by Calculated Risk on 10/28/2012 06:15:00 PM

Sunday, October 28, 2012

Sandy: D.C. Government Offices closed to Public, NYSE Trading Floor Closed

Stay safe! Here is the National Hurricane Center website.

From the U.S. Office of Personnel Management: Monday, October 29, 2012, FEDERAL OFFICES in the Washington, DC, area are CLOSED TO THE PUBLIC.

From the NY Times: N.Y.S.E. Plans to Close Its Trading Floor

The New York Stock Exchange plans to close its trading floor on Monday as Hurricane Sandy approaches, in its first weather-related closure in 27 years. Trading operations will be conducted through its electronic market instead.I think the economic releases scheduled for Monday will still be released (Personal Income and Spending, Senior Loan Officer Survey), but there could be delays.

...

Clients should not notice any differences in the way their orders are executed, Duncan L. Niederauer, the chief executive of NYSE Euronext, said by telephone on Sunday.

Yesterday:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

The S&P 500 change following Presidential Elections

by Calculated Risk on 10/28/2012 01:45:00 PM

For fun on a Sunday: I've been asked frequently how investors will react to the election. First, every election is different. Sometimes it is obvious who is going to win, and the election results are completely expected (like Reagan in 2004 or Clinton in 1996). Other times the election is close (this election is close although I expect President Obama to be reelected).

Sometimes the economy is clearly headed into recession like in 2008. The 2000 election was during the ongoing decline following the stock bubble, and the election was especially unsettling because the Supreme Court made the final decision.

There are always some partisan analysts who predict doom if their candidate doesn't win (see Bruce Bartlett's Partisan Bias and Economic Forecasts). But any "doom" related to the election will be in the intermediate or long term, not in 2013.

The following graph shows the change in the S&P 500 from election day through the end of the year for all elections since 1952. Note: The number of trading days varied mostly because of the timing of the election.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The two worst performing years - no surprise - were 2000 and 2008. The 2000 election followed the stock market bubble, and the economy was collapsing in 2008.

The other elections with a slight negative change were 1956, 1964, and 1984. These were all presidents being reelected and the results were obvious in advance: Eisenhower won reelection with 57.4% of the vote, Johnson won with 61.1%, and Reagan with 58.8%.

But most of the time the market has increased following the election, and the median increase from election day to the end of the year was 3.6%. Every election is different and this is NOT investment advice!

Some "Principal Relief" on Fannie Mae and Freddie Mac Loans

by Calculated Risk on 10/28/2012 09:44:00 AM

From Kathleen Pender at the San Francisco Chronicle: Principal relief for stressed homeowners

A limited number of underwater homeowners in California will soon be able to get principal reductions of up to $100,000 apiece on Fannie Mae and Freddie Mac loans through the federally funded Keep Your Home California program.This is a fairly small program, but this will provide some principal relief for a few borrowers.

...

... in mid-September, Fannie and Freddie told servicers they could immediately begin accepting money for principal reductions from programs financed by the U.S. Treasury's Hardest Hit Fund, including Keep Your Home California.

Fannie's and Freddie's willingness to accept money from Hardest Hit Funds does not signal a change of heart on the part of their regulator, the Federal Housing Finance Agency. ... Fannie Mae spokesman Andrew Wilson says, "This in fact for us is not a principal reduction. It's a principal payment. It's as if your grandmother wanted to give you $50,000 to apply to your mortgage. In this case, the grandmother, as it were, was the Hardest Hit Fund."

...

The fund was set up in 2010 to provide $17 billion in homeowner assistance to 18 states hardest hit by the housing crisis. ... The California Housing Finance Agency set up four programs under the Keep Your Home name to distribute California's share - $1.9 billion. It allocated $772 million to principal reduction ...

...

To qualify for principal reduction in California, homeowners must live in the home, owe more than it is worth, be of low-to-moderate income, and be delinquent or have some hardship that puts them in imminent risk of default.

...

To date, 2,511 homeowners have received principal reductions totaling $185.6 million - or roughly $74,000 apiece.

Earlier:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Saturday, October 27, 2012

Schedule for Week of Oct 28th

by Calculated Risk on 10/27/2012 03:55:00 PM

Earlier:

• Summary for Week Ending Oct 26th

The key report this week is the October employment report to be released on Friday. Other key reports include the August Case-Shiller house price index on Tuesday, October auto sales on Thursday, and the October ISM manufacturing index, also on Thursday.

There are two interesting surveys that will be released on Monday; the Fed's Senior Loan Officer Survey that might show some slight increase in loan demand or loosening of lending standards, and the NMHC apartment survey that tends to lead other indicators of changes in the apartment market.

10:30 AM: Dallas Fed Manufacturing Survey for October. This is the last of the regional survey for October.

2:00 PM: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

Expected: National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August.

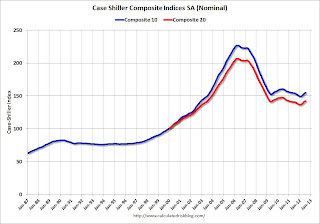

9:00 AM: S&P/Case-Shiller House Price Index for August. Although this is the August report, it is really a 3 month average of June, July and August. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through May 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.1% year-over-year increase in the Composite 20 prices (NSA) for August. The Zillow forecast is for the Composite 20 to increase 1.7% year-over-year, and for prices to increase 0.2% month-to-month seasonally adjusted. The CoreLogic index increased 0.2% in August (NSA).

10:00 AM: Conference Board's consumer confidence index for October. The consensus is for an increase to 72.0 from 70.3 last month.

10:00 AM: Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for an increase to 51.7, up from 49.7 in September.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 365 thousand from 369 thousand.

8:30 AM: Productivity and Costs for Q3. The consensus is for a 1.3% increase in unit labor costs.

10:00 AM ET: ISM Manufacturing Index for October.

10:00 AM ET: ISM Manufacturing Index for October. Here is a long term graph of the ISM manufacturing index. The ISM index indicated expansion in September, after three consecutive months of contraction. The consensus is for a decrease to 51.0, up from 51.5 in September. (above 50 is expansion).

10:00 AM: Construction Spending for September. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 15.0 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate. TrueCar is forecasting:

The October 2012 forecast translates into a Seasonally Adjusted Annualized Rate (“SAAR”) of 14.9 million new car sales, up from 13.3 million in October 2011 and down from 14.94 million in September 2012Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,132,878 new cars will be sold in October for an estimated Seasonally Adjusted Annual Rate (SAAR) this month of 14.8 million light vehicles.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.

8:30 AM: Employment Report for October. The consensus is for an increase of 120,000 non-farm payroll jobs in October; there were 114,000 jobs added in September.The consensus is for the unemployment rate to increase to 7.9% in October, up from 7.8% in September.

This second employment graph shows the percentage of payroll jobs lost during post WWII recessions through September.

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).

The economy has added 5.2 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (4.6 million total jobs added including all the public sector layoffs).There are still 3.7 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 4.0% decrease in orders.

Unofficial Problem Bank list declines to 864 Institutions

by Calculated Risk on 10/27/2012 01:11:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 26, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

The FDIC released its actions through September 2012 and closed a bank this week. There were five removals and four additions leaving the Unofficial Problem Bank List with 864 institutions with assets of $330.4 billion. A year ago, the list had 985 institutions with assets of $406.6 billion. For the month, changes included 11 action terminations, four failures, one unassisted merger, and six additions. Overall, it was a quiet month as it was the fewest action terminations since February 2012 and the fewest additions since the publication of the list.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Actions were terminated against Metro Bank, Lemoyne, PA ($2.4 billion Ticker: METR); Heritage Bank of Central Illinois, Trivoli, IL ($308 million); Minnwest Bank South, Tracy, MN ($213 million); and Freedom Bank, Sterling, IL ($76 million). The failure was Nova Bank, Berwyn, PA ($483 million), which the FDIC could not find a buyer for.

The additions were First State Financial, Inc., Pineville, KY ($395 million); Golden Eagle Community Bank, Woodstock, IL ($152 million); Signature Bank of Georgia, Sandy Springs, GA ($136 million); and Talbot State Bank, Woodland, GA ($72 million). Who would have guessed there are still some unidentified problem banks in Georgia.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now, with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Oct 26th