by Calculated Risk on 10/31/2012 12:42:00 PM

Wednesday, October 31, 2012

CoreLogic: 57,000 Completed Foreclosures in September

From CoreLogic: CoreLogic® Reports 57,000 Completed Foreclosures in September

CoreLogic ... today released its National Foreclosure Report for September that provides monthly data on completed U.S. foreclosures and the overall foreclosure inventory. According to the report, there were 57,000 completed foreclosures in the U.S. in September 2012, down from 83,000 in September 2011 and 59,000 in August 2012. Prior to the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month between 2000 and 2006. Completed foreclosures are an indication of the total number of homes actually lost to foreclosure. Since the financial crisis began in September 2008, there have been approximately 3.9 million completed foreclosures across the country.Note: The foreclosure inventory reported by CoreLogic is lower than the number reported by LPS of 3.87% of mortgages or 1.9 million in foreclosure.

Approximately 1.4 million homes, or 3.3 percent of all homes with a mortgage, were in the national foreclosure inventory as of September 2012 compared to 1.5 million, or 3.5 percent, in September 2011. Month-over-month, the national foreclosure inventory was down 1.1 percent from August 2012 to September 2012. The foreclosure inventory is the share of all mortgaged homes in any stage of the foreclosure process.

“The continuing downward trend in foreclosures along with a gradual clearing of the shadow inventory are signs of stabilization and improvement in the housing market,” said Anand Nallathambi, president and CEO of CoreLogic. “Increasingly improving market conditions and industry and government policy are allowing distressed homeowners to pursue refinancing, loan modifications or short sales rather than foreclosures.”

...

“Homes lost to foreclosure in September 2012 are down 50 percent since the peak month in September 2010 and 22 percent less than the beginning of the year,” said Mark Fleming, chief economist for CoreLogic. “While there is significant progress to be made before returning to pre-crisis levels, the trend is in the right direction as short sales, up 27 percent year over year in August, continue to gain popularity.”

Many observers expected a "surge" in foreclosures this year, but that hasn't happened. However there are still a large number of properties in the foreclosure inventory in some states:

The five states with the highest foreclosure inventory as a percentage of all mortgaged homes were: Florida (11.5 percent), New Jersey (7.3 percent), New York (5.3 percent), Illinois (5.2 percent) and Nevada (4.9 percent).

Chicago PMI: Activity "Idled"

by Calculated Risk on 10/31/2012 09:53:00 AM

From the Chicago ISM:

October 2012: The Chicago Purchasing Managers reported October's Chicago Business Barometer idled, up just 0.2 to a still contractionary 49.9.New orders improved slightly from 47.4 to 50.6 in October. Employment was at 50.3, down from 52.0 in September.

Business Activity measures reflected weakness in five of seven indexes, most notably as the rate of expansion in Production and Employment slowed while New Orders stalled near neutral and Order Backlogs remained in contraction.

EMPLOYMENT: 33 month low;

INVENTORIES: slipped into contraction;

PRICES PAID: inflation slowed a bit;

This was below expectations of a reading of 51.0.

MBA:Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 10/31/2012 07:03:00 AM

From the MBA: Refinance Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6 percent from the previous week to the lowest level since the end of August. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.The refinance index has declined for four straight weeks, but is still at a high level.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.65 percent from 3.63 percent, with points decreasing to 0.39 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

This index is not indicating a pickup in purchase activity.

Tuesday, October 30, 2012

Wednesday: Markets Open, Chicago PMI, Delayed Surveys

by Calculated Risk on 10/30/2012 08:20:00 PM

US Markets will be open on Wednesday. Currently S&P 500 futures are up slightly.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 9:45 AM, the Chicago Purchasing Managers Index for October will be released. The consensus is for an increase to 51.0, up from 49.7 in September.

• Weather delayed: The October National Multi Housing Council (NMHC) Quarterly Apartment Survey will be released either Wednesday or Thursday. This is a key survey for apartment vacancy rates and rents.

• Weather delayed: The October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

The last question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs

HVS: Q3 Homeownership and Vacancy Rates

by Calculated Risk on 10/30/2012 05:23:00 PM

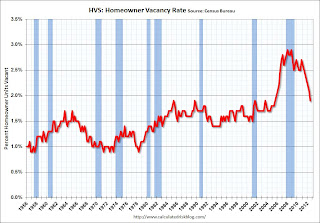

The Census Bureau released the Housing Vacancies and Homeownership report for Q3 2012 this morning.

This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high.

It might show the trend, but I wouldn't rely on the absolute numbers. My understanding is the Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged from Q2 at 65.5%, and down from 66.3% in Q3 2011.

I'd put more weight on the decennial Census numbers and that suggests the actual homeownership rate is probably in the 64% to 65% range.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The HVS homeowner vacancy rate declined to 1.9% from 2.1% in Q2. This is the lowest level since 2005 for this report.

The homeowner vacancy rate has peaked and is now declining, although it isn't really clear what this means. Are these homes becoming rentals? Anyway - once again - this probably shows that the trend is down, but I wouldn't rely on the absolute numbers.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

The rental vacancy rate was unchanged from Q2 at 8.6%, and down from 9.8% in Q3 2011.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the overall trend in the rental vacancy rate - and Reis reported that the rental vacancy rate has fallen to the lowest level since 2001.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey. Unfortunately many analysts still use this survey to estimate the excess vacant supply. However this does suggest that the housing vacancy rates have declined sharply.

Earlier on House Prices:

• Case-Shiller: House Prices increased 2.0% year-over-year in August

• House Price Comments, Real House Prices, Price-to-Rent Ratio

• All Current House Price Graphs