2.7 million by July (up from 2.33 million in January). At the current sales rate, this would push the months-of-supply measure up to 6.7 to 7.1 months from the current 6.4 months. The inventory increase from January to February was the normal seasonal increase.

• The number of completed foreclosures declined in 2011 and are expected to increase in 2012. This will probably lead to more REO (lender Real Estate Owned) listed for sale and some increase in the level of inventory.

I don't think this increase will be huge. My guess is that at most this will add 200 thousand listed REOs to the expected seasonal increase that would put listed inventory at 2.75 to 2.9 million in mid-summer - or about 7.2 to 7.6 months-of-supply at the current sales rate. That is higher than normal, but inventory would still be down 10% or more from 2011.

• Tom Lawler has pointed out that there has been a substantial increase in the number of SF homes purchased by investors with the explicit intention to rent the homes out for several years and this is probably another reason for the decline in invnetory.

The bottom line is the decline in listed inventory is a big deal, and will lead to less downward pressure on prices. Just like last year, inventory will be something to watch closely all year.

The following graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

Click on graph for larger image.

Click on graph for larger image.

This year (dark red for 2012) inventory is at the lowest level for a February since 2005. Inventory is still elevated - especially with the much lower sales rate - but lower inventory levels put less downward pressure on house prices (of course the level of distressed properties is still very high, and there is a significant shadow inventory).

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

Sales NSA (red column) are above the sales for the last four years (2008 through 2011), but well below the bubble years of 2005 and 2006.

The level of sales is still elevated due to investor buying. The NAR noted:

All-cash sales rose to 33 percent of transactions in February from 31 percent in January; they were 33 percent in February 2011. Investors account for the bulk of cash transactions.Earlier:

Investors purchased 23 percent of homes in February, unchanged from January; they were 20 percent in February 2011.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales graphs