by Calculated Risk on 11/08/2012 08:39:00 AM

Thursday, November 08, 2012

Weekly Initial Unemployment Claims decline to 355,000

The DOL reports:

In the week ending November 3, the advance figure for seasonally adjusted initial claims was 355,000, a decrease of 8,000 from the previous week's unrevised figure of 363,000. The 4-week moving average was 370,500, an increase of 3,250 from the previous week's unrevised average of 367,250.The previous week was unrevised.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 370,500. This is about 7,000 above the cycle low for the 4-week average of 363,000 in March.

Weekly claims were lower than the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

Mostly moving sideways this year, but near the cycle bottom.

SPECIAL NOTE: Due to Hurricane Sandy, we will probably see an increase in initial unemployment claims over the next few weeks. The decline this week is probably because some people in a few states - like New York and New Jersey - were not able to file claims immediately.

Wednesday, November 07, 2012

Thursday: Initial Unemployment Claims, Trade Deficit

by Calculated Risk on 11/07/2012 08:43:00 PM

I'll write something soon on the "fiscal slope". It is NOT a "cliff" ... and I suspect something will be worked out (the compromise will very likely include higher tax rates on high income individuals - so the agreement will probably have to happen after January 1st so some politicians can claim they didn't vote to increase taxes). No worries. Jan 1st is not a drop dead date.

Note: Jim Hamilton suggests breaking "the problem into smaller pieces", and Macro Man says the 'fiscal cliff may have to be downgraded to "road hump"'.

From Reuters: Greek government defies protests to approve more austerity

Greece's government voted by a razor thin margin on Thursday to approve an austerity package needed to unlock vital aid and avert bankruptcy ...The beatings will continue until morale improves.

The bill covering the bulk of 13.5 billion euros' ($17.2 billion) worth of belt-tightening measures is a precursor to the 2013 budget law, which the government is expected to push through on Sunday.

If it does, it is expected to unlock a 31.5 billion euro aid tranche from the International Monetary Fund and European Union that Greece needs to shore up its banks and pay off loans.

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 370 thousand from 363 thousand.

• Also at 8:30 AM, the Trade Balance report for September will be released by the Census Bureau. The consensus is for the U.S. trade deficit to increase to $45.4 billion in August, up from from $44.2 billion in August. Export activity to Europe will be closely watched due to economic weakness.

Once more question for the November economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

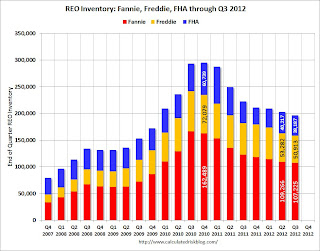

Fannie, Freddie, FHA REO inventory declines in Q3

by Calculated Risk on 11/07/2012 06:56:00 PM

First, from Fannie Mae: Fannie Mae Reports Net Income of $1.8 Billion for Third Quarter 2012

Fannie Mae (FNMA/OTC) today reported net income of $1.8 billion in the third quarter of 2012, compared with a net loss of $5.1 billion in the third quarter of 2011. For the first nine months of 2012, the company has reported $9.7 billion in net income. Lower credit-related expenses resulting from an increase in actual and expected home prices, higher sales prices on the company’s real-estate owned (“REO”) properties, and a decline in fair value losses contributed to the continued improvement in the company’s financial results.Here are some more details from the Fannie Mae's SEC filing 10-Q:

The company reported comprehensive income of $2.6 billion in the third quarter of 2012. The company is able to pay its third-quarter dividend of $2.9 billion to the Department of the Treasury without any draw under its senior preferred stock purchase agreement.

“We are seeing signs of sustained improvement in housing and our actions to support the housing recovery have generated strong financial results in 2012,” said Timothy J. Mayopoulos, president and chief executive officer.

Credit losses decreased in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011 primarily due to: (1) improved actual home prices and sales prices of our REO properties resulting from strong demand in markets with limited REO supply; and (2) lower volume of REO acquisitions due to the slow pace of foreclosures. The decrease in credit losses was partially offset by a decrease in amounts collected by us as a result of repurchase requests in the third quarter and first nine months of 2012 compared with the third quarter and first nine months of 2011. We expect our credit losses to remain high in 2012 relative to pre−housing crisis levels. We expect delays in foreclosures to continue for the remainder of 2012, which delays our realization of credit losses.Fannie sees rising prices and strong demand for REOs.

Click on graph for larger image.

Click on graph for larger image.This graph shows the REO inventory for Fannie, Freddie and the FHA. This was the seventh straight quarterly decline in the "F's" REO inventory, and total "F" REO was down 12% from a year ago.

This is only a portion of the total REO. There is also REO for private-label MBS, FDIC-insured institutions, VA and more. REO has been declining for those categories too. (I'll have more on those categories soon).

Lawler on Freddie Mac Results

by Calculated Risk on 11/07/2012 03:49:00 PM

From economist Tom Lawler: Freddie Mac: GAAP Net Income $2.9 Billion in Q3, GAAP Net Worth $4.9 Billion at End of Quarter (no additional Treasury Draw); SF REO Down Again

Freddie Mac reported that its GAAP net income “attributable” to Freddie Mac last quarter was $2.9 billion, down just a tad from the previous quarter. GAAP net income “attributable” to common stockholders last quarter was $1.1 billion, with the difference reflecting the $1.8 billion “paid” to Treasury on its senior preferred stock holdings.

Freddie also reported “other comprehensive income” of $2.7 billion (mainly reflecting “spread-tightening” on its non-agency AFS securities), and that its GAAP net worth on September 30th was $4.9 billion, up from $1.1 billion in the previous quarter. As a result, Freddie’s regulator does not need to request another Treasury “draw.”

Freddie Mac said that its internal Freddie’s internal national home price index, which is based on repeat transactions of homes backed by mortgages owned or guaranteed by Freddie or Fannie with state value weights based on Freddie’s SF mortgage book, increased by 1.3% from June to September, and was up 4.3% from last September.

Freddie’s improved “GAAP” income this year vs. last year has been mainly attributable to lower credit losses – mainly lower provision for credit losses, though its REO operations expense is also down – driven by improving home prices. Here is a table showing Freddie’s December 2011 home price forecast (for it’s internal HPI) vs. “actuals” so far this year.

| Annualized Growth Rate, Freddie Mac Home Price Index | ||

|---|---|---|

| Dec. 2011 Forecast | "Actual" | |

| Q1/12 | -2.0% | 0.6% |

| Q2/12 | 1.5% | 4.9% |

| Q3/12 | -0.5% | 1.3% |

Freddie noted in it’s 10-Q that “(t)he decline in (REO) expense for the 2012 periods was primarily due to improving home prices in certain geographical areas with significant REO activity, which resulted in gains on disposition of properties as well as lower write-downs of single-family REO inventory.”

Beginning next year, Freddie Mac’s dividend payment on Treasury’s senior preferred stock will change in a fashion that makes it impossible for Freddie Mac (or Fannie Mae) to Here is an excerpt from Freddie’s 10-Q.

“We currently pay cash dividends to Treasury at an annual rate of 10%. On August 17, 2012, Freddie Mac, acting through FHFA, as Conservator, and Treasury entered into a third amendment to the Purchase Agreement, that, among other items, changed our dividend payments on the senior preferred stock. For each quarter from January 1, 2013 through and including December 31, 2017, the dividend payment will be the amount, if any, by which our net worth at the end of the immediately preceding fiscal quarter, less the applicable capital reserve amount, exceeds zero. The applicable capital reserve amount will be $3 billion for 2013 and will be reduced by $600 million each year thereafter until it reaches zero on January 1, 2018. For each quarter beginning January 1, 2018, the dividend payment will be the amount, if any, by which our net worth at the end of the immediately preceding fiscal quarter exceeds zero. If the calculation of the dividend payment for a quarter does not exceed zero, then no dividend will accrue or be payable for that quarter.”As Freddie noted, “(t)his effectively ends the circular practice of Treasury advancing funds to us to pay dividends back to Treasury, and “(a)s a result of this amendment, over the long term, our future profits will effectively be distributed to Treasury.” This change, of course, eliminates the possibility that the GSEs can re-build capital.

CR Note: Freddie's REO declined to 50,913 houses, down from 53,271 in Q2. I'll have more on REO when Fannie reports.

Bankruptcy Filings declined 14% in Fiscal 2012

by Calculated Risk on 11/07/2012 12:31:00 PM

From the US Court: Bankruptcy Filings Down in Fiscal Year 2012

Bankruptcy cases filed in federal courts for fiscal year 2012, the 12-month period ending September 30, 2012, totaled 1,261,140, down 14 percent from the 1,467,221 bankruptcy cases filed in FY 2011, according to statistics released today by the Administrative Office of the U.S. Courts.The number of filings for the quarter ending Sept 2012 were the lowest since 2008.

...

For the 12-month period ending September 30, 2012, business bankruptcy filings—those where the debtor is a corporation or partnership, or the debt is predominantly related to the operation of a business—totaled 42,008, down 16 percent from the 49,895 business filings reported in the 12-month period ending September 30, 2011.

Non-business bankruptcy filings totaled 1,219,132, down 14 percent from the 1,417,326 non-business bankruptcy filings in September 2011.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by year since 1987.

Note: The peal in 2005 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation).

This is another indicator of less economic stress.