by Calculated Risk on 11/14/2012 11:11:00 AM

Wednesday, November 14, 2012

Report: Housing Inventory declines 17% year-over-year in October

From Realtor.com: October 2012 Real Estate Data

The total US for-sale inventory of single family homes, condos, townhomes and co-ops remained at historic lows, with 1.76 million units for sale in October 2012, down -17.00% compared to a year ago.For sale inventories declined on a year-over-year basis in 141 of the 146 markets tracked by Realtor.com. Forty four cities saw year-over-year declines greater than 20%.

The median age of inventory was down -11.81% compared to one year ago.

On a month-over-month basis, inventory declined in 127 of 146 markets.

Going forward, I expect to see smaller year-over-year declines simply because inventory is already very low.

The NAR is scheduled to report October existing home sales and inventory next week on Monday, November 19th. The key number in the NAR report will be inventory, and inventory will be down sharply again year-over-year in October.

Retail Sales declined 0.3% in October

by Calculated Risk on 11/14/2012 08:30:00 AM

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $411.6 billion, a decrease of 0.3 percent from the previous month, but 3.8 percent above October 2011. ... The August to September 2012 percent change was revised from 1.1 percent to 1.3 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for September were revised up to a 1.3% increase (from 1.1% increase).

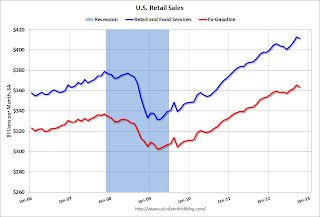

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.2% from the bottom, and now 8.6% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.

The second graph shows the same data, but just since 2006 (to show the recent changes). Most of the decline in October was due to fewer auto sales - a direct impact of Hurricane Sandy. Retail sales ex-autos were unchanged in October.Excluding gasoline, retail sales are up 20.2% from the bottom, and now 8.0% above the pre-recession peak (not inflation adjusted).

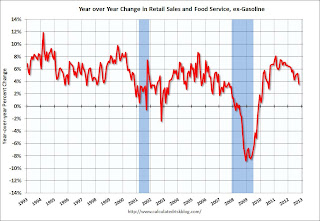

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 3.5% on a YoY basis (3.8% for all retail sales).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

MBA: Mortgage Applications rebound after Hurricane Sandy, Mortgage Rates fall to Record Low

by Calculated Risk on 11/14/2012 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 13 percent from the previous week, ending a five-week decline. The seasonally adjusted Purchase Index increased 11 percent from one week earlier.Some of this decline in activity was related to Hurricane Sandy.

“Following the decrease in applications two weeks ago due to the effects of superstorm Sandy, mortgage applications in many East Coast states rebounded strongly this week,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Application volume in New Jersey more than doubled over the week, while volume in Connecticut and New York increased more than 60 percent. In addition to the rebound in the states impacted by the storm, the 30 year fixed mortgage rate reached a new record low in the survey.”

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.52 percent from 3.61 percent, with points decreasing to 0.41 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This record low rate for 30 year fixed mortgages beats the previous survey low of 3.53 percent for the week ending September 28, 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index. The purchase index has been mostly moving sideways over the last two years.

The increase this week was mostly just a rebound from the sharp decline the previous week due to Hurricane Sandy.

Tuesday, November 13, 2012

Wednesday: Retail Sales, Producer Price Index, FOMC Minutes

by Calculated Risk on 11/13/2012 09:05:00 PM

From Jon Hilsenrath and Kristina Peterson at the WSJ: Fed Leans Toward Clearer Guidance

Under a new approach being considered by senior officials, the Fed would state how high inflation would have to rise or how low unemployment would have to fall before it would begin moving rates ...There might be a mention of possible targets in the FOMC minutes to be released on Wednesday.

"Several of my [Fed] colleagues have advocated such an approach, and I am also strongly supportive," Janet Yellen, the Fed's vice chairwoman, said ...

...

Chicago Fed President Charles Evans wants the Fed to offer assurances it will keep short-term rates low at least until the unemployment rate falls to 7%, as long as inflation remains below 3%. Minneapolis Fed President Narayana Kocherlakota has proposed thresholds of 5.5% for the unemployment rate and 2.25% for inflation.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. Look for activity to rebound following Hurricane Sandy.

• At 8:30 AM, Retail sales for October will be released. Retail sales (especially auto sales) were impacted by Hurricane Sandy. The consensus is for retail sales to decrease 0.2% in October, and for retail sales ex-autos to increase 0.1%.

• Also at 8:30 AM, the Producer Price Index for October will be released. The consensus is for a 0.1% increase in producer prices (0.1% increase in core).

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales report for September (Business inventories). The consensus is for 0.6% increase in inventories.

• At 2:00 PM, the FOMC Minutes for Meeting of October 23-24, 2012 will be released. Look for a possible discussion of setting targets for exiting QE3.

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Fiscal Slope: Alternative Minimum Tax (AMT)

by Calculated Risk on 11/13/2012 05:52:00 PM

Earlier I posted on the Fiscal Slope: 2 Million to Lose Emergency Unemployment Benefits

Here is another part of the fiscal slope from the WSJ: IRS Warns: AMT Poised to Bite 33 Million Taxpayers

If Congress doesn’t act to extend relief from the alternative minimum tax by the end of 2012 – an important element of the fiscal cliff – the IRS said Tuesday that it would have to enforce the AMT against about 33 million households ...AMT relief is renewed every year. Maybe someday they'll just index it for inflation.

"If there is no AMT patch enacted by the end of the year, the IRS would be forced to operate the 2013 tax filing season based on the expiration of the AMT patch,” the acting IRS commissioner, Steven Miller, wrote in a letter to GOP Sen. Orrin Hatch of Utah on Tuesday. “There would be serious repercussions for taxpayers.”

The AMT was created in the 1960s to make sure that very wealthy people who accumulate a lot of deductions still paid some tax. Over the years, it has begun to hit many middle-class households, at least on paper, in part because it’s not indexed for inflation.