by Calculated Risk on 11/09/2012 06:02:00 PM

Friday, November 09, 2012

Las Vegas Real Estate: Sales increase slightly in October

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

From the GLVAR: GLVAR reports increasing local home sales, as prices begin to level off heading into winter

GLVAR said the total number of local homes, condominiums and townhomes sold in October was 3,651. That’s up from 3,298 in September, but down from 3,881 total sales in October 2011.A few key points:

...

The total number of homes listed for sale on GLVAR’s Multiple Listing Service bounced back in October, with a total of 16,778 single-family homes listed for sale at the end of the month. That’s up from 16,775 homes listed for sale at the end September, but down 21.9 percent from one year ago. ...

The number of available homes listed for sale without any sort of pending or contingent offer also increased from the previous month. By the end of October, GLVAR reported 4,079 single-family homes listed without any sort of offer. That’s up 3.4 percent from 3,943 such homes listed in September, but still down 60.6 percent from one year ago.

...

Meanwhile, 44.7 percent of all existing local homes sold during October were short sales. That’s down slightly from a record 44.8 percent in September, but still up dramatically from 25.4 percent one year ago. Continuing a trend of declining foreclosure sales in recent months, bank-owned homes accounted for 11.6 percent of all existing home sales in October, down from 13.6 percent in September.

...

"The biggest thing I noticed in this month’s report is that the inventory of homes available for sale went up. We sold fewer homes in October than we listed,” GLVAR President Kolleen Kelley explained. “As inventory goes up, you’re not going to see prices go up as much. It’s supply and demand.”

• Inventory increased slightly in September, and inventory is down 21.9% from October 2011. However, for single family homes without contingent offers, inventory is still down sharply from a year ago (down 60.6% year-over-year).

• Short sales are almost four times foreclosures now. The GLVAR reported 44.7% of sales were short sales, and only 11.6% foreclosures. We've seen a shift from foreclosures to short sales in most areas (not just in areas with new foreclosure laws).

• The percent distressed sales was extremely high at 56.3% in September (short sales and foreclosures), but down from 58.4% in September.

• There is a push to complete short sales, from the article:

Kelley said many homeowners have been rushing to short-sell their homes by the end of 2012, when the Mortgage Forgiveness Debt Relief Act is set to expire unless Congress acts to extend it. If Congress does not extend this law by Dec. 31, she said any amount of money a bank writes off in agreeing to sell a home as part of a short sale will become taxable when sellers file their income taxes.

The Recession Probability Chart

by Calculated Risk on 11/09/2012 02:22:00 PM

One of the most frequent questions I receive via email is: "Is another recession starting?" There are quite a few people who have been calling a recession recently (ECRI has called several recessions since August 2011 or so). They still have time on their most recent calls, but their earlier calls were wrong.

Part of the problem in forecasting right now is the sluggish recovery has ups and downs, and each down looks like the start of a recession to some models. Another problem is that negative news sells ... and there is an entire industry that sells doom and gloom. And that industry has expanded significantly in recent years ...

There is a recession probability chart from the St Louis Fed making the rounds today. The chart shows that the odds of a recession have increased recently (ht Bruce).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the chart from FRED at the St Louis Fed: "This recession probabilities series from University of Oregon economist Jeremy Piger is a monthly measure of the probability of recession in the United States obtained from a dynamic-factor Markov-switching model applied to 4 monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales."

However there are reasons this shouldn't be interpreted as indicating a new recession. Jeff Miller at a Dash of Insight does the heavy lifting: Debunking the 100% Recession Chart. Jeff actually read the underlying papers - and contacted the authors. Please read his post for more.

My view is the economy is not currently in a recession, and that economic growth will pickup in 2013, although there are downside risks from Europe and the potential for a policy mistake in the US (no agreement on the fiscal bluff). As I've noted before, I see two key reason for a pickup in the US: 1) I expect residential investment to increase next year (the key leading indicator for the economy), 2) I think the drag from state and local governments will subside.

Of course I could be wrong, but currently I'm not even on recession watch!

A few thoughts on Fiscal Agreement

by Calculated Risk on 11/09/2012 12:33:00 PM

A personal note: I'd like to thank Governor Romney for his personal sacrifice. I believe he is a decent man, and I think everyone should appreciate the sacrifice all candidates made in running for office (I'd never do it, even at the local level). I also think President Obama is a decent man, and I remain optimistic about the future.

From Reuters: Obama to Make Statement on Economy Friday

The president is likely to discuss looming tax increases and government spending cuts — the so-called fiscal cliff — that would go into effect early next year unless Congress acts to prevent them. He is due to make the statement from the East Room of the White House at 1:05 p.m.As I've noted before, there is no "cliff" and January 1st is not a drop dead date. Note: In the comments, Jackdawracy suggests "Fiscal Hillock" and energyecon suggests "fiscal bluff".

There are a few things that appear certain (but you never know with policy):

1) The top marginal tax rate will increase from 35% to 39.6%. The details still need to be worked out (at what income the highest bracket will start, and what happens with dividends and capital gains). The it is pretty clear the top tax rate will increase.

2) The payroll tax cut is probably going away. This was the 2% payroll tax reduction that workers received in 2010 and 2011. For a family with a $50,000 per year income, this is a tax increase of about $20 per week.

3) The Alternative Minimum Tax (AMT) relief will probably be extended (it is every year).

4) Given that the top marginal tax rate will increase - and that certain politicians can't vote for any bill with a tax increase - the agreement will probably be voted on in January after the Bush tax cuts expire.

I doubt we will see the current scheduled defense spending cuts (aka "sequestration"), but there will probably be some defense cuts.

Probably the most controversial issue, and least economically important (minimal drag on economy) is raising the top marginally tax rate. High income earners have a propensity to save, and raising their marginal rate a few percentage points will not have much impact on the economy - but it will significantly reduce the deficit.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the top marginal tax rate since 1920. There are many details missing (like the level of the top tax bracket). The current proposal is to raise the top tax bracket back to 39.6% from 35% - the same level as in the '90s.

Back in 1993, many analysts (like Larry Kudlow) argued raising the tax rate from 31% to 39.6% would take the economy into a deep recession or even depression. They were wrong. The other parts of the "fiscal cliff" are more important for the economy in the short run than the top tax rate.

One of the arguments against raising the top tax rate is that it will be a disincentive to start new companies. Wrong again. Note the top marginal tax rate in the 1970s - it was 70%. That was when Bill Gates started Microsoft, Steve Jobs started Apple and ... many others (Thomas Peterffy, who founded Interactive Brokers and ran many political ads recently started his company in 1977 with a 70% top tax rate). I've met with many entrepreneurs over the years, and none of them even mentioned the top personal tax rate - they were too focused on their company, products and market.

Hopefully this fiscal issue will be resolved without much disruption, and my guess is some sort of compromise will be reached early in 2013.

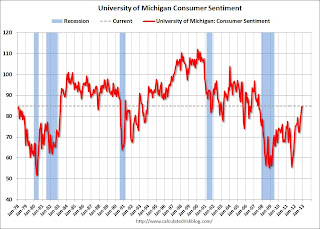

Preliminary November Consumer Sentiment increases to 84.9

by Calculated Risk on 11/09/2012 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for November increased to 84.9 from the October reading of 82.6. This was the highest level since July 2007 - before the recession started.

This was above the consensus forecast of 83.1. Overall sentiment is still somewhat weak - probably due to a combination of the high unemployment rate and the sluggish economy - but consumer sentiment has been improving recently.

However - remember - that sharp decline in sentiment in August 2011 was due to the threat of default and the debt ceiling debate. Hopefully we will not see that again early next year before the fiscal slope is resolved.

Thursday, November 08, 2012

Friday: Consumer sentiment

by Calculated Risk on 11/08/2012 09:12:00 PM

Tim Duy remains depressed about Europe: Europe Back In The Spotlight

Europe faded from the news over the summer. European Central Bank President Mario Draghi's shift to allowing his institution to serve as a lender of last resort calmed nerves and took the worst case scenario of imminent breakup off the table even though the program has yet to be implemented. With crisis again averted, market participants shifted their focus to the Federal Reserve and the US elections.I wonder when we will see a headline reading "Europe is Back", instead of "Europe Back in he Spotlight"? Not any time in the near future. Very depressing.

In the meantime, economic conditions in Europe continued to slowly deteriorate. We are now looking at another year of dismal growth in the Eurozone. This crisis seems to have no end in sight.

...

Bottom Line: Yes, I remain a Euroskeptic. Maybe it is just in my blood. Europe still looks ugly, and will continue to be so for the next year at least (I tend to think wave after wave of austerity will push the Eurozone into a multi-year malaise, but let's just take it one year at a time for now). I expect European troubles will continue to cloud the global outlook and vex the earning plans of large multinationals for the time being.

Friday:

• At 8:30 AM, Import and Export Prices for October. The consensus is no change in import prices.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for sentiment to increase slightly to 83.3.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories report for September will be released. The consensus is for a 0.3% increase in inventories.