by Calculated Risk on 4/05/2012 02:55:00 PM

Thursday, April 05, 2012

Employment Situation Preview

Tomorrow (Friday) the BLS will release the March Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 201,000 payroll jobs in March, and for the unemployment rate to remain unchanged at 8.3%.

Note:

• The weather was mild in January and February, and it is possible that some hiring was pulled forward. Several analysts have pointed out that the BLS reported that few people were "not at work due to bad weather" in January and February. I looked back at previous years with mild weather (using the BLS "not at work, bad weather" measurement), and employment gains in March were solid following mild weather during January and February. So I don't expect much payback due to the weather.

• The economic questions for tomorrow (see pickem game on top right sidebar) is to take the over or under on the consensus for payroll jobs and to forecast the unemployment rate.

Here is a summary of recent data:

• The ADP employment report showed an increase of 209,000 private sector payroll jobs in March. Although ADP seems to track the BLS over time, the ADP report hasn't been very useful in predicting the BLS report. Also note that government payrolls declined by about 18,000 over the last three months (about 6,000 per month), so the ADP report suggests 209,000 private nonfarm payroll jobs added, minus 6,000 government workers - or around 203,000 total jobs added in March (close to the consensus).

• The ISM manufacturing employment index increased to 56.1% from 53.2% in February. A historical correlation between the ISM index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing increased about 14,000 in March.

The ISM service employment index increased to 56.7% from 55.7% in March. Based on a historical correlation between the ISM non-manufacturing employment index and the BLS employment report for service, this reading suggests the gain of around 240,000 private payroll jobs for services in March.

Combined the ISM surveys suggest an employment report somewhat above the consensus.

• Initial weekly unemployment claims averaged about 366,000 in March, down slightly from 374,000 average in January and February.

For the BLS reference week (includes the 12th of the month), initial claims were at about the same level as in January and February when the economy added 284,000 and 227,000 payroll jobs respectively.

• The final March Reuters / University of Michigan consumer sentiment index increased to 76.2, up slightly from the February reading of 75.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This suggests a weak but improving labor market.

• And a little optimism from the NFIB (small business): NFIB Jobs Statement: Job Creation Shows Mixed Signals

“March came in like a lion on the job-front, but went out tempered by future job growth indicators. Overall, the March survey anticipates some strength in the job creation number with little change in the unemployment rate. With job openings and plans for job creation both falling, prospects for a surge in job creation in the small business sector are still not promising.The participants in the NFIB surveys still aren't doing much hiring, however the small business index from Intuit showed 65,000 small business jobs created in March.

Building on February’s increased jobs numbers, March’s survey gives us the best readings since January and February of 2011. The net change in employment per firm (seasonally adjusted) was 0.22, double the reading for February.

• And on the unemployment rate from Gallup: U.S. Unemployment Declines in March

U.S. unemployment, as measured by Gallup without seasonal adjustment, declined to 8.4% in March from 9.1% in February, while Gallup's seasonally adjusted rate fell to 8.1% from 8.6% in February.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution.

...

Gallup's monitoring of the unemployment situation includes the entire month, while the BLS uses a mid-month reference week.

Gallup's seasonally adjusted unemployment rate was essentially unchanged at 8.5% in mid-March from 8.6% in February, but then fell to 8.1% for all of March. How much of the sharp decline in unemployment during the second half of March will be picked up in the government's mid-month reference week is unclear.

There always seems to be some randomness to the employment report, but the overall situation has improved (lower initial weekly unemployment claims, more job openings). The ADP report suggests the consensus is close, and the ISM reports suggest the consensus is a little low.

Once again I'll take the over (above 201,000 payroll jobs), and I think a further decline in the unemployment rate is possible (this depends on the participation rate and if discouraged workers return to the labor force).

More: Office Vacancy Rate declines slightly to 17.2% in Q1

by Calculated Risk on 4/05/2012 12:43:00 PM

Early this morning I noted that Reis reported the office vacancy rate declined slightly to 17.2% in Q1 from 17.3% in Q4 2011. The vacancy rate was at 17.6% in Q1 2011.

Here are a few more comments and a long term graph from Reis.

Comments from Reis Senior Economist Ryan Severino:

National vacancies continued falling at a very modest pace in the first quarter, mirroring the tepid improvement in the labor market. The sector absorbed 5.998 million SF, the fifth consecutive quarterly gain in occupied stock since the beginning of 2011.

Although net absorption levels remain muted, five consecutive quarters of positive net absorption provide convincing evidence that the sector is indeed recovering. ... Given the rate of improvement that the sector is experiencing, it will be years before it is able to recover the space that was vacated during the recession and early stages of the economic recovery. The national vacancy rate has regressed back to levels unseen since 1993 and remains well above the cyclical low of 12.5% from 2007 before the onset of the recession.

...

National asking and effective rent growth improved slightly in the first quarter, continuing the slow upward trend that began in the first quarter of 2011. Annual gains of 1.6 and 2.1 percent, respectively, also indicate a moderate pace of improvement, but are unimpressive.

...

Weak supply growth remains a tailwind for improvement in the office sector. During the first quarter of 2012 only 1.917 million square feet of office space were completed. This represents the lowest quarterly level on record since Reis began tracking quarterly market data in 1999. ... With little supply being delivered, even the low levels of absorption that we are observing are sufficient enough to generate vacancy rate declines and rent growth.

Click on graph for larger image.

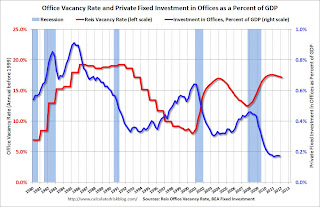

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the office sector even as the vacancy rate was rising. This was due to the very loose lending that led to the S&L crisis.

In the '90s, office investment picked up as the vacancy rate fell. Following the bursting of the stock bubble, the vacancy rate increased sharply and office investment declined.

During the housing bubble, office investment started to increase even before the vacancy rate had fallen below 14%. This was due to loose lending - again. Investment essentially stopped following the financial crisis.

The good news is, as Severino noted, there is very little new office construction right now and the vacancy rate will probably continue to decline.

Office vacancy data courtesy of Reis.

Trulia announces new "mix adjusted" House Asking Price Monitor, Prices up 1.4% from Q4

by Calculated Risk on 4/05/2012 10:00:00 AM

This is an interesting new asking price monitor from Trulia. Usually people report median asking prices, but unfortunately the median is impacted by the mix of homes. However Trulia adjusts the asking prices both for the mix of homes listed for sale and for seasonal factors. Of course this is just asking prices, not sales prices, but this might provide an early hint at changes in house prices.

This has the advantage of giving a much earlier look at prices than the repeat sales indexes. As an example, the recent Case-Shiller report was for "January". But that was really a three month average of November, December and January - and the index is based on recorded closing prices - so some of this index was based on contracts signed last September. That is 6 or even 7 months ago.

The Trulia monitor will be released monthly, and the report today is for asking prices in March.

From Trulia:

Trulia today launched the Trulia Price Monitor and the Trulia Rent Monitor, the earliest leading indicators available of trends in home prices and rents. Based on the for-sale homes and rentals listed on Trulia.com, these Monitors take into account changes in the mix of listed homes, reflecting trends in prices and rents for similar homes in similar neighborhoods through March 31, 2012.

Nationally, asking prices on for-sale homes – which lead sales prices by approximately two or more months – were 1.4 percent higher in March than one quarter ago. Prices increased month over month 0.9 percent in March and 0.6 percent in February. The Trulia Price Monitor is seasonally adjusted, so these monthly and quarterly increases are on top of typical springtime price jumps. Unadjusted for seasonality, asking prices rose 2.4 percent quarter over quarter. According to the Monitor, asking prices had been declining prior to February and reached a low in January.

...

“Asking prices rose in February and March, but this doesn’t mean that the bottom is forever behind us. The robo-signing settlement will accelerate the foreclosure process, pushing more homes onto the market and dragging down prices in areas that suffered most from the housing crash,” said Jed Kolko, Trulia’s Chief Economist.

Click on graph for larger image.

Click on graph for larger image.The first graph from Trulia shows the month over month prices changes (seasonally adjusted) as reported by the monitor. This shows asking prices were falling for most of 2011, but have turned up in early 2012.

Here is a list of price and rent changes for the 100 largest metro areas.

And here is a map from Trulia showing the year-over-year change in asking prices.

And here is a map from Trulia showing the year-over-year change in asking prices.On a year-over-year basis many MSAs are still in the red (as opposed to quarter-over-quarter or month-over-month). According to the list of cities, 41 MSAs (out of 100) had increasing asking prices year-over-year, and 67 quarter-over-quarter.

There are still many more distressed sales to come, and asking prices could turn down again - but this does suggest prices have turned up recently.

Weekly Initial Unemployment Claims decline to 357,000

by Calculated Risk on 4/05/2012 08:30:00 AM

The DOL reports:

In the week ending March 31, the advance figure for seasonally adjusted initial claims was 357,000, a decrease of 6,000 from the previous week's revised figure of 363,000. The 4-week moving average was 361,750, a decrease of 4,250 from the previous week's revised average of 366,000.The previous week was revised up to 363,000 from 359,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 361,750.

The 4-week moving average is at the lowest level since early 2008 (including revisions).

And here is a long term graph of weekly claims:

Slow and steady improvement. This is the lowest level for claims since early 2008.

Reis: Office Vacancy Rate declines slightly in Q1 to 17.2%

by Calculated Risk on 4/05/2012 12:22:00 AM

From Reuters: Sluggish job growth crimps US office market rebound

The national vacancy rate slipped to 17.2 percent in the first quarter, a slight improvement from 17.3 percent in the 2011 fourth quarter, according to preliminary figures from Reis. A year earlier the vacancy rate was 17.6 percent. ... The national vacancy rate has risen to levels not seen since 1993 and remains well above the cyclical low of 12.5 percent posted in 2007 ...

The average U.S. office asking rent rate rose to $28.10 per square foot in the first quarter, up 0.5 percent from the 2011 fourth quarter. ...

Overall, the national office market has posted five quarters of improvement, leading Reis to believe the market is in the midst of a slow recovery. ... "The lack of new supply has been the saving grace for the office sector," Severino said. "The levels of demand that we're seeing right now, while they're positive, they're not really significant. It pales in comparison with cycles past."

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate declined to 17.2% in Q1, down from 17.3% in Q4. The vacancy rate was at a cycle high of 17.6% in Q3 and Q4 2010. It appears the office vacancy rate peaked in 2010 and is declining very slowly.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.