by Calculated Risk on 11/17/2012 04:34:00 PM

Saturday, November 17, 2012

Unofficial Problem Bank list declines to 857 Institutions

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 16, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the OCC released its latest actions this Friday, which contributed to many changes to the Unofficial Problem Bank List. This week, there were seven removals and four additions that leave the list at 857 institutions with assets of $329.2 billion. A year ago, the list held 903 institutions with assets of $419.6 billion.Earlier:

The OCC or the Federal Reserve terminated actions against The Citizens National Bank, Putnam, CT ($354 million Ticker: CTZR); Bankers' Bank of the West, Denver, CO ($348 million); North Cascades National Bank, Chelan, WA ($333 million); Incommons Bank, N.A., Mexia, TX ($98 million); Prairie National Bank, Stewardson, IL ($54 million); and Butte State Bank, Butte, NE ($42 million). Amazingly, the FDIC closed another bank in Georgia -- Hometown Community Bank, Braselton, GA ($134 million), which is the 84th failure in the state since 2008.

Additions this week include Roma Bank, Robbinsville, NJ ($1.7 billion); First National Bank, Ronceverte, WV ($262 million); Interamerican Bank, A FSB, Miami, FL ($240 million); and St Tammany Homestead Savings and Loan Association, Covington, LA ($96 million).

We wish all readers a Happy Thanksgiving as the next update will be published after the holiday. As such, it is likely to be a quiet weekend as the FDIC will take the long weekend off from closings and they will likely not publish their latest actions until Friday the 30th.

• Summary for Week Ending Nov 16th

• Schedule for Week of Nov 18th

Schedule for Week of Nov 18th

by Calculated Risk on 11/17/2012 01:11:00 PM

Earlier:

• Summary for Week Ending Nov 16th

This is a short week (Happy Thanksgiving!), but there are several key releases early in the week.

On Monday, the NAR will release existing home sales for October, and the NAHB will release their homebuilder confidence survey. On Tuesday, Housing Starts for October will be released. Housing has been the bright spot for the U.S. economy recently.

Also on Tuesday, Fed Chairman Ben Bernanke will speak on "The Economic Recovery and Economic Policy".

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis. Sales in September 2012 were 4.75 million SAAR.

Economist Tom Lawler estimates the NAR will report sales at 4.84 million SAAR. Goldman Sachs is forecasting a decline in sales to 4.67 million, and Merrill Lynch is forecasting 4.60 million.

A key will be inventory and months-of-supply.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 41, unchanged from October. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. Total housing starts were at 872 thousand (SAAR) in September, up 15.0% from the revised August rate of 758 thousand (SAAR). Single-family starts increased 11.0% to 603 thousand in September.

The consensus is for total housing starts to decline to 840,000 (SAAR) in October, down from 872,000 in September.

Goldman Sachs is forecasting a decline in starts to 840,000, and Merrill Lynch is forecasting 815,000.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for October 2012

12:15 PM: Speech by Fed Chairman Ben Bernanke, The Economic Recovery and Economic Policy, At the Economic Club of New York, New York, New York

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 400 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

9:00 AM: The Markit US PMI Manufacturing Index Flash. This is a new release and might provide hints about the ISM PMI for November. This index was at 51.5 in October.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for November). The consensus is for no change from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

10:00 AM: Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

All US markets will be closed in observance of the Thanksgiving Day Holiday.

Europe: Two day EU Leaders Summit Meeting

SIFMA recommends US markets close at 2:00 PM ET following the Thanksgiving Day Holiday. The NYSE will close at 1:00 PM ET.

Summary for Week Ending Nov 16th

by Calculated Risk on 11/17/2012 05:01:00 AM

Hurricane Sandy impacted the economic data released last week, especially retail sales, industrial production and initial weekly unemployment claims. The Fed reported that Sandy "reduced the rate of change in total output by nearly 1 percentage point". Also the Philly Fed and Empire State manufacturing surveys were weak due to Sandy. Since we are usually looking for the trend in the data, we have to be careful to look through short term event driven increases or decreases in the data. Overall I'd expect the data to return to trend fairly quickly.

Most of the discussion last week was related to the "fiscal slope", or more accurately, how much austerity the US should enact in 2013. This will be an ongoing discussion, and I expect some reasonable compromise to be reached - although I expect taxes will increase on just about everyone in 2013 with a combination of the payroll tax cut expiring and tax rates for higher income earners increasing.

Fed Chairman Ben Bernanke spoke this week and expressed concern that mortgage lending standards might be "overly tight". Also the FOMC minutes suggested the Fed is considering setting unemployment rate and inflation thresholds for raising the Fed Funds rate. I'll have more on thresholds before the FOMC meeting in December.

There was some good news on mortgage delinquencies. The MBA reported that delinquencies declined again in Q3, although they believe there is several years of "in foreclosure" inventory that still needs to be resolved.

Here is a summary of last week in graphs:

• Retail Sales declined 0.3% in October

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales declined 0.3% from September to October (seasonally adjusted), and sales were up 3.8% from October 2011. Sales for September were revised up to a 1.3% increase (from 1.1% increase).

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

This was below the consensus forecast for retail sales of a 0.2% declined in October. However the increase in September was revised up, and most of this decline was related to Hurricane Sandy (there should be some bounce back soon).

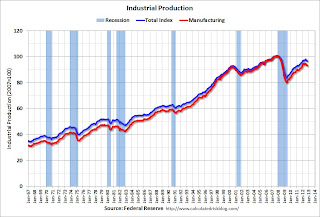

• Industrial Production decreased 0.4% in October due to Hurricane Sandy, Capacity Utilization decreased

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

The Fed reported: "Hurricane Sandy, which held down production in the Northeast region at the end of October, is estimated to have reduced the rate of change in total output by nearly 1 percentage point."

This graph shows Capacity Utilization. This series is up 10.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.8% is still 2.5 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

This graph shows industrial production since 1967.

This graph shows industrial production since 1967.

Industrial production decreased in October to 96.6. This is 15% above the recession low, but still 4.1% below the pre-recession peak.

IP was slightly below expectations due to the impact of Hurricane Sandy. We will probably see some bounce back over the next couple of months.

• Weekly Initial Unemployment Claims increased sharply to 439,000

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."

The DOL reported: "In the week ending November 10, the advance figure for seasonally adjusted initial claims was 439,000, an increase of 78,000 from the previous week's revised figure of 361,000."The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 383,750.

This sharp increase is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were higher than the consensus forecast.

• Key Measures show low inflation in October

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 2.2%, and the CPI less food and energy rose 2.0%. Core PCE is for September and increased 1.7% year-over-year.On a monthly basis, two of these measure were above the Fed's target; median CPI was at 2.3% annualized, core CPI increased 2.2% annualized. However trimmed-mean CPI was at 1.7% annualized, and core PCE for September increased 1.4% annualized. These measures suggest inflation is close to the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis.

• MBA: Mortgage Delinquencies decreased in Q3

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.

The MBA reported that 11.47 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q3 2012 (delinquencies seasonally adjusted). This is down from 11.85 percent in Q2 2012.From the MBA: Mortgage Delinquency and Foreclosure Rates Decreased During Third Quarter

This graph shows the percent of loans delinquent by days past due.

Loans 30 days delinquent increased to 3.25% from 3.18% in Q2. This is just above 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket decreased to 1.19% in Q3, from 1.22% in Q2.

The 90 day bucket decreased to 2.96% from 3.19%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.07% from 4.27% and is now at the lowest level since Q1 2009.

Friday, November 16, 2012

Lawler: Early Read on October Existing Home Sales

by Calculated Risk on 11/16/2012 07:48:00 PM

From economist Tom Lawler:

Based on what I've seen, I expect the NAR's existing home sales number will come in at a seasonally adjusted annual rate of 4.84 million.

The unadjusted YOY change will be a boatload higher in October than in September, but October this year had two more business days than last October, so...

Closed sales were only slightly impacted by Sandy; a bigger impact in some hit markets is more likely to show up in November.

Best guess on inventories is a monthly decline of 3.4%.

CR Notes: The consensus is for the NAR to report sales of 4.74 million on seasonally adjusted annual rate (SAAR) basis on Monday. Based on Lawler's estimates, the NAR will report inventory around 2.3 million units for October, and months-of-supply will be around 5.7 months. This will be the lowest level of inventory for October since 2001 or 2002, and the lowest months-of-supply since early 2006.

Bank Failure #50 in 2012: Hometown Community Bank, Braselton, Georgia

by Calculated Risk on 11/16/2012 05:12:00 PM

Hometown Bank on the buffet

Bad asset stuffing.

by Soylent Green is People

From the FDIC: CertusBank, National Association, Easley, South Carolina, Assumes All of the Deposits of Hometown Community Bank, Braselton, Georgia

As of September 30, 2012, Hometown Community Bank had approximately $124.6 million in total assets and $108.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $36.7 million. ... Hometown Community Bank is the 50th FDIC-insured institution to fail in the nation this year, and the tenth in Georgia.There are still banks in Georgia? Ten out of fifty failures this year have been in Georgia.