by Calculated Risk on 4/02/2012 07:18:00 PM

Monday, April 02, 2012

WaPo: Student Debt and Senior Citizens

From the WaPo: Senior citizens continue to bear burden of student loans

New research from the Federal Reserve Bank of New York shows that Americans 60 and older still owe about $36 billion in student loans ... More than 10 percent of those loans are delinquent. As a result, consumer advocates say, it is not uncommon for Social Security checks to be garnished or for debt collectors to harass borrowers in their 80s over student loans that are decades old.The NY Fed research has some data and graph on student debt: Grading Student Loans

The outstanding student loan balance now stands at about $870 billion,1 surpassing the total credit card balance ($693 billion) and the total auto loan balance ($730 billion). With college enrollments increasing and the costs of attendance rising, this balance is expected to continue its upward trend.

This chart from the NY Fed shows the student debt outstanding by age. From the NY Fed:

This chart from the NY Fed shows the student debt outstanding by age. From the NY Fed: Among people under thirty years old, 40.1 percent have outstanding student loan debt. Among people between the ages of thirty and thirty-nine, 25.1 percent have outstanding student loan debt. In contrast, only 7.4 percent of people who are at least forty years old have outstanding student loan debt. As a result, $580 billion of the total $870 billion in student loan debt is owed by people younger than forty.There is much more in the research paper.

Wells Fargo on Housing: Better Days Ahead, Prices to bottom mid-year

by Calculated Risk on 4/02/2012 02:59:00 PM

Earlier this year I argued that there was a good chance house prices would bottom this year (I predicted a bottom in Not Seasonally Adjusted prices in March - of course that data will not be released for several months). There are several other analysts and economists who now see prices bottoming this year or early next year.

Wells Fargo economists put out a special commentary on housing this morning: Spring Came Early for the Housing Market

The latest data on home prices also came in a little better than expected, and the survey data from the NAHB/Wells Fargo Homebuilders Survey as well as anecdotal reports from builders and realtors all suggest better days are ahead for the industry.Wells Fargo believes the housing recovery will unfold slowly, and they only expect new home sales to increase 12% in 2012 to 340 thousand, and housing starts to increase to 710 thousand (includes multifamily, owner built and more).

Drawing definitive conclusions from the winter housing data is perilous. The winter months account for the smallest proportion of the year’s housing activity, and unseasonably mild weather during the winter months can cause the data to bounce around quite a bit from month to month. The March and April data are much more important, and all indications suggest that the key spring selling season has gotten off to a solid start.

...

We have nudged our forecast for home sales and new home construction slightly higher, as the spring selling season appears to have gotten off to a strong start. ... the anecdotal evidence is hard to dismiss. Most builders and realtors report significant gains in buyer interest and sales. Moreover, the gains are organic rather than incentive induced. Unfortunately, conservative appraisals and tight mortgage underwriting continue to undermine a large number of deals. We suspect that the undertow from these two hindrances will subside over the course of this year, as the fog surrounding shadow inventories lightens up a bit and more lenders come back to the market.

...

We expect home prices to definitively bottom by the middle of this year, as the backlog of foreclosures finally begins clear. For properties not in foreclosure, prices have probably already bottomed, but should remain relatively low nonetheless given the competition and perceived competition from foreclosures.

It is important to note that Wells Fargo is forecasting a very weak year for housing - just an increase from the weakest years on record. Their forecast would be the 3rd worst year for new home sales since 1963, only behind the 2011 and 2010 - and about half the median annual sales since 1963.

Their forecast would be the 4th worst year for housing starts since 1959. Note: starts bottomed in 2009, and most of the increase since then has been from multifamily starts). The Wells Fargo forecast is for about half the median for annual housing starts since 1959.

Sometimes I see commentary saying there is no recovery in housing, and the commentator then points to the current low level of sales and starts. However, when most people use the word "recovery" they mean an increase from the previous period - not the absolute level of sales and starts. Sales and starts will be weak in 2012, but better than 2011.

Construction Spending declines in February

by Calculated Risk on 4/02/2012 12:09:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending declined in February:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2012 was estimated at a seasonally adjusted annual rate of $808.9 billion, 1.1 percent (±1.3%)* below the revised January estimate of $818.1 billion. The February figure is 5.8 percent (±1.8%) above the February 2011 estimate of $764.2 billion.Private construction spending was also declined in February:

Spending on private construction was at a seasonally adjusted annual rate of $527.3 billion, 0.8 percent (±1.1%)* below the revised January estimate of $531.7 billion. Residential construction was at a seasonally adjusted annual rate of $246.5 billion in February, nearly the same as (±1.3%)* the revised January estimate of $246.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $280.8 billion in February, 1.6 percent (±1.1%) below the revised January estimate of $285.3 billion.

Click on graph for larger image.

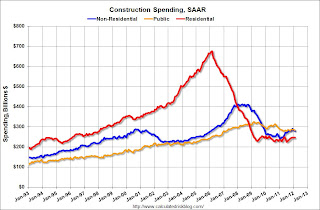

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 63.5% below the peak in early 2006, and up 10% from the recent low. Non-residential spending is 32% below the peak in January 2008, and up about 15% from the recent low.

Public construction spending is now 13% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.

ISM Manufacturing index indicates slightly faster expansion in March

by Calculated Risk on 4/02/2012 10:00:00 AM

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%.

From the Institute for Supply Management: March 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in March for the 32nd consecutive month, and the overall economy grew for the 34th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 53.4 percent, an increase of 1 percentage point from February's reading of 52.4 percent, indicating expansion in the manufacturing sector for the 32nd consecutive month. The Production Index increased 3 percentage points from February's reading of 55.3 percent to 58.3 percent, and the Employment Index increased 2.9 percentage points to 56.1 percent. Of the 18 industries included in the survey, 15 are experiencing overall growth. Comments from the panel remain positive, with several respondents citing increased sales and demand for the next few months."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in March than in February. It appears manufacturing employment expanded in March with the employment index at 56.1%.

Over There: Unemployment rate at new high in Euro Zone

by Calculated Risk on 4/02/2012 08:48:00 AM

From Reuters: Unemployment in Euro Zone Hit New High in February

Unemployment in the euro zone reached its highest level in almost 15 years in February, with more than 17 million people out of work, according to figures released Monday.Here is the Eurostat data by country.

Joblessness in the 17-nation currency zone rose to 10.8 percent, up by 0.1 point from January, Eurostat said Monday.

...

Separate data released Monday showed manufacturing activity in the euro zone shrank for an eighth successive month in March, providing further support for Brussels’s forecast that euro zone output will shrink 0.3 percent this year.

Rising unemployment, falling manufacturing, declining output ... no surprise.