by Calculated Risk on 11/05/2012 11:59:00 AM

Monday, November 05, 2012

Trulia: Asking House Prices increased in October

Press Release: Trulia Reports October Asking Prices Rise 2.9% Year-over-Year, But Rents Rise Faster at 5.1%

In October, asking prices rose 0.7% month-over-month, for a 2.9% year-over-year increase – the biggest yearly gain in the Trulia Price Monitor to date. More than two thirds of large metros – 69 out of 100 – had year-over-year price increases. The month-over-month and quarter-over-quarter price increases are larger when foreclosures are included than when they’re excluded – which means foreclosure prices are now rising faster than prices on non-distressed homes.These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a SA basis.

...

Rents Up 5.1% Year-over-Year – and Rising Even in Markets Where Prices are Falling

Rents have increased year-over-year in 24 of the 25 largest rental markets – all except Las Vegas. Rents are rising alongside big price gains in Oakland, Denver, and San Francisco; people looking for a home in these markets will find bargains disappearing whether they’re looking to rent or own. But rents are also rising sharply in Chicago and Philadelphia, despite falling for-sale prices.

...

“Continued widespread price increases are good for homeowners but not for home-seekers,” said Jed Kolko, Trulia’s Chief Economist. “For homeowners, rising prices add to their wealth and help bring underwater borrowers closer to positive equity. For home-seekers, however, rising prices could put homeownership out of reach. In markets like Denver, San Francisco, and Oakland, where prices and rents are both rising, higher prices mean higher down payments, but rising rents make it harder to save enough.”

More from Jed Kolko, Trulia Chief Economist: Asking Prices Rise Yet Again in October, But Rents Rise Faster

ISM Non-Manufacturing Index decreases in October

by Calculated Risk on 11/05/2012 10:00:00 AM

The October ISM Non-manufacturing index was at 54.2%, down from 55.1% in September. The employment index increased in October to 54.9%, up from 51.1% in September. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 34th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 54.2 percent in October, 0.9 percentage point lower than the 55.1 percent registered in September. This indicates continued growth this month at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.4 percent, which is 4.5 percentage points lower than the 59.9 percent reported in September, reflecting growth for the 39th consecutive month. The New Orders Index decreased by 2.9 percentage points to 54.8 percent. The Employment Index increased by 3.8 percentage points to 54.9 percent, indicating growth in employment for the third consecutive month. The Prices Index decreased 2.5 percentage points to 65.6 percent, indicating prices increased at a slower rate in October when compared to September. According to the NMI™, 13 non-manufacturing industries reported growth in October. The majority of the respondents' comments reflect a positive but guarded outlook on business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.9% and indicates slower expansion in October than in September. The internals were mixed with the employment index up, but new orders down.

Gasoline Prices down 30 cents over last month

by Calculated Risk on 11/05/2012 08:29:00 AM

From the SacBee: Gas prices decline sharply in October, trend may continue through end of the year

"Gas prices at the end of October were dropping at the fastest speeds in nearly four years," said Beth Mosher, director of public affairs for AAA Chicago. "If this trend continues, motorists could be paying less than last year to fill up their cars."Gasoline prices in California have fallen sharply following the recent spike due to refinery issues, and most areas are now under $4 per gallon.

Assuming a smooth restart to production following Hurricane Sandy, AAA predicts that gas prices will continue to drop through the end of the year. ... The Northeast is a significant gasoline consumer and not a major producer, so it is expected that the decline in demand from people not driving will outweigh any disruption in gasoline production.

Brent crude is now down to $105.33 per barrel. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.47 per gallon. That is about 3 cents below the current level according to Gasbuddy.com.

Notes: Add a California city to the graph - like Los Angeles or San Francisco - and you will see the recent sharp increase and decrease. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, November 04, 2012

Monday: ISM Service Index

by Calculated Risk on 11/04/2012 08:40:00 PM

A couple of earlier posts that might interest some readers:

• Retail: Seasonal Hiring vs. Retail Sales

• Update: Further Discussion on Labor Force Participation Rate

A few scary articles on Europe:

• From the WSJ: Europe's Bank Reviews Collateral

The European Central Bank is looking into whether it is treating Spanish government Treasury bills too generously when commercial banks present them as collateral for loans, potentially reviving concerns over the safety of the central bank's €3 trillion ($3.85 trillion) balance sheet.• From the WSJ: Greece's Siren Call

An ECB spokeswoman confirmed the collateral examination Sunday after Germany's Welt am Sonntag newspaper reported, based on its own research, that the ECB hasn't followed its own rules when banks presented some Spanish government securities.

Voting in the Greek parliament on the passage of €13.5 billion ($17.33 billion) of austerity measures, labor reforms and the 2013 budget will also be a focus for financial markets. ... The immediate risk is that Greece fails to approve the new austerity measures. ... The next vote is needed to unlock €31.5 billion of bailout funding, much of which will go to recapitalize Greece's banks. Again, PASOK's behavior will be key.• From the Telegraph: Angela Merkel: eurozone crisis will last at least another five years

If Greece jumps that hurdle, it still needs an extension of two years from the rest of Europe on its budget targets, as its economy has suffered far more than forecast.

“We need a long breath of five years and more,” [Merkel] told a conference in Sternberg, GermanyFive more years?

Monday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for October will be released. The consensus is for a decrease to 54.9 from 55.1 in September. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for October will be released. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors and seems like a decent leading indicator for house prices.

The Asian markets are mostly red tonight, with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 8.

Oil prices are falling with WTI futures at $84.78 per barrel and Brent down to $105.44 per barrel. This is the lowest level since July. And gasoline prices are falling too!

Weekend:

• Summary for Week Ending Nov 2nd

• Schedule for Week of Nov 4th

Two more questions this week for the November economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Update: Further Discussion on Labor Force Participation Rate

by Calculated Risk on 11/04/2012 02:31:00 PM

Last month I wrote Understanding the Decline in the Participation Rate. As a follow on, I wrote: Further Discussion on Labor Force Participation Rate. Here is a repeat with some added data, graphs and commentary.

Definitions from the BLS:

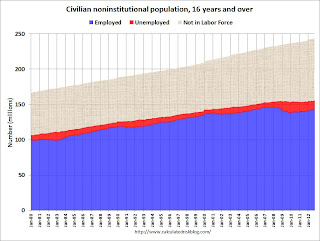

Civilian noninstitutional population: "consists of persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities and homes for the aged) and who are not on active duty in the Armed Forces". If you look at the first graph below, the total of the Blue, Red, and light brown areas is the Civilian noninstitutional population.

"The civilian labor force consists of all persons classified as employed or unemployed". This is Blue and Red combined on the first graph.

"The labor force participation rate represents the proportion of the civilian noninstitutional population that is in the labor force." So this is Blue and Red, divided by all areas combined.

"The employment-population ratio represents the proportion of the civilian noninstitutional population that is employed." This is Blue divided by the total area.

"The unemployment rate is the number of unemployed as a percent of the civilian labor force." This is Red divided by Red and Blue combined. This is the REAL unemployment rate (some claim U-6 is the "real rate", but that is nonsense - although U-6 is an alternative measure of underemployment, it includes many people working part time).

Click on graph for larger image.

Click on graph for larger image.

There are some bumps in the total area - usually when there is a decennial census. These are due to changes in population controls.

Note that the Blue area collapsed in 2008 and early 2009, and started increasing in 2010. This shows the increase in employment over the last few years. Over the last few years, the red area (unemployment) has been decreasing.

However the combined area, the civilian labor force, has not increased much - even though the civilian noninstitutional population has been increasing. Some people argue that this evidence of a large number of people who left the labor force because of the weak labor market - and that the actual unemployment rate should be much higher than 7.9%.

However, as I noted last month, some decrease in the labor force participation rate was expected, and it appears most of the decline in the participation rate can be explained by demographic shifts.

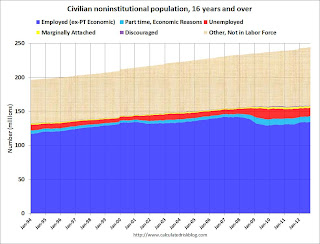

The second graph is similar to the first graph, but breaks the data down by a few more categories. Some of this data is only available since January 1994.

The second graph is similar to the first graph, but breaks the data down by a few more categories. Some of this data is only available since January 1994.

The light blue area is part time for economic reasons. "These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job." Some of the dark blue workers are working part time too, but that is by choice. The dark blue and light blue add to dark blue in the previous graph.

The yellow area is marginally attached workers. "These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey."

The purple area is discouraged workers. "Discouraged workers are persons not currently looking for work because they believe no jobs are available for them."

Part time for economic reasons, marginally attached workers, and discouraged workers are all included in U-6, an alternate measure of labor underutilization.

The third graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census, and a recent Census Bureau projection for 2020.

The third graph shows the number of people in the US by age group from both the 2000 and 2010 decennial Census, and a recent Census Bureau projection for 2020.

This graph shows two key shifts. First, baby boomers are now moving into lower participation rate age groups. Look at the increase in the 55-to-59 and 60-to-64 groups from 2000 (blue) to 2010 (red).

A second key demographic is the significant increase in people in the 15-to-19 and 20-to-24 age groups. These groups have lower participation rates usually because of school enrollment - and enrollment has been increasing.

Taken together, it is clear why the labor force hasn't increase as quickly as the civilian noninstitutional population, and therefore, why a decline in the labor force participation rate was expected.

Also - in 2010, the group with the highest population was in the '45 to 49 age group, followed by the '50 to 54 age group. By 2020, the seven groups with the highest projected population will all be under 35! Sure, some geezers will hang around, and that will push down the overall participation rate - but there is a new engine of growth coming.