by Calculated Risk on 3/30/2012 12:50:00 PM

Friday, March 30, 2012

State Unemployment Rates "little changed" in February

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in February. Twenty-nine states recorded unemployment rate decreases, 8 states posted rate increases, and 13 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while only one state experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.3 percent in February. Rhode Island and California posted the next highest rates, 11.0 and 10.9 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Misc: Chicago PMI declines to 62.2, Consumer Sentiment improves

by Calculated Risk on 3/30/2012 09:55:00 AM

• Chicago PMI: The overall index declined to 62.2 in March from 64.0 in February. This was below consensus expectations of 63.0 and indicates slower growth in March. Note: any number above 50 shows expansion. From the Chicago ISM:

The Chicago Purchasing Managers reported the March Chicago Business Barometer paused after February's ten month high. While slowing, the Chicago Business Barometer marked its fifth month above 60, a 2-1/2 year period of expansion and trend data improved. Increases were seen in five of eight Business Activity Indexes, highlighted by significant advances in Prices Paid and Inventories, and a notable lengthening in lead times for Production Material.•

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.Click on graph for larger image.

This was above the consensus forecast of an increase to 74.7. Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer and is near the high since collapsing in late 2007 and early 2008.

Personal Income increased 0.2% in February, Spending 0.8%

by Calculated Risk on 3/30/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for February:

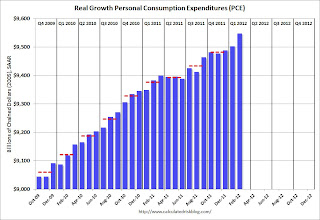

Personal income increased $28.2 billion, or 0.2 percent ... in February, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $86.0 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in February, compared with an increase of 0.2 percent in January. ... The price index for PCE increased 0.3 percent in February, compared with an increase of 0.2 percent in January. The PCE price index, excluding food and energy, increased 0.1 percent, compared with an increase of 0.2 percent.

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 3.7% in February.

This was a sharp increase in spending in February (and January spending was revised up). Using the two-month method, it appears real PCE will increase around 2.0% in Q1 (PCE is the largest component of GDP); the mid-month method suggests an increase closer to 2.9%.

Thursday, March 29, 2012

Los Angeles Mayor to "lay off a large number of employees"

by Calculated Risk on 3/29/2012 09:20:00 PM

Just a reminder that the state and local layoffs haven't ended ...

From the LA Daily News: L.A. Mayor Antonio Villaraigosa calls for layoffs of city workers

"We're going to lay off a large number of employees. I'm not going to say how many," [Mayor Antonio Villaraigosa] said ... today.According to the BLS, state and local governments have reduced payrolls by about 650 thousand over the last four years. The pace of layoffs has slowed recently, but there are still more to come.

...

City Administrative Officer Miguel Santana said this week the city's budget deficit for the next fiscal year is close to $220 million.

...

The mayor said he will push to raise the retirement age for city workers to 67, vowing to put it before voters if not approved by the City Council.

Q4 GDP and GDI

by Calculated Risk on 3/29/2012 07:19:00 PM

Early this morning the BEA released the third estimate of Q4 GDP. The BEA reported that Real gross domestic product "increased at an annual rate of 3.0 percent in the fourth quarter of 2011", the same as the previous estimate.

Also in the release, the BEA reported the real gross domestic income (GDI) increased at a 4.4% annualized rate in Q4.

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). A research paper in 2010 suggested that GDI is often more accurate than GDP. For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...During the worst period of the recession, GDI fell more than GDP as Nalewaik noted. In subsequent revisions, GDP was revised down showing the economy contracted more than originally reported - and closer to the original GDI reports.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

The opposite has happened over the last two quarters - GDI is showing stronger growth than GDP - and this suggests that 2nd half 2011 GDP might be revised up with the next annual revision that will be released on July 27th (Revised Estimates will be provided for years 2009 through 2011).

David Wessell wrote about this at the WSJ Real Time Economics this morning GDI: An Alternate Measure Showing Stronger U.S. Growth

With its third revision of fourth-quarter GDP, issued Thursday, the agency also released its GDI estimates. Here’s what they show:Of course this is all history and the focus will be on Q1.

GDP Q4 up 3.0% GDI Q4 up 4.4%

GDP Q3 up 1.8% GDI Q3 up 2.6%

FULL YEAR 2011 GDP: up 1.7% FULL YEAR 2011 GDI: up 2.1%

As our colleague Jon Hilsenrath notes: “The clues in these numbers are especially important now because of the Okun’s Law conundrum: The economy doesn’t seem to be growing fast enough to account for the recent sharp declines in the unemployment rate. It might be the case that GDP numbers are understating growth.” (Read more about the disconnect between growth and labor-market improvement.)

Reacting to the latest numbers (on Twitter), economist Justin Wolfers of the University of Pennsylvania said: “GDI growth was fast enough to explain rapid jobs growth. Historically, GDP revises toward GDI.”

Note: Personal income and outlays for February will be released tomorrow.