by Calculated Risk on 11/15/2012 08:30:00 AM

Thursday, November 15, 2012

Weekly Initial Unemployment Claims increased sharply to 439,000

The DOL reports:

In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000. The 4-week moving average was 383,750, an increase of 11,750 from the previous week's revised average of 372,000.The previous week was revised up from 355,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year ...

Zillow: 1.3 million fewer U.S. homeowners were in negative equity in Q3

by Calculated Risk on 11/15/2012 12:01:00 AM

From Zillow: Negative Equity Recedes in Third Quarter; Fewer than 30% of Homeowners with Mortgages Now Underwater

Negative equity fell in the third quarter, with 28.2 percent of all homeowners with mortgages underwater, down from 30.9 percent in the second quarter, according to the third quarter Zillow® Negative Equity Report. ...According to Zillow, 1.7 homeowners have moved out of negative equity over the least two quarters.

Slightly more than 14 million U.S. homeowners with a mortgage were in negative equity, or underwater, in the quarter, owing more on their mortgages than their homes are worth. That was down from 15.3 million in the second quarter.

Much of the decline in negative equity can be attributed to U.S. home values rising 1.3 percent in the third quarter compared to the second quarter ...

“The fall in negative equity rates means homeowners have additional options for refinancing or selling their homes,” said Zillow Chief Economist Dr. Stan Humphries. “But while we’re moving in the right direction, a substantial number of homes are still locked up in negative equity, unable to enter the existing re-sale market despite the desires of their owner. The housing market has found real momentum of its own, but is not immune from shocks to the broader economy. If negotiations centered on resolving the fiscal cliff don’t inspire confidence in investors and consumers alike, recent home value gains – and, as a result, falling negative equity rates – could stall.”

Click on graph for larger image.

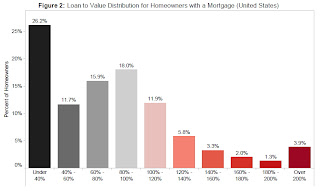

Click on graph for larger image.Zillow provided this chart of Zillow's estimate of the Loan-to-Value (LTV) for homeowners with a mortgage.

The homeowners with a little negative equity are probably at low risk of foreclosure, but at the far right - like the 3.9% who owe more than double what their homes are worth - are clearly at risk.

Here is an interactive map of Zillow's negative equity data.

Wednesday, November 14, 2012

Thursday: Unemployment Claims, CPI, MBA Mortgage Delinquency Survey, Bernanke and much more

by Calculated Risk on 11/14/2012 08:01:00 PM

November 15th is Doris "Tanta" Dungey's birthday. Happy Birthday T!

For new readers, Tanta was my co-blogger back in 2007 and 2008. She was a brilliant, writer - very funny - and a mortgage expert. Sadly, she passed away in 2008, and I like to celebrate her life on her birthday.

I strongly recommend Tanta's "The Compleat UberNerd" posts for an understanding of the mortgage industry. And here are many of her other posts.

On her passing, from the NY Times: Doris Dungey, Prescient Finance Blogger, Dies at 47, from the WaPo: Doris J. Dungey; Blogger Chronicled Mortgage Crisis, from me: Sad News: Tanta Passes Away

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 376 thousand from 355 thousand. Note: Claims are expected to increase following Hurricane Sandy.

• Also at 8:30 AM, the Consumer Price Index for October will be released. The consensus is for CPI to increase 0.1% in October and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for November. The consensus is for a reading of minus 5, up from minus 6.2 in October (below zero is contraction). I'm expecting a decline due to Hurricane Sandy.

• At 10:00 AM, MBA's 3rd Quarter 2012 National Delinquency Survey. As usual, I will be on the conference call and take notes.

• Also at 10:00 AM, the Philly Fed Survey for November. The consensus is for a reading of minus 4.5, down from 5.7 last month (above zero indicates expansion).

• At 1:20 PM, Fed Chairman Ben Bernanke will speak, Housing and Mortgage Markets, At the HOPE Global Financial Dignity Summit, Atlanta, Georgia.

WSJ: FHA Close to Exhausting Reserves

by Calculated Risk on 11/14/2012 04:07:00 PM

As we discussed last week, the FHA Fiscal Year 2012 Actuarial Review is due this week. Nick Timiraos at the WSJ has a preview: Housing Agency Close to Exhausting Reserves

The Federal Housing Administration is expected to report later this week that it could exhaust its reserves because of rising mortgage delinquencies ... That could result in the agency needing to draw on taxpayer funding for the first time in its 78-year history.As Timiraos notes, the FHA's market share was small during the peak of the bubble (luckily) and most of the really horrible loans were made by Wall Street related mortgage lenders. However, Timiraos doesn't mention that many of the loans that the FHA insured at the peak were so-called Downpayment Assistance Programs (DAPs). These DAPs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). The FHA attempted to stop this practice - the IRS called it a "scam" - but thanks to Congress, the DAPs led to billions of losses for the FHA.

... The New Deal-era agency, which doesn't actually make loans but instead insures lenders against losses, has played a critical role stabilizing the housing market by backing mortgages of borrowers who make down payments of as little as 3.5%—loans that most private lenders won't originate without a government guarantee. ... Overall, the FHA insured nearly 739,000 loans that were 90 days or more past due or in foreclosure at the end of September, an increase of more than 100,000 loans from one year ago. That represents around 9.6% of its $1.08 trillion in mortgages guarantees.

The FHA's annual audit estimates how much money the agency would need to pay off all claims on projected losses, against how much it has in reserves. Last year, that buffer stood at $1.2 billion ...

The decision over whether the FHA will need money from Treasury won't be made until next February, when the White House typically releases its annual budget. Because the FHA has what is known as "permanent and indefinite" budget authority, it wouldn't need to ask Congress for funds; it would automatically receive money from the U.S. Treasury.

Most of the agency's losses now stem from loans made as the housing bust deepened. Around 25% of mortgages guaranteed in 2007 and 2008 are seriously delinquent, compared with around 5% of those insured in 2010.

Of course, as Timiraos mentioned, the FHA also saw a sharp increase in demand in the 2007 through 2009 period as private lenders disappeared and Fannie and Freddie tightened standards - and those loans have performed poorly. Now the bill is coming due ...

FOMC Minutes: "Participants generally favored" Thresholds

by Calculated Risk on 11/14/2012 02:00:00 PM

It seems very likely that the Fed will adopt a threshold rule for the Feds Fund Rate based on inflation and unemployment, and remove the forward guidance sentence from the statement at the December 11th and 12th meeting. Note: The forward guidance includes the sentence: "currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015".

From the Fed: Minutes of the Federal Open Market Committee, October 23–24, 2012. Excerpt:

A staff presentation focused on the potential effects of using specific threshold values of inflation and the unemployment rate to provide forward guidance regarding the timing of the initial increase in the federal funds rate. The presentation reviewed simulations from a staff macroeconomic model to illustrate the implications for policy and the economy of announcing various threshold values that would need to be attained before the Federal Open Market Committee (FOMC) would consider increasing its target for the federal funds rate. Meeting participants discussed whether such thresholds might usefully replace or perhaps augment the date-based guidance that had been provided in the policy statements since August 2011. Participants generally favored the use of economic variables, in place of or in conjunction with a calendar date, in the Committee's forward guidance, but they offered different views on whether quantitative or qualitative thresholds would be most effective. Many participants were of the view that adopting quantitative thresholds could, under the right conditions, help the Committee more clearly communicate its thinking about how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook. Accordingly, thresholds could increase the probability that market reactions to economic developments would move longer-term interest rates in a manner consistent with the Committee's view regarding the likely future path of short-term rates. A number of other participants judged that communicating a careful qualitative description of the indicators influencing the Committee's thinking about current and future monetary policy, or providing more information about the Committee's policy reaction function, would be more informative than either quantitative thresholds or date-based forward guidance. Several participants were concerned that quantitative thresholds could confuse the public by giving the impression that the FOMC focuses on a small number of economic variables in setting monetary policy, when the Committee in fact uses a wide range of information. Some other participants worried that the public might mistakenly interpret quantitative thresholds as equivalent to the Committee's longer-run objectives or as triggers that, when reached, would prompt an immediate rate increase; but it was noted that the Chairman's postmeeting press conference and other venues could be used to explain the distinction between thresholds and these other concepts.There are still many details to work out, but it appears likely the Fed will adopt thresholds based on the unemployment rate and inflation. It sounds like the thresholds will be for the Fed Funds rate, and not QE3.

Participants generally agreed that the Committee would need to resolve a number of practical issues before deciding whether to adopt quantitative thresholds to communicate its thinking about the timing of the initial increase in the federal funds rate. These issues included whether to specify such thresholds in terms of realized or projected values of inflation and the unemployment rate and, in either case, what values for those thresholds would best balance the Committee's objectives of promoting maximum employment and price stability. Another open question was whether to supplement thresholds expressed in terms of the unemployment rate and inflation with additional indicators of economic and financial conditions that might signal a need either to raise the federal funds rate before a threshold is crossed or to delay until well afterward. A final question was whether the statement should also provide forward guidance about the likely path of the federal funds rate after the initial increase. It was noted that such guidance could have significant effects on financial conditions and the economy. At the conclusion of the discussion, the Chairman asked the staff to provide additional background material, taking into account the range of participants' views.

emphasis added