by Calculated Risk on 11/25/2012 01:08:00 PM

Sunday, November 25, 2012

Greece Update: Eurozone finance ministers meet Monday

The eurozone finance ministers are meeting on Monday, and trying to reach an agreement to disburse more funds to Greece.

From the Financial Times: Greece upbeat about signing debt deal

Eurozone finance ministers will make another attempt on Monday ... to settle differences over debt relief measures for Athens and give a green light to disburse up to €44bn of aid.And from Bloomberg: Euro Ministers Take Third Swing at Clearing Greek Payment

The stumbling blocks to a deal, in addition to Berlin’s reluctance to accept drastic interest rate cuts, include opposition by some eurozone members to returning profits from the European Central Bank’s purchases of Greek bonds, and a gloomy assessment of Greece’s growth prospects until 2020 by the IMF.

excerpt with permission

Finance chiefs from the 17-member single currency return to Brussels tomorrow ...I expect an agreement will be reached soon that will buy more time.

Euro-area finance ministers held a conference call yesterday to prepare for the Brussels meeting. A breakthrough hinges on coming up with 10 billion euros ($13 billion) through reductions in interest rates charged by creditors and a debt buyback financed by bailout funding. The gap emerged when the finance chiefs agreed this month to give Greece two more years to meet targets.

Update: Case-Shiller House Prices will probably decline month-to-month Seasonally starting in October

by Calculated Risk on 11/25/2012 10:32:00 AM

This is just a reminder: The Not Seasonally Adjusted (NSA) monthly Case-Shiller house price indexes will show month-to-month declines soon, probably starting with the October report to be released in late December. The CoreLogic index has already started to decline on a month-to-month basis. This is not a sign of impending doom - or another collapse in house prices - it is just the normal seasonal pattern.

Even in normal times house prices tend to be stronger in the spring and early summer, than in the fall and winter. Currently there is a stronger than normal seasonal pattern because conventional sales are following the normal pattern (more sales in the spring and summer), but distressed sales (foreclosures and short sales) happen all year. So distressed sales have a larger negative impact on prices in the fall and winter.

In the coming months, the key will be to watch the year-over-year change in house prices and to compare to the NSA lows in early 2012. As an example, the September CoreLogic report showed a 0.3% month-to-month decline in September from August, but prices were up 5.0% year-over-year. That was the largest year-over-year increase since 2006.

I think house prices have already bottomed, and that prices will be up close to 5% year-over-year when prices reach the usual seasonal bottom in early 2013.

Click on graph for larger image.

Click on graph for larger image.

Note: The Case-Shiller September report will be released this coming Tuesday. For this graph, I used Zillow's forecast for September.

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller Composite 20 index over the last several years. The CoreLogic index turned negative in the September report (CoreLogic is 3 month weighted average, with the most recent month weighted the most). Case-Shiller NSA will probably turn negative month-to-month in the October report (also a three month average, but not weighted).

Saturday, November 24, 2012

Jim the Realtor: Upcoming REO listings

by Calculated Risk on 11/24/2012 07:48:00 PM

I haven't checked in with Jim the Realtor in San Diego for some time. In this video below, Jim reviews a few upcoming REO listings in North County San Diego. Jim says: "there are only 16 houses owned by banks that aren't on the market" in the North County area (152 homes closed in the area last month, so the bank owned REO will not have much of an impact).

The first house is interesting. It looks like the bank will actually make money when they sell it.

The third house is good for a laugh (starts about 4:20). The bank has made some absurd repairs, like putting in a low end vanity in the master bath to replace a built-in that went all the way across the bathroom. (around 9:20 - Jim can't help but laugh).

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Unofficial Problem Bank list unchanged at 857 Institutions

by Calculated Risk on 11/24/2012 05:27:00 PM

CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining recently.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 23, 2012. (repeat from last week, table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As expected, a very quiet week for the Unofficial Problem Bank List as it went without change. You have to go back to January 6th of this year for the last time it went a week unchanged. The list stands at 857 institutions with assets of $329.2 billion. A year ago, the list held 980 institutions with assets of $400.5 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

Next week, the FDIC will likely release its actions through October 2012 and the Official Problem Bank List as of September 30, 2012. The difference between the two lists will likely drop from 187 at last issuance to the low 170s.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Earlier:

• Summary for Week Ending Nov 23rd

• Schedule for Week of Nov 25th

Schedule for Week of Nov 25th

by Calculated Risk on 11/24/2012 01:01:00 PM

Earlier:

• Summary for Week Ending Nov 23rd

Negotiations concerning the "fiscal slope" in the US will be back in the headlines this week. And, in Europe, the discussion on funding for Greece will resume on Monday.

There are two key housing reports this week: Case-Shiller house prices on Tuesday, and New Home Sales on Wednesday.

Revised Q3 GDP will be released on Thursday, and the October Personal Income and Outlays report will be released on Friday.

For manufacturing, three regional manufacturing reports will be released (Richmond, Dallas and Kansas City Fed surveys), plus the Chicago PMI will be released Friday.

The NY Fed will release their Q3 Report on Household Debt and Credit on Tuesday, and the FDIC is expected to release the Q3 Quarterly Banking Profile this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for November. The consensus is for 4.7 for the general business activity index, up from 1.8 in September.

Expected: LPS "First Look" Mortgage Delinquency Survey for October.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September.

9:00 AM: S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through August 2012 (the Composite 20 was started in January 2000).

The consensus is for a 2.9% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 3.0% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. The consensus is for a decrease to -8 for this survey from -7 in October (below zero is contraction).

10:00 AM: FHFA House Price Index for September 2012. This is based on GSE repeat sales and is no longer as closely followed as Case-Shiller (or CoreLogic). The consensus is for a 0.5% increase in house prices.

10:00 AM: Conference Board's consumer confidence index for November. The consensus is for an increase to 72.8 from 72.2 last month.

3:00 PM: New York Fed to Release Q3 Report on Household Debt and Credit

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

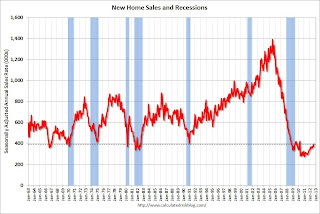

10:00 AM ET: New Home Sales for October from the Census Bureau.

10:00 AM ET: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for a decrease in sales to 387 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 389 thousand in September.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. This might show some slight improvement. Some analysts will be looking for concerns about Europe or the "fiscal cliff".

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

8:30 AM: Q3 GDP (second release). This is the second release from the BEA. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

10:00 AM ET: Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for November. The consensus is for an a reading of -1, up from -4 in October (below zero is contraction).

8:30 AM ET: Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.