by Calculated Risk on 4/03/2012 02:00:00 PM

Tuesday, April 03, 2012

FOMC Minutes: No Push for QE3

"Several members" were concerned that the unemployment rate would be elevated, and inflation subdued in late 2014. That would suggest further action now, but, later in the discussion, "a couple of members" indicated further action might be necessary if the "economy lost momentum". So it doesn't seem like there is any push for QE3 in the short term.

From the Fed: Minutes of the Federal Open Market Committee, March 13, 2012. Excerpts:

With the economic outlook over the medium term not greatly changed, almost all members again agreed to indicate that the Committee expects to maintain a highly accommodative stance for monetary policy and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. Several members continued to anticipate, as in January, that the unemployment rate would still be well above their estimates of its longer-term normal level, and inflation would be at or below the Committee's longer-run objective, in late 2014. It was noted that the Committee's forward guidance is conditional on economic developments, and members concurred that the date given in the statement would be subject to revision in response to significant changes in the economic outlook. While recent employment data had been encouraging, a number of members perceived a nonnegligible risk that improvements in employment could diminish as the year progressed, as had occurred in 2010 and 2011, and saw this risk as reinforcing the case for leaving the forward guidance unchanged at this meeting.

The Committee also stated that it is prepared to adjust the size and composition of its securities holdings as appropriate to promote a stronger economic recovery in a context of price stability. A couple of members indicated that the initiation of additional stimulus could become necessary if the economy lost momentum or if inflation seemed likely to remain below its mandate-consistent rate of 2 percent over the medium run.

Update on Possible GSE Principal Reductions

by Calculated Risk on 4/03/2012 11:48:00 AM

Following a ProPublica story last week, Fannie and Freddie: Slashing Mortgages Is Good Business, there was some commentary suggesting that principal reductions would result in a windfall for banks holding 2nd liens.

Michael Stegman, Counselor to the Secretary of the Treasury for Housing Finance Policy responded: GSEs & Principal Reduction: How HAMP Helps More Underwater Homeowners (ht Dan)

Recently, various sources have alleged that large banks will get a windfall if Fannie Mae and Freddie Mac (the GSEs) reduce the principal balance on first lien mortgage loans that are owned or guaranteed by the GSEs. The claims arise from a concern that if the GSEs reduce the principal balance on a GSE first lien mortgage loan, any investor holding a second (and subordinated) lien on the property stands to benefit unfairly.The bank "windfall" argument was incorrect.

In fact, the principal reduction program that we have asked the FHFA to allow the GSEs to participate in, the principal reduction alternative of the Home Affordable Modification Program (HAMP), is designed to protect against exactly this result.

Of course, not all under water GSE loans have second liens. But if they do, under HAMP, where a first lien mortgage is modified, then the holder of an eligible second lien must modify that lien proportionately if they are a participant in the Second Lien Modification Program (2MP). ...

So quite contrary to providing a windfall to the banks, GSE participation in this program would force them to help homeowners even further by writing down these second lien loans.

However a valid point was raised by Tom Lawler: The program might make sense to Fannie and Freddie only if the Treasury incentive is included. If that is the case, then the program might not make sense for taxpayers.

Principal reduction can be a very effective and cost saving program if done correctly, but I have to see the details of the proposal before deciding if this makes sense.

LPS: February Foreclosure Starts and Sales Reversed Prior Month’s Increases

by Calculated Risk on 4/03/2012 09:24:00 AM

LPS released their Mortgage Monitor report for February today.

According to LPS, 7.57% of mortgages were delinquent in February, down sharply from 7.97% in January, and down from 8.80% in February 2011.

LPS reports that 4.13% of mortgages were in the foreclosure process, down slightly from 4.15% in January, and down slightly from 4.15% in February 2011.

This gives a total of 11.7% delinquent or in foreclosure. It breaks down as:

• 2,059,000 loans less than 90 days delinquent.

• 1,722,000 loans 90+ days delinquent.

• 2,065,000 loans in foreclosure process.

For a total of 5,846,000 loans delinquent or in foreclosure in February.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.57% from the peak in January 2010 of 10.97%, but the decline has halted. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.11%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.07 million).

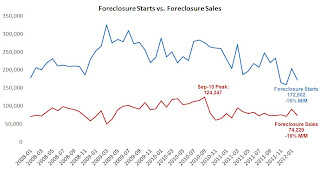

This graph provided by LPS Applied Analytics shows foreclosure starts and sales.

This graph provided by LPS Applied Analytics shows foreclosure starts and sales.

Foreclosure starts and sales were up in January, but then declined in February. This was before the mortgage servicer settlement was announced in mid-February and filed with the court in March, so it is still too early to see the impact of the settlement.

Bloomberg article on House Prices

by Calculated Risk on 4/03/2012 08:44:00 AM

Several people have sent me this Bloomberg article by Kathleen Howley: Home Prices Seen Dropping 10% in U.S. on Foreclosures: Mortgages

From the second paragraph:

Sales of repossessed properties probably will rise 25 percent this year from 1 million in 2011, according to Moody’s Analytics Inc. Prices for the homes could drop as much as 10 percent because they deteriorated as they were held in reserve during investigations by state officials resolved in February, according to RealtyTrac Inc.So RealtyTrac is saying prices for some repossessed properties could fall 10 percent "because they deteriorated" while in the foreclosure process. That sounds correct, but that isn't overall prices.

Later in the article, Howley does quote an economist predicting a further 5% to 10% price decline this year:

The [Case-Shiller Composite 20] index probably will fall 5 percent to 10 percent this year, a range that depends on the condition of the mothballed homes, [Patrick Newport, an economist at IHS Global Insight] said.An added thought: The most recent Case-Shiller report was for January. If the Composite 20 index fell as much from January through March as in 2011, prices are already down 3% this year as of the end of March (Compare that to Celia Chen and Diane Swonk's predictions for the year).

That compares with a forecast for a 2.9 percent decline by Celia Chen, a housing economist at Moody’s Analytics in West Chester, Pennsylvania, and a prediction of a 3.9 percent decline by Diane Swonk, chief economist of Mesirow Financial Inc. in Chicago.

Jim the Realtor: Multiple Offers at the low-to-mid end

by Calculated Risk on 4/03/2012 12:18:00 AM

Jim makes some interesting comments on multiple offers in the following video.

It probably seems strange to hear Jim talking about the "lower end" while showing a $655,000 house, but this is in an expensive area of coastal north county in San Diego.

Jim discusses some other recent listings that have had multiple offers - one with eight offers, another with 14 offers that for 10% over list price.