by Calculated Risk on 3/29/2012 04:12:00 PM

Thursday, March 29, 2012

Bernanke: "The Federal Reserve and the Financial Crisis" Part 4

This is part 4 of 4 of a lecture series on the Federal Reserve.

From the WSJ: Fed Chief Bernanke Defends Bond Buys

In the period after World War II, "many central banks began to view financial stability as kind of a junior partner to monetary policy—it was not as important," Mr. Bernanke said. "It's now clear that maintaining financial stability is just as important a responsibility as monetary and economic stability, and indeed this is very much a return to where the Fed came from in the beginning."My comment: One of the key reason for the financial crisis was the lack of proper oversight during the bubble. Usually I'm pretty optimistic, but as time passes, and memories fade, the oversight will probably be ignored again.

Here is a link to the lecture series including links to videos.

Here are the slides for the lectures:

Lecture 1: Origins and Mission of the Federal Reserve

Lecture 2: The Federal Reserve after World War II

Lecture 3: The Federal Reserve’s Response to the Financial Crisis

Lecture 4: The Aftermath of the Crisis

CoreLogic: Almost 65,000 completed foreclosures in February 2012

by Calculated Risk on 3/29/2012 01:03:00 PM

From CoreLogic: CoreLogic® Reports Almost 65,000 Completed Foreclosures Nationally in February

CoreLogic ... today released its National Foreclosure Report for January, which provides monthly data on completed foreclosures, foreclosure inventory and 90+ delinquency rates. There were approximately 65,000 completed foreclosures in February 2012, compared to 66,000 in February 2011, and 71,000 in January 2012. The number of completed foreclosures for the 12 months ending in February was 862,000. From the start of the financial crisis in September 2008, there have been approximately 3.4 million completed foreclosures.This is a new monthly report and will help track the number of completed foreclosures, and to see if the lenders are starting to clear the foreclosure inventory backlog following the mortgage settlement.

Approximately 1.4 million homes, or 3.4 percent of all homes with a mortgage, were in the foreclosure inventory as of February 2012 compared to 1.5 million, or 3.6 percent, in February 2011 and 1.4 million, or 3.4 percent, in January 2012. Nationally, the number of borrowers in the foreclosure inventory decreased by 115,000, a decline of 7.6 percent, in February 2012 compared to February 2011.

"The pace of completed foreclosures is down slightly compared to January, running at an annualized pace of 670,000, but compares favorably to the pace of completed foreclosures in February a year ago. Even though the pace of completed foreclosures has slowed, the overall foreclosure inventory is decreasing because REO sales were up in February,” said Mark Fleming, chief economist for CoreLogic. “With the spring buying season upon us, the inventory may decline further as the pace of distressed-asset sales rises along with the rest of the housing market.”

Notes: The sequence is 1) a loan goes delinquent, 2) if it doesn't cure, after several months, the foreclosure process begins (this is called the "foreclosure inventory"), 3) then the foreclosure is completed and becomes REO (lender Real Estate Owned), and then 4) the REO is sold. Sometimes, during this process, the loan will cure or a short sale approved, so not all loans in the foreclosure inventory are future "completed foreclosures".

When CoreLogic reports "completed foreclosures", they are discussing the number of homes moving from the foreclosure process to REO.

Another vendor, LPS, reported 91,086 completed foreclosures in January (significantly above the revised 71,000 reported by CoreLogic). I've heard that the LPS February numbers will probably be higher than CoreLogic too (LPS will release next week).

Kansas City Fed: Growth in Manufacturing Activity Moderated Slightly in March

by Calculated Risk on 3/29/2012 11:00:00 AM

From the Kansas City Fed: Growth in Tenth District Manufacturing Activity Moderated Slightly but Remained Solid Overall

Growth in Tenth District manufacturing activity moderated slightly but remained generally solid overall, with a continued positive outlook for future months. ... The month-over-month composite index was 9 in March, down from 13 in February but up from 7 in January ...The index for number of employees increased from 11 to 12, and the average workweek index increase to +2 from -3 in February.

The production index dropped from 20 to 13, and the order backlog index also fell after rising last month. In contrast, the shipments and new order indexes both increased from 8 to 17, and employment index also edged higher.

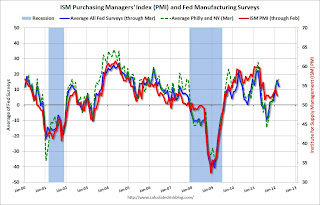

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

The ISM index for March will be released Monday April 2nd, and these surveys suggest some increase from the 52.4 reading in February.

Weekly Initial Unemployment Claims decline to 359,000

by Calculated Risk on 3/29/2012 08:30:00 AM

The DOL reports:

In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500.Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,000 (after annual revisions).

The 4-week moving average is at the lowest level since early 2008 (including revisions).

And here is a long term graph of weekly claims:

The ongoing decline in initial weekly claims is good news. After the revisions, this is the lowest level for claims since early 2008 and the trend is down.

Wednesday, March 28, 2012

Update: Gasoline Prices

by Calculated Risk on 3/28/2012 08:14:00 PM

From the WSJ: Iran Oil Flow Slows, and Price Fears Rise

By the end of March, with three months until a European Union embargo on Iranian oil takes effect, Iran's exports are expected to fall by about 300,000 barrels a day from last month, to 1.9 million barrels daily, a nearly 14% drop ...From Jim Hamilton at Econbrowser: A rational reason for high oil prices

Mounting fears of Iranian disruptions have sent the price U.S. motorists pay at gasoline pumps closer to $4 a gallon.

From the WaPo: Gas prices in D.C. surpass $4 a gallon

Two months before the summer driving season officially starts, average gas prices in the Washington region have hit $4, the earliest they have ever reached that milestone ... According to AAA’s national survey of gas prices, a gallon of regular-grade fuel is now averaging $4.15 in the District. ... The national average is $3.91, compared to about $3.70 last month and just below $3.59 this time last year.Hey - I wish gasoline was back to only $4 per gallon in California!

Note: The graph shows oil prices for WTI; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |