by Calculated Risk on 3/27/2012 09:00:00 AM

Tuesday, March 27, 2012

Case Shiller: House Prices fall to new post-bubble lows in January

S&P/Case-Shiller released the monthly Home Price Indices for January (a 3 month average of November, December and January).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:

2012 Home Prices Off to a Rocky Start According to the S&P/Case-Shiller Home Price Indice

Data through January 2012, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices ... showed annual declines of 3.9% and 3.8% for the 10- and 20-City Composites, respectively. Both composites saw price declines of 0.8% in the month of January. Sixteen of 19 MSAs also saw home prices decrease over the month; only Miami, Phoenix and Washington DC home prices went up versus December 2011. (Due to delays in data reporting, the January 2012 index values for Charlotte are not included in this month’s release).

“Despite some positive economic signs, home prices continued to drop. The 10- and 20- City Composites and eight cities – Atlanta, Chicago, Cleveland, Las Vegas, New York, Portland, Seattle and Tampa – made new lows,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Detroit and Phoenix, two cities that have suffered massive price declines, plus Denver, saw increasing prices versus January 2011. The 10-City Composite was down 3.9% and the 20-City was down 3.8% compared to January 2011.

Click on graph for larger image.

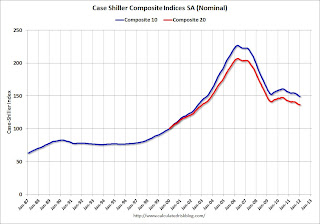

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and down 0.1% in January (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and unchanged in January (SA) from December. The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.8% compared to January 2011.

The Composite 20 SA is down 3.8% compared to January 2011. This was a slightly smaller year-over-year decline for both indexes than in December.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next couple of months (this report was for the three months ending in January). I'll have more on prices later.

Monday, March 26, 2012

House Prices and Lagged Data

by Calculated Risk on 3/26/2012 10:33:00 PM

All data is lagged, but some data is lagged more than others.

In times of economic stress, I tend to watch the high frequency data closely: initial weekly unemployment claims, monthly manufacturing surveys, and consumer sentiment. The “high frequency” data is lagged, but the lag is usually just a week or two.

Most of the time I focus on the monthly employment report, GDP, housing starts, new home sales and retail sales. The lag for most of this data is several weeks. As an example, the BLS reference period contains the 12th of the month, so the report is lagged a few weeks by the time it is released. The housing starts and new home sales data released last week were for February, so the lag is also a few weeks after the end of the month. The advance estimate of quarterly GDP is released several weeks after the end of the quarter.

But sometimes the lag can be much longer. Tomorrow morning the January Case-Shiller house price index will be released. This is actually a three month average for house sales recorded in November, December and January. (Update: April 24: S&P obtains the data when recorded, but uses closing dates, not recording dates for the price index).

But remember that the purchase agreement for a house that closed in November was probably signed in September or early October. So some portion of the Case-Shiller index will be for contract prices 6 or even 7 months ago!

Other house price indexes do a little better. CoreLogic uses a weighted 3 month average with the most recent month weighted the most – and they will release their February index next week, almost a month ahead of Case-Shiller. The LPS house price index is for just one month (not an average) and uses only closings (not recordings like other indexes that can add an additional lag).

But the key point is that the Case-Shiller index will not catch the inflection point for house prices until well after the event happens. Just something to remember ...

Dallas Fed: Texas Manufacturing Expansion Continues in March

by Calculated Risk on 3/26/2012 06:40:00 PM

This was released earlier today.

From the Dallas Fed: Texas Manufacturing Expansion Continues

Texas factory activity continued to increase in March, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, held steady at 11.1, suggesting growth continued at about the same pace as last month.The Dallas Fed asked some special questions on hiring plans too. The survey indicated that more firms expect to hire over the next six months as opposed to the previous special survey in January 2011. The reason given for hiring is "Expected growth of sales or revenue is high". More demand.

...

Perceptions of broader economic conditions remained positive in March. The general business activity index was positive for the third month in a row, although it fell from 17.8 to 10.8. Twenty-three percent of firms noted improvement in the level of business activity, while 12 percent noted a worsening. The company outlook index posted a sixth consecutive positive reading, but it also retreated slightly, falling to 9.5 from 15.8 last month.

Labor market indicators reflected higher labor demand. Strong employment growth continued in March, although the index edged down from 25.2 to 21.7. Twenty-nine percent of firms reported hiring new workers, while 7 percent reported layoffs. The hours worked index continued to suggest average workweeks lengthened.

Lawler on possible Fannie and Freddie Principal Reductions

by Calculated Risk on 3/26/2012 03:57:00 PM

From housing economist Tom Lawler:

Several media stories, including one from NPR/ProPublica, suggest that new analysis by folks at Fannie and Freddie indicate that engaging in some principal reduction modifications may be cost effective to the GSEs.

At least one of these stories, however, made what appears to be a “most erroneous” statement. E.g. a ProPublica reporter, in a follow-up article to the original NPR/ProPublica article on this issue, wrote that the GSE’s analysis suggested that “(s)uch loan forgiveness wouldn’t just help hundreds of thousands of families (stay) in their homes,” but “it would help save Freddie and Fannie money,” which “would help taxpayers…”

That latter statement, however, appears to be incorrect. Other reports, including an interview with Freddie’s CEO, indicate that the GSEs’ analysis finds that principal reductions would be “cost effective” for the GSEs ONLY after factoring in the new, turbo-charged incentives Treasury would pay to the GSEs (and other lenders/investors) for doing a principal reduction under HAMP. Such incentives -- which were recently tripled, and which the administration recently agreed would be paid to the GSEs as well as other HAMP participants (the GSEs didn’t use to get any HAMP incentives) – are obviously paid for by the government/taxpayers.

HousingWire reported on Friday, e.g., that Freddie CEO “Ed” Haldeman said the following at a symposium:

"I have to say recently the Treasury sweetened the program and tremendously increased the incentive payments in their offer to us. We will reevaluate that to see what may be in our economic best interest. If there are very large incentive payments — which could be 50% of what you could write down — it may be in our economic self-interest to participate in that."

So here’s the “taxpayer” scoop: as best as I can tell, the GSEs’ analysis (which, to be fair, some have questioned) suggests that principal reductions would NOT make sense for them (or, implicitly, for taxpayers) without any Treasury/taxpayer incentive payments. However, IF the GSEs receive hefty incentive payments from Treasury/taxpayers to engage in principal reductions, then in some cases doing so WOULD make sense to the GSEs – but NOT to taxpayers!

CR Note: Hopefully the analysis will be released!

Comment: QE3 Remains Likely

by Calculated Risk on 3/26/2012 01:22:00 PM

I still think QE3 is likely around mid-year. Fed Chairman Bernanke's comments this morning that the "job market remains far from normal", and that he views the high unemployment rate as cyclical, not structural (I think this is obvious), suggests the Fed remains ready to take more action.

The next two meetings of the FOMC (April 24th and 25th, and June 19th and 20th) are both two day meetings. Although the Fed remains data dependent, I think they might hint at further action in April, and possibly announce QE3 in June.

From Kristina Peterson and Jon Hilsenrath at the WSJ: Bernanke Notes Labor Market Concerns

Federal Reserve Chairman Ben Bernanke said low interest-rate policies were needed to confront deep, continuing problems in the labor market.Goldman Sachs economists wrote in early March:

The comments run counter to a view that has emerged in financial markets recently that the Fed is preparing to back away from its low-interest-rate policies. ... Mr. Bernanke's comments indicate that his own views about policy haven't shifted as much as the markets have in recent weeks.

...

Mr. Bernanke avoided trying an answer another question: Whether the Fed will launch another bond-buying program, known to many as "quantitative easing," to push long-term interest rates even lower. The Fed has clearly left the door open to another program, but hasn't made any decisions on whether or how to proceed on that front. Mr. Bernanke's comments Monday suggested another round of bond buying is still on the table if the economy slows or unemployment starts rising again, but it's not a sure thing.

We expect that the Fed will ultimately announce a return to balance sheet expansion sometime in the first half of 2012, likely including purchases of mortgagebacked securities (MBS).At the same time, Merrill Lynch noted:

In our view, it is wishful thinking to believe the Fed will do QE when the data flow is healthy. We expect renewed QE only after Operation Twist ends in June ... only if the economy is slowing ... Under our growth forecast ... QE3 comes in September.If the economy slows, and key inflation measures start falling again - then QE3 remains likely. But right now, with most data somewhat better than expected, and inflation a little higher than the Fed's target, the Fed is still in "wait and see" mode.

If we look at the most recent projections, the unemployment rate has fallen a little faster than expected, GDP has been a little stronger, and inflation is a little higher. My guess is the decline in the unemployment rate will slow, and inflation will ease - so I think QE3 remains likely around mid-year.