by Calculated Risk on 3/23/2012 05:38:00 PM

Friday, March 23, 2012

Bank Failure #14 in 2012: Covenant Bank & Trust, Rock Spring, Georgia

Another Georgia bank down

The Ouroboros

by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes

All of the Deposits of Covenant Bank & Trust, Rock Spring, GeorgiaAre there any banks left in Georgia?

As of December 31, 2011, Covenant Bank & Trust had approximately $95.7 million in total assets and $90.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.5 million. ... Covenant Bank & Trust is the fourteenth FDIC-insured institution to fail in the nation this year, and the fourth in Georgia.

DOT: Vehicle Miles Driven increased 1.6% in January

by Calculated Risk on 3/23/2012 04:30:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +1.6% (3.5 billion vehicle miles) for January 2012 as compared with January 2011. Travel for the month is estimated to be 224.8 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Even with a small year-over-year increase in December, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 50 months - and still counting!

The second graph shows the year-over-year change from the same month in the previous year.

This is the second consecutive month with a year-over-year increase in miles driven - for the first time since 2010.

This is the second consecutive month with a year-over-year increase in miles driven - for the first time since 2010.Looking back, gasoline prices (regular) were around $3.06 per gallon in January 2011, and averaged $3.33 per gallon this year. Even though prices are up sharply over the last couple of months, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

Zillow's forecast for Case-Shiller House Price index in January

by Calculated Risk on 3/23/2012 02:35:00 PM

Zillow Forecast: January Case-Shiller Composite-20 Expected to Show 3.7% Decline from One Year Ago

On Tuesday, March 27th, the Case-Shiller Composite Home Price Indices for January will be released. Zillow predicts that both the 20-City and the 10-City Composite Home Price Indices (non-seasonally adjusted [NSA]) will decline by 3.7 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from December to January will be zero percent and -0.1 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Zillow's forecasts for Case-Shiller have been pretty close, and I expect Case-Shiller will report house prices at a new post-bubble low in January for the Not Seasonally Adjusted (NSA) indexes.

The seasonally adjusted indexes will probably be close to the level reported in December.

One of the keys this year will be to watch the year-over-year change in the various house price indexes. The composite 10 and 20 indexes declined 3.9% and 4.0% respectively in December, after declining 3.8% in November. Zillow is forecasting a slightly smaller year-over-year decline in January.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | January 2011 | 154.36 | 155.43 | 140.78 | 141.98 |

| Case-Shiller (last month) | December 2011 | 149.89 | 149.76 | 136.71 | 136.63 |

| Zillow January Forecast | YoY | -3.7% | -3.7% | -3.7% | -3.7% |

| MoM | -0.8% | -0.1% | -0.8% | 0.0% | |

| Zillow Forecasts1 | 148.7 | 149.6 | 135.6 | 136.7 | |

| Post Bubble Lows | 149.89 | 149.76 | 136.71 | 136.63 | |

| Date of Low | December 2011 | December 2011 | December 2011 | December 2011 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Home Sales: Distressing Gap

by Calculated Risk on 3/23/2012 12:16:00 PM

Here is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through February. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image.

Click on graph for larger image.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

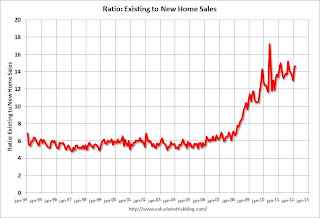

The second graph shows the same information but as a ratio of existing sales to new home sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

So far there has been little progress towards a more "normal" market.

On February New Home Sales:

• New Home Sales decline in February to 313,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales decline in February to 313,000 Annual Rate

by Calculated Risk on 3/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was down from a revised 318 thousand in January (revised down from 321 thousand). November and December of last year were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2012 were at a seasonally adjusted annual rate of 313,000 ... This is 1.6 percent (±23.9%)* below the revised January rate of 318,000, but is 11.4 percent (±17.8%)* above the February 2011 estimate of 281,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply increased to 5.8 in February from 5.7 in January.

The all time record was 12.1 months of supply in January 2009.

This is now close to normal (less than 6 months supply is normal).

This is now close to normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of February was 150,000. This represents a supply of 5.8 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 54,000 units in February. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2012 (red column), 25 thousand new homes were sold (NSA). Last year only 22 thousand homes were sold in February (although 2012 is a leap year). This was the second weakest February since this data has been tracked - the third weakest was February 2010 with 27 thousand homes sold. The high for February was 109 thousand in 2005.

This was below the consensus forecast of 325 thousand.

This was below the consensus forecast of 325 thousand.New home sales have averaged only 303 thousand SAAR over the 22 months since the expiration of the tax credit ... mostly moving sideways, although sales have been increasing a little lately (averaging 322 thousand rate over the last four months).