by Calculated Risk on 11/30/2012 05:01:00 PM

Friday, November 30, 2012

Fannie Mae, Freddie Mac Mortgage Serious Delinquency rates declined in October

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in October to 3.35% from 3.41% September. The serious delinquency rate is down from 4.00% in October last year, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 3.31%, from 3.37% in September. Freddie's rate is down from 3.54% in October 2011, and this is the lowest level since August 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

In 2009, Fannie's serious delinquency rate increased faster than Freddie's rate. Since then, Fannie's rate has been falling faster - and now the rates are at about the same level.

Although this indicates ongoing progress, the "normal" serious delinquency rate is under 1% - and it looks like it will take several years until the rates back to normal.

Restaurant Performance Index indicates contraction in October

by Calculated Risk on 11/30/2012 12:08:00 PM

From the National Restaurant Association: Restaurant Performance Index Fell to its Lowest Level in 14 Months as Operator Optimism Plunged

The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.5 in October, down 0.9 percent from September. In addition, October represented the first time in 14 months that the RPI fell below 100, which signifies contraction in the index of key industry indicators.

“Although restaurant operators overall continued to report positive same-store sales in October, their short-term outlook for sales growth and the economy is decidedly more pessimistic,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “Nearly two out of five restaurant operators expect business conditions to worsen in the next six months, which is double the proportion that expect conditions to improve.”

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 99.3 in October – down 0.6 percent from a level of 99.9 in September. While same-store sales remained positive in October, declines in the labor and customer traffic indicators outweighed the performance, which resulted in a Current Situation Index reading below 100 for the third time in the last four months.

Click on graph for larger image.

Click on graph for larger image.The index declined to 99.5 in October, down from 100.4 in September (below 100 indicates contraction).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.

The impact of Sandy on PCE, Chicago PMI at 50.4

by Calculated Risk on 11/30/2012 10:00:00 AM

I've receive several questions about the impact of Hurricane Sandy on PCE. Sandy hit New York city on October 29th.

We have an example of a hurricane hitting at the end of a month. Katrina hit on August 29, 2005, so we can look back at the real PCE numbers then.

July, 2005: $8,886.8 (Billions of chained (2005) dollars; seasonally adjusted at annual rates)

Aug, 2005: $8,854.9 (Katrina hit on Aug 29th, decline of $32 billion)

Sept, 2005: $8,817.0 (decline of $37 billion)

Then PCE increased in October and November to $8,833.8 and $8,878.4, respectively.

This time for real PCE:

Sept, 2012: $9,641.9

Oct, 2012: $9,612.4 (Sandy hit on Oct 29th, decline of $29 billion)

So Sandy will probably impact November PCE, and any impact on PCE from the storm will be mostly over in December.

From Joe Joe Weisenthal at Business Insider: CHICAGO PMI RISES TO 50.4 — But Huge Drop In New Orders

ChicagoPMI rose back ... 50.4 was a hair shy of estimates.Above 50 is expansion and this follows two months of contraction. Last month the Chicago PMI was at 49.9.

The new orders index fell to 45.3 from 50.6.

On the other hand, employment rose to 55.2 from 50.3.

Personal Income unchanged in October, Spending decreased 0.2%

by Calculated Risk on 11/30/2012 08:47:00 AM

The BEA released the Personal Income and Outlays report for October:

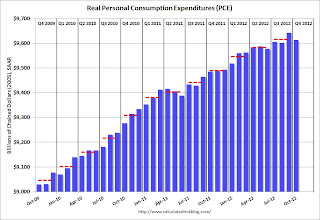

Personal income increased $0.4 billion, or less than 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $20.2 billion, or 0.2 percent.The following graph shows real Personal Consumption Expenditures (PCE) through October (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

The October estimates of personal income and outlays reflect the effects of Hurricane Sandy, which made landfall in the United States on October 29. The storm affected 24 states, with particularly severe damage in New York and New Jersey. BEA cannot quantify the total impact of the storm on personal income and outlays because most of the source data used to estimate these components reflect the effects of the storm and cannot be separately identified. However, BEA did make adjustments where source data were not yet available or did not reflect the effects of Sandy. The largest of these adjustments was for work interruptions, which reduced wages and salaries by about $18 billion (at an annual rate).

Real PCE -- PCE adjusted to remove price changes -- decreased 0.3 percent in October, in contrast to an increase of 0.4 percent in September. ... The price index for PCE increased 0.1 percent in October, compared with an increase of 0.3 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

...

Personal saving -- DPI less personal outlays -- was $410.1 billion in October, compared with $391.3 billion in September. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.4 percent in October, compared with 3.3 percent in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. According to the BEA, Hurricane Sandy impacted PCE in October, but the BEA could not quantify the total impact - however PCE in October was weak.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.6%.

Thursday, November 29, 2012

Friday: October Personal Income and Outlays, Chicago PMI

by Calculated Risk on 11/29/2012 09:04:00 PM

A couple of articles on the fiscal slope negotiations:

Suzy Khimm at the WaPo has the initial White House proposal: The White House’s fiscal cliff proposal

Jonathan Weisman at the NY Times writes: G.O.P. Balks at White House Plan on Fiscal Crisis

Treasury Secretary Timothy F. Geithner presented the House speaker, John A. Boehner, a detailed proposal on Thursday to avert the year-end fiscal crisis with $1.6 trillion in tax increases over 10 years, $50 billion in immediate stimulus spending, home mortgage refinancing and a permanent end to Congressional control over statutory borrowing limits.For the economy this proposal would resolve the "fiscal cliff" uncertainty, significant reduce the fiscal drag, and also reduce the deficit. Of course there are other agendas too - this proposal is a starting point - but hopefully eliminating the debt ceiling nonsense is part of the final agreement.

My guess is an agreement will be reached, perhaps in early January after the tax cuts expire, so politicians can claim to be cutting taxes.

Friday:

• At 8:30 AM, the Personal Income and Outlays report for October will be released. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

The last question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).