by Calculated Risk on 11/28/2012 08:55:00 PM

Wednesday, November 28, 2012

Thursday: Q3 GDP, Unemployment claims, Pending Home Sales

First, Jon Hilsenrath at the WSJ discusses some of the issues that will be discussed at the next FOMC meeting in December: Fed Likely to Keep Buying Bonds

Central bank officials face critical decisions at their next policy meeting Dec. 11-12. ... Since September the Fed has been buying $40 billion a month of mortgage-backed securities and looks set to continue that program. ...My guess is the Fed will expand "QE3" to around $85 billion per month when Operation Twist concludes. On communication, I'm not sure they are ready to change to thresholds for unemployment and inflation, so that will probably wait until March (but it could happen in December).

The more urgent issue is what to do with a $45 billion-a-month program known as Operation Twist, in which the central bank is buying long-term Treasury securities and funding the purchases with sales of short-term Treasurys.

...

Another issue for officials to consider at the December meeting is whether to alter their communications strategy. For several months, they have been debating whether to state explicitly what unemployment rates or inflation rates would get them to raise short-term interest rates from their very low levels. ... If the Fed is going to adopt such a move, it would make sense to do it either at the December meeting or in March, when Mr. Bernanke will hold news conferences and be able to explain the central bank's thinking on the complicated subject.

emphasis added

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 390 thousand from 410 thousand.

• Also at 8:30 AM, the second estimate for Q3 GDP will be released. The consensus is that real GDP increased 2.8% annualized in Q3, revised up from 2.0% in the advance release.

• At 10:00 AM, the NAR will release Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

• At 11:00 AM, the Kansas City Fed regional Manufacturing Survey for November. This is the last of the regional surveys for November, and the consensus is for a reading of -1, up from -4 in October (below zero is contraction).

Earlier on New Home Sales:

• New Home Sales at 368,000 SAAR in October

• New Home Sales and Distressing Gap

• New Home Sales graphs

Another question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

FHFA: HARP Refinance Boom Continued in September

by Calculated Risk on 11/28/2012 04:38:00 PM

Note: HARP is the program that allows borrowers with loans owned or guaranteed by Fannie Mae or Freddie Mac - and with high loan-to-value (LTV) ratios - to refinance at low rates. Fannie or Freddie are already responsible for the loan, and allowing the borrower to refinance lowers the default risk.

From the FHFA:

The Federal Housing Finance Agency (FHFA) today released its September Refinance Report, which shows that Fannie Mae and Freddie Mac loans refinanced through the Home Affordable Refinance Program (HARP) accounted for nearly one-quarter of all refinances in the third quarter of 2012. More than 90,000 homeowners refinanced their mortgage in September through HARP with more than 709,000 loans refinanced since the beginning of this year. The continued high volume of HARP refinances is attributed to record-low mortgage rates and program enhancements announced last year.Note: the automated system wasn't released until the end of March - and there were some issues with that system - so HARP refinances didn't really pickup until sometime in Q2. Now they are on pace for around 1 million refinances this year.

...

In September, half of the loans refinanced through HARP had loan-to-value (LTV) ratios greater than 105 percent and one-fourth had LTVs greater than 125 percent.

In September, 19 percent of HARP refinances for underwater borrowers were for shorter-term 15- and 20-year mortgages, which help build equity faster than traditional 30-year mortgages.

HARP refinances in September represented 45 percent of total refinances in states hard hit by the housing downturn–Nevada, Arizona, Florida and Georgia–compared with 21 percent of total refinances nationwide.

These "underwater" borrowers are current (most took out loans 5 to 7 years ago), and they will probably stay current with the lower interest rate.

This table shows the number of HARP refinances by LTV through September of this year compared to all of 2011. Clearly there has been a sharp increase in activity. Note: Here is the September report.

| HARP Activity | |||

|---|---|---|---|

| 2012, Through September | All of 2011 | Since Inception | |

| Total HARP | 709,006 | 400,024 | 1,730,857 |

| LTV >80% to 105% | 407,330 | 340,033 | 1,338,565 |

| LTV >105% to 125% | 159,980 | 59,991 | 250,596 |

| LTV >125% | 141,696 | 0 | 141,696 |

Fed's Beige Book: "Economic activity expanded at a measured pace"

by Calculated Risk on 11/28/2012 02:00:00 PM

Economic activity expanded at a measured pace in recent weeks, according to reports from contacts in the twelve Federal Reserve Districts. Cleveland, Richmond, Atlanta, Chicago, Kansas City, Dallas, and San Francisco grew at a modest pace, while St. Louis and Minneapolis indicated a somewhat stronger increase in activity. In contrast, Boston reported a slower rate of growth. Weaker conditions in New York were attributed to widespread disruptions at the end of October and into November caused by Hurricane Sandy. Philadelphia reported general weakness that was exacerbated by the hurricane. ...And on real estate:

Among key sectors, consumer spending grew at a moderate pace in most Districts, while manufacturing weakened, on balance. Seven of the twelve Districts reported either slowing or outright contraction in manufacturing, and two others gave mixed reports. ...

Overall, markets for single-family homes continued to improve across most Districts with the exception of Boston and Philadelphia. Residential real estate markets in the New York District were mixed but generally firm prior to the storm. Selling prices were steady or rising. Boston, New York, Richmond, Atlanta, Kansas City, and Dallas noted declining or tight inventories.Hmmm ... from "moderate" growth a few months ago, to "modest" growth in the last report, and now "measured". I'm not sure about the difference, but it does suggest sluggish growth. Real estate continues to be the bright spot.

Construction and commercial real estate activity generally improved across Districts since the last report. Gains, albeit modest in most cases, were reported by Philadelphia, Richmond, Chicago, and Minneapolis. The gains among Cleveland's contacts were tempered by reports in recent weeks of a slowdown in inquiries and a decline in public-sector projects. Kansas City described activity as holding firm and noted that real estate markets remained stronger than a year ago.

New Home Sales and Distressing Gap

by Calculated Risk on 11/28/2012 11:49:00 AM

New home sales in October were below expectations at a 368 thousand seasonally adjusted annual rate (SAAR). And sales for September were revised down from 389 thousand SAAR to 369 thousand.

This has led to some worrying about the housing recovery, as an example from Reuters: New Home Sales Drop 0.3%, Cast Shadow on Recovery

The data leaves the pace of new home sales just below the pace reported in May, suggesting little upward momentum the market for new homes.Yes, new home sales have been moving sideways for the last 6 months. However sales are still up significantly from 2011, and I expect sales to continue to increase over the next few years.

New home sales have averaged 361,000 on an annual rate basis through October. That means sales are on pace to increase 18% from last year. Most sectors would be pretty upbeat about an 18% increase in sales.

But even with the significant increase this year, 2012 will be the 3rd lowest year since the Census Bureau started tracking new home sales in 1963. This year will be above 2010 and 2011, but below the 375,000 sales in 2009. I expect sales to double from here within the next several years as distressed sales continue to decline.

Click on graph for larger image.

Click on graph for larger image.I started posting this graph four years ago when the "distressing gap" first appeared.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through October. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Earlier:

• New Home Sales at 368,000 SAAR in October

• New Home Sales graphs

New Home Sales at 368,000 SAAR in October

by Calculated Risk on 11/28/2012 10:00:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 368 thousand. This was down from a revised 369 thousand SAAR in August (revised down from 389 thousand).

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in October 2012 were at a seasonally adjusted annual rate of 368,000 ... This is 0.3 percent below the revised September rate of 369,000, but is 17.2 percent above the October 2011 estimate of 314,000.

Click on graph for larger image in graph gallery.

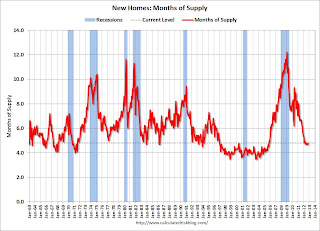

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply increased in October to 4.8 months. September was revised up to 4.7 months (from 4.5 months).

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of October was 147,000. This represents a supply of 4.8 months at the current sales rate.On inventory, according to the Census Bureau:

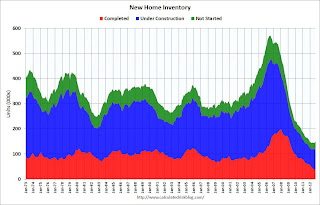

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was just above the record low in October. The combined total of completed and under construction is also just above the record low since "under construction" is starting to increase.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2012 (red column), 29 thousand new homes were sold (NSA). Last year only 25 thousand homes were sold in October. This was the third weakest October since this data has been tracked (above 2011 and 2010). The high for October was 105 thousand in 2005.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.

New home sales have averaged 361 thousand SAAR over the first 10 months of 2012, up sharply from the 307 thousand sales in 2011. Also sales are finally at the lows for previous recessions too.This was below expectations of 387,000. I'll have more soon ...