by Calculated Risk on 11/13/2012 02:07:00 PM

Tuesday, November 13, 2012

DataQuick: SoCal Home Sales increase in October

From DataQuick: Southland Home Sales, Median Price Rise Above Year Ago

Southern California home sales rose sharply in October as move-up buyers joined investors, shifting the mix of homes selling up a notch as foreclosure resales hit a five-year low. ... A total of 21,075 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 18.0 percent from 17,859 sales in September, and up 25.2 percent from 16,829 sales in October 2011, according to San Diego-based DataQuick.The median price is being impacted by the mix, with fewer low end distressed sales pushing up the median. This is why I focus on the repeat sales indexes.

...

The Southland’s lower-cost areas continued to post the weakest sales compared with last year. The number of homes that sold below $200,000 fell 11.2 percent year-over-year, while sales below $300,000 dipped 0.3 percent. Sales in these more affordable markets have been hampered by the slowdown in foreclosure activity, which results in fewer foreclosed properties listed for sale, as well as the high percentage of homeowners who still owe more than their homes are worth, meaning they can’t sell and move on.

Sales rose sharply in most mid- to-higher-cost markets in October. Sales between $300,000 and $800,000 – a range that would include many move-up buyers – jumped 41.5 percent year-over-year. October sales over $500,000 rose 55.2 percent year-over-year, while sales over $800,000 rose 52.4 percent compared with October 2011.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 16.3 percent of the Southland resale market last month. That was down from 16.6 percent the month before and 32.8 percent a year earlier. Last month’s level was the lowest since it was 16.0 percent in October 2007. In the current cycle, the foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 26.0 percent of Southland resales last month. That was down slightly from an estimated 27.6 percent the month before and up from 25.4 percent a year earlier.

This report shows why we need to focus on the composition of sales (conventional vs. distressed) as opposed to just overall sales. Sales are declining in the high foreclosures areas because the number of foreclosed properties is declining. But sales are now picking up in other areas, and these are mostly conventional sales.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th.

Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

by Calculated Risk on 11/13/2012 11:14:00 AM

As I noted last week, the "fiscal cliff" includes expiring Bush tax cuts for high, middle and low income earners, the expiring 2% payroll tax cut, expiring Alternative Minimum Tax (AMT) relief, expiring emergency unemployment benefits, and scheduled defense spending cuts (aka "sequestration").

Here is an article on the emergency unemployment benefits from Michael Fletcher at the WaPo: 2 million could lose unemployment benefits unless Congress extends program

More than 2 million Americans stand to lose their jobless benefits unless Congress reauthorizes federal emergency unemployment help before the end of the year.

...

These workers have exhausted their state unemployment insurance, leaving them reliant on the federal program.

In addition to those at risk of abruptly losing their benefits in December, 1 million people would have their checks curtailed by April if the program is not renewed ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, in October there were 5.00 million workers who had been unemployed for more than 26 weeks and still want a job. This is generally trending down, but is still very high.

As the WaPo article notes, many of these people are surviving on their unemployment benefits.

NFIB: Small Business Optimism Index increases slightly in October

by Calculated Risk on 11/13/2012 08:33:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

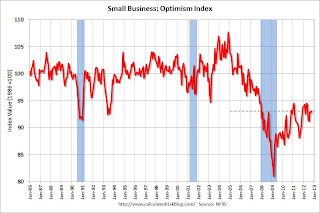

The National Federation of Independent Business (NFIB) Small Business Optimism Index rose 0.3 in October to 93.1; the slight uptick in the reading did not seem to indicate a dramatic shift in owner sentiment over the course of the month.

...

One indicator that rose slightly in October is the frequency of reported capital outlays in the past six months, increasing 3 points to 54 percent. ... Weak sales is still the reported No. 1 business problem for 22 percent of owners surveyed. ... October was another weak job creation month, though better than September due primarily to a reduction in terminations which will raise the net jobs number. According to the October survey, owners stopped releasing workers; the average change in employment per firm rose to just 0.02 workers—essentially zero.

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 93.1 in October from 92.8 in September.

Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy. This index remains low, and once again, lack of demand is a huge problem for small businesses.

Monday, November 12, 2012

Lawler: Preliminary Table of Short Sales and Foreclosures for Selected Cities in October

by Calculated Risk on 11/12/2012 07:08:00 PM

Economist Tom Lawler sent me the following preliminary table today of short sales and foreclosures for a few selected cities in October. Over the weekend I posted some data from Sacramento showing a sharp increase in conventional sales, and that distressed sales have fallen to the lowest level since the Sacramento Association started tracking the data.

There has been a shift from foreclosures to short sales. Foreclosures are down and short sales are up in all of these cities. In most areas, short sales far out number foreclosures, although Minneapolis is an exception with more foreclosures than short sales.

The overall percent of distressed sales (combined foreclosures and short sales) are down year-over-year almost everywhere. In the cities listed below, distressed sales are down about 25% from a year ago.

And previously from Lawler:

Note that the distressed sales shares in the below table are based on MLS data, and often based on certain “fields” or comments in the MLS files, and some have questioned the accuracy of the data. Some MLS/associations only report on overall “distressed” sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Oct | 11-Oct | 12-Oct | 11-Oct | 12-Oct | 11-Oct | |

| Las Vegas | 44.7% | 25.4% | 11.6% | 48.1% | 56.3% | 73.5% |

| Reno | 40.0% | 32.0% | 12.0% | 38.0% | 52.0% | 70.0% |

| Phoenix | 26.2% | 29.2% | 12.9% | 35.6% | 39.1% | 64.8% |

| Sacramento | 35.7% | 26.8% | 12.0% | 37.3% | 47.7% | 64.1% |

| Minneapolis | 10.5% | 12.6% | 25.1% | 33.6% | 35.6% | 46.2% |

| Mid-Atlantic (MRIS) | 11.7% | 15.2% | 9.1% | 16.0% | 20.7% | 31.2% |

| Charlotte | 13.2% | 17.4% | ||||

| Memphis* | 26.3% | 30.8% | ||||

| Birmingham AL | 30.8% | 35.5% | ||||

| *share of existing home sales, based on property records | ||||||

Lawler on Builder Results

by Calculated Risk on 11/12/2012 02:51:00 PM

A few comments and a table from economist Tom Lawler:

D.R. Horton and Beazer Homes released their operating results for the quarter ended September 30th today. Here is a table showing some summary stats for nine large publicly-traded home builders. The net orders and settlements figures include results from “discontinued operations.”

The combined order backlog of the builders on September 30th, 2012 was 30,461, up 44.6% from last September.

CR Note: I broke Tom's table into two sections - the first for orders and settlements, and the second for prices.

This increase in net orders was about the same as last quarter (year-over-year), and the backlog is continuing to increase.

| Net Orders | Settlements | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | 5,276 | 4,241 | 24.4% | 5,575 | 4,987 | 11.8% |

| PulteGroup | 4,544 | 3,564 | 27.5% | 4,418 | 4,198 | 5.2% |

| NVR | 2,558 | 2,218 | 15.3% | 2,656 | 2,255 | 17.8% |

| The Ryland Group | 1,507 | 1,008 | 49.5% | 1,322 | 1,015 | 30.2% |

| Beazer Homes | 1,110 | 1,023 | 8.5% | 1,608 | 1,404 | 14.5% |

| Standard Pacific | 989 | 764 | 29.5% | 861 | 697 | 23.5% |

| Meritage Homes | 1,204 | 906 | 32.9% | 1,197 | 840 | 42.5% |

| MDC Holdings | 1,008 | 595 | 69.4% | 1,039 | 707 | 47.0% |

| M/I Homes | 757 | 587 | 29.0% | 746 | 582 | 28.2% |

| Total | 18,953 | 14,906 | 27.2% | 19,422 | 16,685 | 16.4% |

| Average Closing Price | |||

|---|---|---|---|

| Qtr. Ended: | 9/30/2012 | 9/30/2011 | % Chg |

| D.R. Horton | $231,085 | $215,300 | 7.3% |

| PulteGroup | $279,000 | $262,000 | 6.5% |

| NVR | $321,700 | $308,900 | 4.1% |

| The Ryland Group | $264,000 | $249,000 | 6.0% |

| Beazer Homes | $228,600 | $228,100 | 0.2% |

| Standard Pacific | $369,000 | $346,000 | 6.6% |

| Meritage Homes | $280,000 | $259,000 | 8.1% |

| MDC Holdings | $308,600 | $289,800 | 6.5% |

| M/I Homes | $266,000 | $238,000 | 11.8% |

| Total | $271,027 | $254,436 | 6.5% |