by Calculated Risk on 11/08/2012 05:12:00 PM

Thursday, November 08, 2012

New CBO report on "Fiscal Cliff"

Note: My baseline forecast assumes a compromise on the fiscal slope (more of a "slope" than a "cliff", and January 1st is not a drop dead date). My current guess is an agreement will be reached AFTER January 1st - so that the Bush tax cuts can expire and certain politicians can claim they didn't vote to raise taxes (silly, but that is politics).

I expect the relief from the Alternative Minimum Tax (AMT) will be extended, the tax cuts for low to middle income families will be reenacted, and that most, but not all, of the defense spending cuts will be reversed (aka "sequestration"). However I think the payroll tax cut will probably not be extended, and tax rates on high income earners will increase a few percentage points to the Clinton era levels.

It wasn't worth spending much time on this before the election, but now the details will be important. As the CBO notes, a policy mistake could lead to economic contraction (a new recession), but I think some reasonable agreement is likely.

From the Congressional Budget Office: CBO Releases a Report on the Economic Effects of Policies Contributing to Fiscal Tightening in 2013

Significant tax increases and spending cuts are slated to take effect in January 2013, sharply reducing the federal budget deficit and causing, by CBO’s estimates, a decline in the nation’s economic output and an increase in unemployment. What would be the economic effects of eliminating various components of that fiscal tightening—or what some term the fiscal cliff?

To answer that question, today CBO released a report—Economic Effects of Policies Contributing to Fiscal Tightening in 2013. This report provides additional details about the agency’s estimates—originally released in its August report An Update to the Budget and Economic Outlook: Fiscal Years 2012–2022—of the economic effects of reducing fiscal tightening.

As CBO projected in August, the sharp reduction in the deficit will cause the economy to contract but will also put federal debt on a path more likely to be sustainable over time. If certain scheduled tax increases and spending cuts would not take effect and current tax and spending policies were instead continued, the economy would grow in the short term, but the government’s debt would continue to increase.

This report focuses on the economic effects of eliminating individual components of the changes in policy that are scheduled to take effect: the automatic reductions in defense spending; the automatic reductions in nondefense spending and the scheduled reductions in Medicare’s payment rates for physicians; the extension of certain expiring tax cuts and indexation of the alternative minimum tax; and extension of the payroll tax cut and emergency unemployment benefits.

Eliminating the first three of those changes—which would capture all of the policies included in CBO’s “alternative fiscal scenario”—would boost real (inflation-adjusted) gross domestic product (GDP) by about 2¼ percent by the end of 2013. Eliminating all of those changes would boost real GDP in 2013 by about 3 percent. The bulk of that impact would stem from changes in tax policies, CBO estimates

Lawler: REO inventory of "the F's" and PLS

by Calculated Risk on 11/08/2012 04:00:00 PM

CR Note: Yesterday I posted a graph of REO inventory (lender Real Estate Owned) for the Fs (Fannie, Freddie and the FHA). Economist Tom Lawler has added estimates for PLS (private label securities). Note that the FHA data was for August.

From Tom Lawler:

Here is a chart showing some history of SF REO holdings of Fannie, Freddie, FHA, and private-label securities (from Barclays Capital). Note that FHA has not yet released its report to the FHA commissioner for September (everything there may be focused on the FY 2012 Actuarial Review due out next week, which could be a doozy!), and the number for the end of Q3/2012 (38,187) is actually the August inventory number.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

More from CR: When the FDIC's Q3 quaterly banking profile is released in a couple of weeks, I'm sure Tom will add an estimate for REO at FDIC-insured institutions. This is not all REO: In addition to the FDIC-insured institution REO, this excludes non-FHA government REO (VA, USDA, etc.), credit unions, finance companies, non-FDIC-insured banks and thrifts, and a few other categories.

REO inventories have declined over the last year. This was a combination of more sales and fewer acquisitions.

Also note Tom's comment on the forthcoming FHA FY 2012 Actuarial Review. That will be interesting.

LPS: Mortgage Delinquency Rates increased in September

by Calculated Risk on 11/08/2012 02:17:00 PM

LPS released their Mortgage Monitor report for September today. According to LPS, 7.40% of mortgages were delinquent in September, up from 6.87% in August, and down from 7.72% in September 2011.

LPS reports that 3.87% of mortgages were in the foreclosure process, down from 4.04% in August, and down from 4.18% in September 2011.

This gives a total of 11.27% delinquent or in foreclosure. It breaks down as:

• 2,170,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,530,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 1,940,000 loans in foreclosure process.

For a total of 5,640,000 loans delinquent or in foreclosure in August. This is up from 5,450,000 last month, and down from 6,130,000 in September 2011.

This following graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquency rate has generally been trending down, although there was a pretty sharp increase in September.

Note: A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 3.87%. There are still a large number of loans in this category (about 1.9 million), but it appears this is starting to decline.

From LPS:

The September Mortgage Monitor report released by Lender Processing Services looked at the significant month-over-month increase in the nation’s delinquency rates – up 7.7 percent from August, and representing the largest monthly increase since 2008. While September has historically been marked by seasonal rises in delinquencies, this was still a marked upturn. However, according to LPS Applied Analytics Senior Vice President Herb Blecher, it is important to view the month’s data in its proper context.As Blecher notes, this is just one month of data, and there might be some seasonal issues.

“September’s increase in the delinquency rate was indeed significant, but the overall trend is still one of improvement,” Blecher said. “Despite the monthly jump, delinquencies are down 30 percent from their January 2010 peak, and our analysis revealed some interesting factors related to the spike. Of course, one month’s data does not indicate a trend. We will be monitoring these factors over the coming months to see how the situation develops.”

Blecher continued, “September 2012 was notable in its short duration of business days and virtually all transactional or operational metrics we observed declined in volume for the month; foreclosure starts, foreclosure sales, delinquent cures and loan prepayments all dropped from their August levels. It is important to note that we also saw the percentage of re-defaulting modifications contributing to the delinquency rate actually declined from the month prior.”

NAHB: Builder Confidence in the 55+ Housing Market Increases in Q3

by Calculated Risk on 11/08/2012 11:25:00 AM

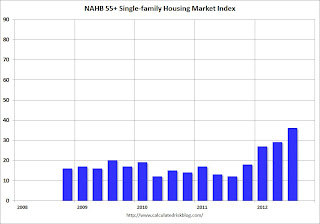

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008, so all readings are very low.

From the NAHB:

Builder Confidence in the 55+ Housing Market Continues to Improve in the Third Quarter

Builder confidence in the 55+ housing market for single-family homes showed significant improvement in the third quarter of 2012 compared to the same period a year ago, according to the National Association of Home Builders' (NAHB) latest 55+ Housing Market Index (HMI) released today. The index more than tripled year over year from a level of 12 to 36, which is the highest third-quarter reading since the inception of the index in 2008.

...

The 55+ multifamily condo HMI had a significant increase of 13 points to 23, which is the highest third-quarter reading since the inception of the index in 2008; however, condos remain the weakest segment of the 55+ housing market. All 55+ multifamily HMI components increased considerably compared to a year ago as present sales rose 13 points to 22, expected sales for the next six months jumped 19 points to 29 and traffic of prospective buyers climbed 11 points to 22.

...

"Like other segments of the housing industry, the market for 55+ housing is continuing on a steady upward path, driven by improving conditions in additional markets around some parts of the country" said NAHB Chief Economist David Crowe "While we expect the upward trend to continue as the recovery broadens, the speed of the recovery is being constrained by factors as tight mortgage credit, making it difficult for potential 55+ customers to sell their current homes, and shortages of inputs to construction such as buildable lots that are beginning to emerge in some market areas."

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q3 2012. All of the readings are very low for this index, but there has been a fairly sharp increase over the last year.

This is going to be a key demographic for household formation over the next couple of decades - if the baby boomers can sell their current homes!

There are two key drivers: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.

The second graph shows the homeownership rate by age for 1990, 2000, and 2010. This shows that the homeownership rate usually increases until 70 years old or so.So demographics should be favorable for the 55+ market - if these people can sell their current homes.

Trade Deficit declined in September to $41.5 Billion

by Calculated Risk on 11/08/2012 09:25:00 AM

The Department of Commerce reported:

[T]otal September exports of $187.0 billion and imports of $228.5 billion resulted in a goods and services deficit of $41.5 billion, down from $43.8 billion in August, revised. September exports were $5.6 billion more than August exports of $181.4 billion. September imports were $3.4 billion more than August imports of $225.2 billion.The trade deficit was smaller than the consensus forecast of $45.4 billion.

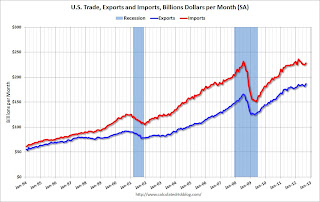

The first graph shows the monthly U.S. exports and imports in dollars through September 2012.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in September. Exports are at a new high.

Exports are 13% above the pre-recession peak and up 3.5% compared to September 2011; imports are 1% below the pre-recession peak, and up about 1.5% compared to September 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $98.88 in September, up from $94.36 per barrel in August. The trade deficit with China increased to $29.1 billion in September, up from $28.0 billion in September 2011. Most of the trade deficit is due to oil and China.

The trade deficit with the euro area was $7.6 billion in August, up from $6.4 billion in August 2011.

This suggests a small upward revision to Q3 GDP.