by Calculated Risk on 3/31/2012 08:05:00 AM

Saturday, March 31, 2012

Summary for Week ending March 30th

Last week S&P reported that the Case-Shiller house price index fell to a new post-bubble low in January. However it is important to remember that the Case-Shiller index has a significant lag to current pricing.

The report last week was for a three month average for house sales recorded in November, December and January, and sales are usually recorded a couple of months after the purchase agreement is signed. For a house that closed in November, the purchase agreement was probably signed in September or early October. So some portion of the just reported Case-Shiller index was for contract prices over 6 months ago!

Even the most recent portion of the index (for January) is probably for contracts signed in November or early December. A significant lag was fine when we expected prices to just keep on falling, but for those of us now looking for an inflection point for house prices, the Case-Shiller index will only tell us well after the event.

Other data was mixed last week. Three regional Fed manufacturing surveys showed slower expansion in March, the Chicago PMI declined, and pending home sales were down in February.

On the other hand, personal spending increased in February, consumer sentiment improved, and weekly initial unemployment continued to trend down.

Overall mixed and still sluggish growth.

Here is a summary in graphs:

• Case Shiller: House Prices fall to new post-bubble lows in January

S&P/Case-Shiller released the monthly Home Price Indices for January (a 3 month average of November, December and January).

Click on graph for larger image.

Click on graph for larger image.

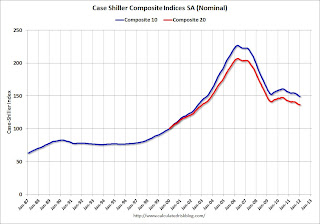

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.2% from the peak, and down 0.1% in January (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and unchanged in January (SA) from December. The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 SA is down 3.8% compared to January 2011.

The Composite 20 SA is down 3.8% compared to January 2011. This was a slightly smaller year-over-year decline for both indexes than in December.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Prices increased (SA) in 9 of the 20 Case-Shiller cities in January seasonally adjusted (only 3 cities increased NSA). Prices in Las Vegas are off 61.8% from the peak, and prices in Dallas only off 8.6% from the peak. There was no data for Charlotte in January.

Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next couple of months (this report was for the three months ending in January).

• Real House Prices and Price-to-Rent Ratio decline to late '90s Levels

Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

This graph shows the CoreLogic, Case-Shiller Composite 20, and Case-Shiller National indexes in real terms (adjusted for inflation using CPI less Shelter).

This graph shows the CoreLogic, Case-Shiller Composite 20, and Case-Shiller National indexes in real terms (adjusted for inflation using CPI less Shelter). In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to February 2000, and the CoreLogic index back to August 1999.

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to February 2000 levels, and the CoreLogic index is back to August 1999.

• Weekly Initial Unemployment Claims decline to 359,000

The following graph shows the 4-week moving average of weekly claims since January 2000.

The DOL reports "In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500." Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."

The DOL reports "In the week ending March 24, the advance figure for seasonally adjusted initial claims was 359,000, a decrease of 5,000 from the previous week's revised figure of 364,000. The 4-week moving average was 365,000, a decrease of 3,500 from the previous week's revised average of 368,500." Note: "This week's release reflects the annual revision to the weekly unemployment claims seasonal adjustment factors. The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 365,000 (after annual revisions).

The 4-week moving average is at the lowest level since early 2008 (including revisions).

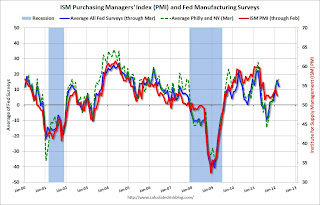

• Regional Fed Manufacturing Surveys

Three regional Fed surveys were released last week: Richmond, Dallas and Kansas City. All three showed slightly slower expansion in March.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:The New York and Philly Fed surveys are averaged together (dashed green, through March), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through February (right axis).

• Personal Income increased 0.2% in February, Spending 0.8%

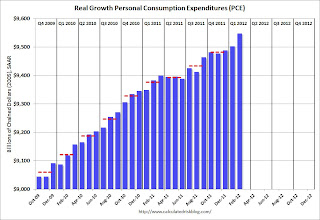

The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars).

PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase.

PCE increased 0.8% in February, and real PCE increased 0.5%. January was revised up from unchanged to a 0.2% increase. Note: The PCE price index, excluding food and energy, increased 0.1 percent. The personal saving rate was at 3.7% in February.

This was a sharp increase in spending in February (and January spending was revised up). Using the two-month method, it appears real PCE will increase around 2.0% in Q1 (PCE is the largest component of GDP); the mid-month method suggests an increase closer to 2.9%.

• Consumer Sentiment improves in March

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.

The final Reuters / University of Michigan consumer sentiment index for March increased to 76.2, up from the preliminary reading of 74.3, and up from the February reading of 75.3.This was above the consensus forecast of an increase to 74.7. Overall sentiment is still fairly weak, although sentiment has rebounded from the decline last summer and is near the high since collapsing in late 2007 and early 2008.

• Other Economic Stories ...

• Chicago PMI declines to 62.2

• From the NAR: Pending Home Sales Ease in February but Solidly Higher Than a Year Ago

• From ATA: ATA Truck Tonnage Increased 0.5% in February

• Restaurant Performance Index increases in February

Friday, March 30, 2012

Unofficial Problem Bank list declines to 948 Institutions

by Calculated Risk on 3/30/2012 10:30:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for March 30, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, the FDIC released its enforcement action activity for February 2012. For the week, there were six removals and five additions, which leave the Unofficial Problem Bank List with 948 institutions and assets of $377.6 billion. A year ago, there were 985 institutions with assets of $431.1 billion. For the month of March 2012, there were 21 removals and nine additions or a net decline of 12 institutions and assets of $12.1 billion. This month there were 14 removals from action termination, which is the first month since the list has been published that action terminations greatly outpaced new additions.The unofficial problem bank list peaked at 1,004 institutions in July 2011, and has slowly declined since then.

The action terminations this week include Homestreet Bank, Seattle, WA ($2.2 billion); Security State Bank, Scott City, KS ($132 million); United Pacific Bank, City Of Industry, CA ($126 million); America California Bank, San Francisco, CA ($123 million); and Peoples Bank of the South, Bude, MS ($78 million). The failed Fidelity Bank, Dearborn, MI ($843 million Ticker: DEAR), which had been operating under a Prompt Corrective Action order since September 2011, was also removed this week.

The five additions include Community Bank of Florida, Inc., Homestead, FL ($525 million); Frontier Bank, LaGrange, GA ($298 million); Bank of Eastman, Eastman, GA ($221 million); First Enterprise Bank, Oklahoma City, OK ($167 million); and Surety Bank, DeLand, FL ($112 million).

Fannie Mae and Freddie Mac Serious Delinquency rates declined in February

by Calculated Risk on 3/30/2012 06:33:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in February to 3.82%, down from 3.90% in January. This is down from 4.44% in February 2011. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined to 3.57% in February, down from 3.59% in January. Freddie's rate is down from 3.82% in Feburary 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The serious delinquency rate has been declining, but declining very slowly. The recent sideways move for Freddie Mac would still hasn't been explained. With the mortgage servicer settlement, I'd expect the delinquency rate to start to decline faster over the next year.

The "normal" serious delinquency rate is under 1%, so there is a long way to go.

Bank Failure #16 in 2012: Fidelity Bank, Dearborn, Michigan

by Calculated Risk on 3/30/2012 05:10:00 PM

Michigan mega morass

Sixteenth sour shop

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Fidelity Bank, Dearborn, Michigan

As of December 31, 2011, Fidelity Bank had approximately $818.2 million in total assets and $747.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $92.8 million. ... Fidelity Bank is the 16th FDIC-insured institution to fail in the nation this year, and the first in Michigan.It is Friday! And I need one ...

Restaurant Performance Index increases in February

by Calculated Risk on 3/30/2012 03:20:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Improves as Restaurant Performance Index Stood Above 100 for 4th Consecutive Month

Bolstered by positive same-store sales and traffic results and an optimistic outlook among restaurant operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained above 100 for the fourth consecutive month in February. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.9 in February, up 0.6 percent from January’s level of 101.3. In addition, the RPI stood solidly above the 100 threshold in February, which signifies expansion in the index of key industry indicators.

“Buoyed by continued gains in national employment and an extra day in February as a result of Leap Year, a solid majority of restaurant operators reported positive same-store sales and traffic results,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators are bullish about sales growth in the months ahead, while their outlook for the economy remains cautiously optimistic.”

“Perhaps the most positive indicator is the optimistic outlook for staffing levels in the months ahead,” Riehle added. “Only seven percent of restaurant operators expect to reduce staffing levels in the next six months, the lowest level in nearly eight years.”

Click on graph for larger image.

Click on graph for larger image.The index increased to 101.9 in February from 101.3 in January (above 100 indicates expansion). This was boosted by the leap year (the index is not adjusted), but this is still positive.

The comment on employment was especially positive.