by Calculated Risk on 4/01/2012 06:57:00 PM

Sunday, April 01, 2012

WaPo on Investors buying Foreclosures to Rent

A long article from Edward Robinson at the WaPo: Foreclosures give rise to new industry. A few excerpts:

Waypoint, which owns 1,100 houses and is buying five more a day, is betting that converting foreclosures into rentals is a better way to make a profit. Other firms, such as Landsmith in San Francisco, are now cropping up and pursuing the same strategy in Arizona, California and Nevada.I've talked to several smaller investor groups, and they have all done very well. Now the larger groups are moving in.

With many suburban homes selling for half their peak values and demand for rentals from prospective tenants climbing, Waypoint was earning a return of

8 to 9 percent on its capital as of Dec. 31, according to a quarterly report. That beats the 6.3 percent gain in the BI NA Multifamily REIT Index, which tracks the performance of 27 apartment-building operators.

...

The home rental market boasts a total property value of $3 trillion, according to Morgan Stanley housing analyst Oliver Chang. Yet institutions have long shunned it as too scattered and impractical to be profitable.

...

Oaktree Capital Management, the investment firm co-founded by billionaire Howard Marks, announced a $450 million deal with Carrington Capital Management to acquire and convert foreclosed single-family homes into rental properties. Carrington rents out more than 3,000 houses in California and other states.

Starwood Capital Group is poised to enter the foreclosure-to-rental market, according to an investor familiar with its plans. So, too, are Zell and the real estate arm of Apollo Investment Management.

...

Investors are already having an effect: The supplies of homes for sale in Phoenix, Orlando and other hard-hit markets have fallen more than 60 percent from their post-crash highs as bargain hunters scoop up foreclosures.

Investors buying foreclosures to rent is one of the reasons inventory levels of existing homes has fallen so sharply.

Yesterday:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st

And the winner is ... me!

by Calculated Risk on 4/01/2012 11:43:00 AM

For the question contest in March, the leaders were:

1) Bill (Calculated Risk)

2) Billy Forney

3) Bryant Dodson

4) Charles Chuckray

5 tie) Walt Tucker

5 tie) Ed Hodder

Congratulations to all.

For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login.

In April, I'll ask some economic predictions several times a week: For April 2nd, I'm asking: Will the March ISM Manufacturing Index be over 53? (Note: I'm leaving the market predictions out for April).

Contestants receive 1 point for each correct answer. At the end of each month, I'll list the leaders in a post on the blog.

For both February and March, the winner was ... CR. Hey, play along and beat CR!

Yesterday:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st

McCulley: Monetary and Fiscal policy must be "irresponsible" in a liquidity trap

by Calculated Risk on 4/01/2012 09:45:00 AM

I've been reading former PIMCO managing director Paul McCulley for years (great insights). The following piece discusses the current liquidity trap and the failure of austerity in Europe: "Fiscal austerity does not work in a liquidity trap and makes as much sense as putting an anorexic on a diet."

From Paul McCulley and Zoltan Pozsar: Does Central Bank Independence Frustrate the Optimal Fiscal-Monetary Policy Mix in a Liquidity Trap? (ht Richard)

An excerpt:

The United States and much of the developed world are in a liquidity trap. However, policymakers still have not embraced this diagnosis which is a problem as solutions to a liquidity trap require specific sets of policies. There are policies that will work, and there are policies that will not work. Correct diagnosis is necessary to prescribe the right policy medication.I agree with McCulley that most of the world is in a liquidity trap and it appears that austerity alone will eventually fail at the ballot box, see from Reuters: Resistance to Austerity Stirs in Southern Europe

A liquidity trap is a circumstance in which the private sector is deleveraging in the wake of enduring negative animal spirits caused by the bursting of joint asset price and credit bubbles that leave private sector balance sheets severely damaged. In a liquidity trap the animal spirits of the private sector cannot be revived by a reduction in short-term interest rates because there is no demand for credit. This effectively means that conventional monetary policy does not work in a liquidity trap.

...

This is not to say that the private sector should not deleverage. It has to. It is a part of the economy’s healing process and a necessary first step toward a self-sustaining economic recovery.

However, deleveraging is a beast of a burden that capitalism cannot bear alone. At the macro level, deleveraging must be a managed process: for the private sector to deleverage without causing a depression, the public sector has to move in the opposite direction and re-lever by effectively viewing the balance sheets of the monetary and fiscal authorities as a consolidated whole.

...

[McCulley reviews several recent cases]

...

These historical cases of acting responsibly, irresponsibly and half-heartedly irresponsibly relative to orthodoxy carry telling lessons for the outlooks of the Eurozone, U.K. and U.S. today.

First, acting responsibly relative to orthodoxy in the Eurozone and following the German “dictat” of sado-fiscalism and internal devaluation are reminiscent of several defining economic episodes and frictions of the interwar gold standard.

...

On a more systemic level, Germany’s refusal to inflate at the core while insisting on internal devaluation in the periphery is eerily similar to the frictions caused by the imbalance between gold surplus countries refusing to inflate and deficit countries unable to sufficiently deflate during the 1920s and early 1930s.

Just as laboring classes could not bear the pain of adjustments required by the gold standard’s orthodoxies, laboring classes in peripheral Eurozone economies may not be able to bear the pain of adjustments required by the single currency’s orthodoxies.

If history is our guide, painful adjustments will ultimately lead to some countries abandoning the euro, or politics overruling monetary orthodoxies: (1) legal restrictions against monetizing debt today versus the fixed exchange rate mentality of the gold standard, and (2) the independence of the ECB.

...

Second, acting responsibly relative to orthodoxy on the fiscal front, but acting irresponsibly relative to orthodoxy on the monetary front, policies in the U.K. are also unlikely to work.

...

Third, to date, the U.S. has acted irresponsibly relative to orthodoxy on both the fiscal and monetary front. This is good.

However, risks are rising that while the monetary authority will remain committed to acting irresponsibly, the government will choose to act responsibly relative to fiscal orthodoxy and adopt austerity.

Saturday, March 31, 2012

Personal Saving Rate and Real Personal Income less Transfer Payments

by Calculated Risk on 3/31/2012 07:35:00 PM

By request, a couple more graphs based on the February Personal Income and Outlays report. The first graph shows real personal income less transfer payments in 2005 dollars. This has been slow to recover - real (inflation adjusted) personal income less transfer payments decreased slightly in February. This remains 4.2% below the previous peak in early 2008.

From the BEA:

Personal current transfer receipts increased $3.0 billion in February, compared with an increase of $1.6 billion in January.

Click on graph for larger image.

Click on graph for larger image.“Other” government social benefits to persons increased $1.3 billion, in contrast to a decrease of $15.8 billion; the January change was reduced $13.6 billion reflecting the expiration of the Making Work Pay refundable tax credit. Offsetting these changes, government social benefits for social security increased $2.9 billion in February, compared to an increase of $20.3 billion in January; the January change was boosted by a 3.6-percent cost-of-living adjustment (COLAs) to social security benefits.

The second graph is for the personal saving rate.

The saving rate decreased to 3.7% in February.

Personal saving -- DPI less personal outlays -- was $438.7 billion in February, compared with $509.5 billion in January. The personal saving rate -- personal saving as a percentage of disposable income -- was 3.7 percent in February, compared with 4.3 percent in January.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report.

After increasing sharply during the recession, the saving rate has been moving down for the last two to three years - so spending growth has increased a little faster than income growth. This was especially true in February with spending increasing 0.8% and income only increasing 0.2%.

Earlier:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st

Schedule for Week of April 1st

by Calculated Risk on 3/31/2012 01:05:00 PM

Earlier:

• Summary for Week Ending March 30th

The key report for this week will be the March employment report to be released on Friday, Apr 6th. Other key reports include the ISM manufacturing index on Monday, vehicle sales on Tuesday, and the ISM non-manufacturing (service) index on Wednesday. The FOMC minutes for the March meeting will be released on Tuesday.

Note: Reis is expected to release their Q1 Office, Mall and Apartment vacancy rate reports this week. Last quarter Reis reported falling vacancy rates for apartments, a slight decline in vacancy rates for regional malls, and a slight decline in the office vacancy rate.

10:00 AM ET: ISM Manufacturing Index for March.

10:00 AM ET: ISM Manufacturing Index for March. Here is a long term graph of the ISM manufacturing index. The consensus is for a slight increase to 53.0 from 52.4 in February.

10:00 AM: Construction Spending for February. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for March. Light vehicle sales are expected to decline to 14.7 million from 15.0 million in February (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate. TrueCar is forecasting:

The March 2012 forecast translates into a Seasonally Adjusted Annualized Rate (SAAR) of 14.5 million new car sales, up from 13.1 million in March 2011 and down from 15.1 million in February 2012Edmund.com is forecasting:

Edmunds.com estimates that 1,451,956 new cars will be sold in March, for a projected Seasonally Adjusted Annual Rate (SAAR) of 14.9 million units. The projected sales results would be a 26.4 percent increase over February 2012 and a 16.5 percent increase over March 2011.10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for February. The consensus is for a 1.5% increase in orders.

2:00 PM: FOMC Minutes, Meeting of March 13th. The minutes might include a discussion of possible easing options.

4:05 PM: San Francisco Fed President John Williams speaks on the economy to students at University of San Diego.

Early: Reis Q1 2012 Apartment vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been weak this year, although this does not include all the cash buyers.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 208,000 payroll jobs added in March, down from the 216,000 reported last month.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a decrease to 56.7 from 57.3 in February. Note: Above 50 indicates expansion, below 50 contraction.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

Early: Reis Q1 2012 Office vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to essentially unchanged at 360,000.

Markets will be closed in observance of Good Friday.

Early: Reis Q1 2012 Mall vacancy rates.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.

8:30 AM: Employment Report for March. The consensus is for an increase of 201,000 non-farm payroll jobs in March, down from the 227,000 jobs added in February.The consensus is for the unemployment rate to remain unchanged at 8.3%.

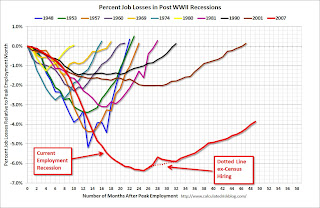

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through February.

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).

The economy has added 3.45 million jobs since employment bottomed in February 2010 (3.94 million private sector jobs added, and 490 thousand public sector jobs lost).There are still 4.9 million fewer private sector jobs now than when the recession started. (5.3 million fewer total nonfarm jobs).

3:00 PM: Consumer Credit for February. The consensus is for a $12.0 billion increase in consumer credit.