by Calculated Risk on 12/07/2012 08:24:00 PM

Friday, December 07, 2012

November Employment Diffusion Indexes

Earlier on employment:

• November Employment Report: 146,000 Jobs, 7.7% Unemployment Rate

• Employment Report: More Positives than Negatives

• All Employment Graphs

This is a technical indicator that I like to follow. The employment diffusion indexes are a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.

Click on graph for larger image.

Click on graph for larger image.The BLS diffusion index for total private employment was at 59.0 in November, down from 63.0 in October. For manufacturing, the diffusion index declined to 47.5, down from 56.8 in October.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s. But even 59 isn't bad and this suggests job growth was spread across a number of industries in November.

AAR: Rail Traffic "mixed" in November

by Calculated Risk on 12/07/2012 03:51:00 PM

Once again rail traffic was "mixed". Most of the decline in rail carloads was due to fewer coal and grain shipments, and intermodal was up - but the strike at the ports of Los Angeles and Long Beach limited the increase.

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for November

Intermodal traffic in November saw an increase for the 36th straight month, totaling 934,595 containers and trailers, up 1.2 percent (11,519 units) compared with November of 2011. Carloads originated in November totaled 1,130,770 carloads, down 4 percent (47,512 carloads) compared with the same month last year. Carloads excluding coal and grain were up 5.5 percent for the month, or 30,466 carloads, compared with the same month last year.

...

“Coal and grain together account for almost half of non-intermodal U.S. rail traffic, so they are obviously very important to railroads. But coal and grain carloads often rise or fall for reasons that have little or nothing to do with the economy. Other commodity categories like autos, lumber, and crushed stone, sand and gravel that are more highly correlated with economic growth have been growing, which we hope is a good sign for the economy moving forward,” said AAR Senior Vice President John T. Gray.

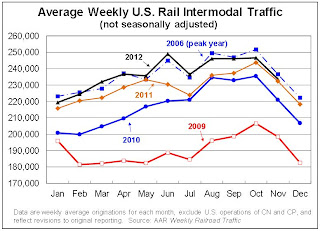

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,130,770 carloads in November 2012, down 4.0% (47,512 carloads) from November 2011 on a non-seasonally adjusted basis. November marked the 10th straight year-over-year monthly carload decline for U.S. railroads ...The second graph is for intermodal traffic (using intermodal or shipping containers):

Coal and grain were, again in November, the main reasons for the decline in total U.S. carloads. Coal carloads were down 12.8% (68,837 carloads) for the month; grain carloads were down 10.7% (9,141 carloads) for the month.

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is near peak levels.

U.S. rail intermodal traffic totaled 934,595 containers and trailers in November 2012, up 1.2% (11,519 intermodal units) over November 2011 and an average of 233,649 per week ... As of November 2012, year-over-year U.S. rail intermodal traffic had risen for 36 straight months, but the 1.2% gain in November was the smallest such increase since August 2011. Part of the reason for that is a strike by harbor clerks at the Ports of Los Angeles and Long Beach that began on November 26 and was settled on December 5. The two ports are by far the first and second highest-volume container ports in the country and are the source and destination for large amounts of U.S. rail intermodal traffic.This suggests economic growth.

Earlier on employment:

• November Employment Report: 146,000 Jobs, 7.7% Unemployment Rate

• Employment Report: More Positives than Negatives

• All Employment Graphs

Employment Report: More Positives than Negatives

by Calculated Risk on 12/07/2012 11:28:00 AM

There were positives and negatives in the November employment report, and I'd like to start with two clear positives.

First, seasonal retail hiring was very strong in November (see 3rd graph below). There is a fairly strong correlation between seasonal hiring and holiday retail sales, and this record seasonal hiring suggests a solid holiday season.

Second, a key theme we've been discussing is that we are nearing the end of state and local government layoffs (see last graph). This has been ongoing for over 3 years, and it appears the drag from state and local governments is mostly over. Of course employment at the Federal level is still shrinking, and everyone expects more austerity in 2013.

Other positives include better than expected employment growth, the decline in the unemployment rate to 7.7% (the lowest level since December 2008), a decline in part time workers, and a decline in the long term unemployed (although this is still very high).

Negatives include the decline in the participation rate, the downward revision to payroll jobs in previous months, and no change in hours worked.

However, overall, I think there were more positives than negatives in this report. Here are a several more graphs...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio declined in November to 75.7% from 76.0% in October. Not good news.

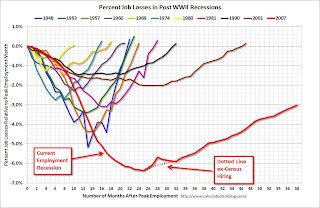

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a record pace in November.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 465.5 thousand workers (NSA) net in November. The combined level for October and November is the highest ever. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are fairly optimistic about the holiday season. There is a decent correlation between retail hiring and retail sales, see: Retail: Seasonal Hiring vs. Retail Sales

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 8.2 million in November, was little changed over the month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in November to 8.18 millon from 8.34 million in October.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 14.4% in November (from 14.6% in October).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.79 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.00 million in October, and is at the lowest level since June 2009. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing. Overall government employment has seen an unprecedented decline over the last 3+ years (not seen since the Depression).

Preliminary December Consumer Sentiment declines sharply to 74.5

by Calculated Risk on 12/07/2012 09:55:00 AM

Note: I'll have more on the employment report soon.

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for December declined to 74.5 from the November reading of 82.7.

This was way below the consensus forecast of 83.0. There are a number of factors that can impact sentiment including unemployment, gasoline prices and other concerns.

Back in August 2011, sentiment declined sharply due to the threat of default and the debt ceiling debate. Unfortunately we might be seeing a repeat of that debacle.

November Employment Report: 146,000 Jobs, 7.7% Unemployment Rate

by Calculated Risk on 12/07/2012 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 146,000 in November, and the unemployment rate edged down to 7.7 percent, the U.S. Bureau of Labor Statistics reported today.

...

Hurricane Sandy made landfall on the Northeast coast on October 29th, causing severe damage in some states. Nevertheless, our survey response rates in the affected states were within normal ranges. Our analysis suggests that Hurricane Sandy did not substantively impact the national employment and unemployment estimates for November.

...

The change in total nonfarm payroll employment for September was revised from +148,000 to +132,000, and the change for October was revised from +171,000 to +138,000.

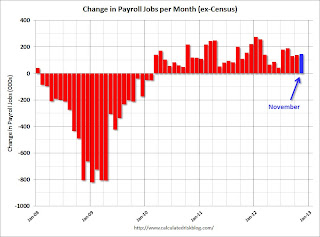

Click on graph for larger image.

Click on graph for larger image.There was uncertainty about this report because of Hurricane Sandy.

The headline number was above expectations of 80,000, but both September and October payroll growth was revised down.

The second graph shows the unemployment rate. The unemployment rate declined to 7.7%.

The unemployment rate is from the household report.

The unemployment rate is from the household report.The unemployment rate declined because of lower participation (a decline in the civilian labor force).

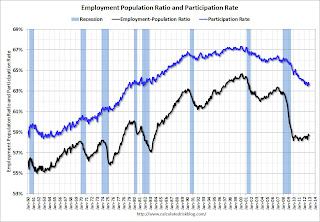

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.6% in November (blue line. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 63.6% in November (blue line. This is the percentage of the working age population in the labor force.The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although most of the recent decline is due to demographics.

The Employment-Population ratio decreased to 58.7% in November (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

With all the uncertainty about the impact of Hurricane Sandy, this was a decent report, especially with the decline in the unemployment rate. However, negatives include the downward revisions to prior months, and the decline in the participation rate. I'll have much more later ...