by Calculated Risk on 4/15/2012 06:35:00 PM

Sunday, April 15, 2012

Europe: Sarkozy calls on ECB to support growth

From the Financial Times: Sarkozy breaks silence over ECB role

“Europe must purge its debts, it has no choice. But between deflation and growth, it has no more choice. If Europe chooses deflation it will die. We, the French, will open the debate on the role of the central bank in the support of growth.” [Sarkozy said]Of course, while most of Europe is worried about deflation, Germany is worried about inflation.

excerpt with permission

And from the NY Times: In Spain and Italy, Signs of a Lingering Crisis for Europe

Neither Spain nor Italy seems a good candidate for meeting the deficit-reduction targets they have agreed to with the European Union, especially if the downturn deepens.And on Greece: the election is scheduled for May 6th, and the smaller parties will probably do very well.

...

While the austerity debate simmers, a more pressing concern is efforts by Italy and Spain to raise financing for government debt they will need to roll over this year. Italy has so far raised only a little more than one-third of the estimated 215 billion euros ($283 billion) it will need this year, according to Reuters calculations. Spain is about half of the way to its goal, the economy minister, Luis de Guindos, said last Tuesday. According to the 2012 budget, the Spanish treasury plans gross issuance of 186 billion euros of debt this year.

The European Central Bank relieved a great deal of pressure with two rounds of cheap, three-year loans to banks in December and February that pumped 1 trillion euros ($1.3 trillion) into the region’s banking system. Many banks, especially in the southern countries like Spain and Italy, turned around and used that money to buy their government’s debt.

That debt-buying is now tapering off, said Guntram Wolff, deputy director at Bruegel, a research organization in Brussels. That raises the question of who might step in to finance these governments. “Investors are starting to express big doubts,” Mr. Wolff said.

Yesterday:

• Summary for Week Ending April 13th

• Schedule for Week of April 15th

Krugman: "Insane in Spain"

by Calculated Risk on 4/15/2012 02:39:00 PM

From Paul Krugman: Insane in Spain

"the euro crisis is [now] ... centered on Spain — which in a way is a good thing, because now the essential craziness of the orthodox German-inspired diagnosis of the crisis is on full display.

For this is really, really not about fiscal irresponsibility. Just as a reminder, on the eve of the crisis Spain seemed to be a fiscal paragon:"

| Spain | Germany | |

|---|---|---|

| Budget Balance, % of GDP, 2007 | +1.9% | +0.3% |

| Net Debt, % of GDP, 2007 | 27% | 50% |

"What happened to Spain was a housing bubble — fueled, to an important degree, by lending from German banks — that burst, taking the economy down with it. ...The German argument falls apart when we look at Spain. Instead of focusing on government spending, we could look at capital flows. Oh well.

And the policy response is supposed to be even more austerity, with the European Central Bank, natch, obsessing over inflation ...

I’m really starting to think that we’re heading for a crackup of the whole system."

The ECB's LTRO has bought a little bit of time, but if the policymakers stay focused on austerity, they will fail. A key European analyst pointed out last week that essentially all recent sovereign issuance in the periphery has been purchased by in-country banks, and that was related to the LTRO from the ECB. In other words, there is no private market for peripheral sovereign debt. The key analyst concluded: "The EMU (Economic and Monetary Union) is over".

Lou Barnes on Boulder, Colorado Housing

by Calculated Risk on 4/15/2012 09:44:00 AM

Long term readers will remember the quote about "neutron loans" from mortgage banker Lou Barnes in 2007:

“All of the old-timers knew that subprime mortgages were what we called neutron loans — they killed the people and left the houses,” said Louis S. Barnes, 58, a partner at Boulder West, a mortgage banking firm in Lafayette, Colo.Here is what Lou Barnes wrote on Friday on housing in Boulder, Colorado:

"What would the turn look like, if really underway? My own back yard has turned in just the last 60 days. The Front Range of Colorado never had a housing bubble: we danced with the Technology Fairy 1999-2001, afterward built too many houses, and made too many stupid loans, but all of that was over by 2004 when we led the nation in foreclosures. Long time ago. We have the 6th-lowest level of mortgage delinquency of any state in the US. Our rental vacancy rate spiked to 12%, now below 5% for the first time since '99 (0% in Boulder!). Rents are moving up quickly. State population in the last dozen years has risen from 4.1 million to 5 million, and we're short of land to build (you could drop Rhode Island in here and never find it, but we are maniacs for "open space" reservations). Building permits have been off 85% since '07. Unemployment is down to 7%-ish. Our listed inventory of homes evaporated by 40% since last year. Buyers have lost their fear, the only problem finding something to show them.Yes, my local market looks like that.

Does your local market look like that? Mister housing-has-bottomed? Eh?

As perfect as our set-up, are prices rising? In rich, government- and tech-payrolled, land-starved Boulder County, yes. At last. Enough to unlock sellers? Ummmm... later.

Two philosophers have remarked incisively on speed. Stephen Hawking: "Time is what keeps everything from happening at once." Then, Satchel Paige's description of Cool Papa Bell: "He was so fast he could flip off the light switch and be in bed before the room got dark. One time he hit a line drive right past my ear. I turned around and saw the ball hit his ass just as he slid into second."

Housing is the polar opposite of Cool Papa Bell.

Here in Colorado, the 1980s were tougher than this patch, and in Boulder we had all the same, lovely conditions as above by the spring of 1990, and the first, timid price increases in nine years. It then took 18 months for prices to begin to rise on the far side of town. Bottom is one thing, better another, recovery something else entirely.

As Barnes notes, a bottom for prices is one thing, a recovery in prices "something else entirely" - and I doubt prices will rise significantly any time soon. However, in more and more areas, it appears prices have bottomed, and buyers have "lost their fear".

Saturday, April 14, 2012

Percent Job Losses: Great Recession and Great Depression

by Calculated Risk on 4/14/2012 08:27:00 PM

The causes of the Great Recession were similar to the Great Depression - as opposed to most post war recessions that were caused by Fed tightening to slow inflation - and I'm frequently asked if we could compare the percent job losses during the two periods. Unfortunately there is very little data for the Great Depression.

Back in February I posted a graph based on some rough annual data.

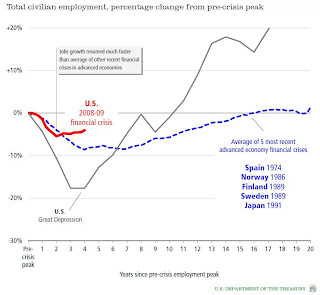

On Friday, Treasury released a slide deck titled Financial Crisis Response In Charts. One of the charts shows the percentage jobs lost in the current recession compared to the Great Depression.

This graph compares the job losses from the start of the employment recession, in percentage terms for the Great Depression, the 2007 recession, and the average for several recent recession following financial crisis.

Although the 2007 recession is much worse than any other post-war recession, the employment impact was much less than during the Depression. Note the second dip during the Depression - that was in 1937 and the result of austerity measures.

Earlier:

• Summary for Week Ending April 13th

• Schedule for Week of April 15th

Unofficial Problem Bank list declines to 944 Institutions

by Calculated Risk on 4/14/2012 04:40:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 13, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

We thought there was a chance for the OCC to release its actions through mid-March but we will have to wait until next week for that press release. As a result, it was quiet week for the Unofficial Problem Bank List with no failures, three removals, and one addition. These changes leave the list at 944 institutions with assets of $375.3 billion. A year-ago, the list held 978 institutions with assets of $429.4 billion. The three removals are for action termination and include Los Alamos National Bank, Los Alamos, NM ($1.5 billion); Empire National Bank, Islandia, NY ($340 million Ticker: EMPK); and Mountain Pacific Bank, Everett, WA ($118 million). The addition was Parke Bank, Sewell, NJ ($790 million Ticker: PKBK).Earlier:

• Summary for Week Ending April 13th