by Calculated Risk on 4/04/2012 09:00:00 AM

Wednesday, April 04, 2012

CoreLogic: House Price Index falls to new post-bubble low in February, Rate of decline slows

Notes: This CoreLogic House Price Index report is for February. The Case-Shiller index released last week was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of the last three months and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® February Home Price Index Reports Month-Over-Month Increase, When Excluding Distressed Sales

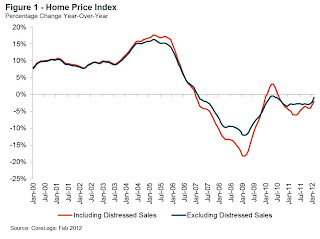

[CoreLogic February Home Price Index (HPI®) report] shows national home prices, including distressed sales, declined on a year-over-year basis by 2.0 percent in February 2012 and by 0.8 percent compared to January 2012, the seventh consecutive monthly decline.

Excluding distressed sales, month-over-month prices increased 0.7 percent in February from January. The CoreLogic HPI® also showed that year-over-year prices declined by 0.8 percent in February 2012 compared to February 2011. Distressed sales include short sales and real estate owned (REO) transactions.

“House prices, based on data through February, continue to decline, but at a decreasing rate. The deceleration in the pace of decline is a first step toward ultimately growing again,” said Mark Fleming, chief economist for CoreLogic. “Excluding distressed sales, we already see modest price appreciation month over month in January and February.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.8% in February, and is down 2.0% over the last year.

The index is off 34.4% from the peak - and is now at a new post-bubble low.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit. Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March.

ADP: Private Employment increased 209,000 in March

by Calculated Risk on 4/04/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 209,000 from February to March on a seasonally adjusted basis. Estimated gains for previous months were revised higher; the gain from December to January was revised up by 9,000 to 182,000, and the gain from January to February was revised up by 14,000 to 230,000.This was slightly above the consensus forecast of an increase of 208,000 private sector jobs in March. The BLS reports on Friday, and the consensus is for an increase of 201,000 payroll jobs in March, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 164,000 in March, after rising a revised 183,000 in February. Employment in the private, goods-producing sector rose 45,000 in March. Manufacturing employment added 23,000 jobs.

Government payrolls have been shrinking, so the ADP report suggests close to 200,000 nonfarm payroll jobs added in March. Note: ADP hasn't been very useful in predicting the BLS report.

Reis: Apartment Vacancy Rate falls to 4.9% in Q1

by Calculated Risk on 4/04/2012 12:12:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

From Reuters: U.S. apartment vacancy rate falls to decade low

The U.S. apartment vacancy rate in the first quarter fell to its lowest level in more than a decade, and rents posted their biggest jump in four years ...

The national vacancy rate fell 0.30 percentage points in the first quarter to 4.9 percent, the lowest level since the fourth quarter 2001, according to preliminary results Reis released Wednesday.

...

Stripping away months of free rent and other perks designed to lure or retain tenants, effective rent rose to $1,018 per month, up 0.9 percent, the largest increase since the first quarter 2008, Reis said.

"I think that rent growth will accelerate this year," said Victor Calanog, head of Research & Economics at Reis.

But that may be short lived. About 150,000-200,000 new units are expected be built next year. That supply likely will dampen rent growth next year ...

"Once that supply hits the market next year, we may find that this is the year rent growth peaked," he said. "It's still going to be a great year for apartment landlords."

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

Tuesday, April 03, 2012

Lawler comments on FHA Single-Family Mutual Mortgage Insurance Fund Quarterly Report to Congress

by Calculated Risk on 4/03/2012 08:20:00 PM

From economist Tom Lawler:

Last week HUD released the FHA Single-Family Mutual Mortgage Insurance Fund Quarterly Report to Congress for the first quarter of FY 2012 (ending 12/31/2011), which gave some insights into the disturbing rise is the number of seriously delinquent FHA-insured SF loans, as well on the surprising slow pace of foreclosure resolutions.

At the bottom of this post is a table summarizing SDQ rates by FY endorsement.

And here is a chart from the report showing SDQ rates by calendar year origination and months of seasoning.

Needless to say, this is not a pretty picture.

In the discussion on the sizable jump in the FHA’s SF SDQ rate, the report said that

“(t)wo factors appear to be driving this result. The first is the persistency of loans in 90-day delinquency as lenders attempt to craft workout plans, and persistency of loans in foreclosure processing. The second is that the historically large FY 2009 and FY 2010 books-of-business are at the age where their serious delinquency rates are increasing toward their life-cycle peaks. Because those books are much larger than is the new FY 2011 book, their loan-age seasoning patterns are not offset by the low default rates on recent endorsements.”The report did not mention the sharp falloff in FHA modifications in the second half of 2011.

Relative to the projection in the FY 2011 annual independent actuarial study, actual FHA claims were 52% lower by loan count and 57% lower by dollars, but NOT because the loans are performing better than projected. Here is an excerpt from the report:

“The number of claims paid this quarter (27,356) is down slightly from that of the previous quarter (30,108). The gap between predicted and actual claims paid shows little variation from the previous quarters, with year-to-date counts 52% below forecast, and year-to-date dollars 57% below forecast. The principal contributing factor to this gap continues to be delays in foreclosure processing in many areas of the country. We anticipate the recent settlement will accelerate foreclosure activity, perhaps within the next two quarters.”The report also included some historical data on the FHA’s loss rate on REO and on pre-foreclosure sales, which showed rising trends in both.

In the quarter ended 12/31/2011, FHA’s loss severity on REO averaged 71.7%, while the loss severity on short sales was 47.4%. Delays in foreclosure processing appear to be a significant factor in rising loss severity rates. The combination of rising SDQs and rising loss severities bodes very poorly for the MMIF outlook, which may help explain the sizable recently-announced hikes in FHA’s premiums.

In the quarter ended 12/31/2011, FHA’s loss severity on REO averaged 71.7%, while the loss severity on short sales was 47.4%. Delays in foreclosure processing appear to be a significant factor in rising loss severity rates. The combination of rising SDQs and rising loss severities bodes very poorly for the MMIF outlook, which may help explain the sizable recently-announced hikes in FHA’s premiums. Here is the table summarizing SDQ rates by FY endorsement.

| Serious Delinquency Rate by Endorsement Fiscal Year, FHA SF Mortgages | |||||||

|---|---|---|---|---|---|---|---|

| Endorsement FY | Pre-2007 | 2007 | 2008 | 2009 | 2010 | 2011 | All Years |

| Q1/12 | 12.58% | 25.59% | 23.83% | 10.92% | 4.07% | 0.93% | 9.59% |

| Q4/11 | 11.57% | 23.36% | 21.38% | 9.13% | 2.96% | 0.45% | 8.70% |

| Q3/11 | 10.77% | 21.83% | 19.97% | 8.05% | 2.13% | 0.22% | 8.18% |

| Q2/11 | 10.98% | 21.71% | 19.49% | 7.58% | 1.61% | 0.08% | 8.31% |

| Q1/11 | 11.59% | 22.44% | 19.65% | 7.23% | 1.20% | 0.01% | 8.78% |

| Q4/10 | 11.41% | 21.49% | 18.37% | 6.08% | 0.65% | 8.66% | |

| Q3/10 | 11.15% | 21.11% | 17.35% | 4.94% | 0.33% | 8.59% | |

| Q2/10 | 11.56% | 21.40% | 17.13% | 4.07% | 0.16% | 9.05% | |

| Q1/10 | 11.89% | 21.55% | 16.22% | 3.05% | 0.02% | 9.44% | |

| Q4/09 | 10.72% | 18.60% | 12.19% | 1.59% | 8.52% | ||

| Q3/09 | 8.71% | 14.23% | 8.45% | 0.84% | 7.14% | ||

U.S. Light Vehicle Sales at 14.4 million annual rate in March

by Calculated Risk on 4/03/2012 03:59:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).

This was below the consensus forecast of 14.7 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 14.37 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The annualized sales rate is up in Q1 from Q4.

March was above the August 2009 rate with the spike in sales from "cash-for-clunkers". Only February had a higher sales rates since early 2008.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Even though this was below expectations, growth in auto sales will make another strong positive contribution to GDP in Q1 2012.