by Calculated Risk on 12/10/2012 10:15:00 AM

Monday, December 10, 2012

Q3 2012: Mortgage Equity Withdrawal strongly negative

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW", but there is little MEW right now - and normal principal payments and debt cancellation.

For Q3 2012, the Net Equity Extraction was minus $112 billion, or a negative 3.8% of Disposable Personal Income (DPI). This is not seasonally adjusted.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

There are smaller seasonal swings right now, perhaps because there is a little actual MEW (this is heavily impacted by debt cancellation right now).

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding declined sharply in Q3. Mortgage debt has declined by $1.15 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a new method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.

The Italian Job

by Calculated Risk on 12/10/2012 09:10:00 AM

From the Financial Times: Monti decision to go rattles markets

Italy’s government borrowing costs jumped and its stock market fell sharply on Monday after Mario Monti’s weekend decision to resign as prime minister threatened to send a new shudder of uncertainty into the eurozone’s most vulnerable economies.According to Bloomberg, the yield on the Italian 2-year increased sharply to 2.32%, and the 10 year yield increased to 4.8%. A large jump, but still lower than a few months ago.

excerpt with permission

From the NY Times: Next Act in Italian Drama: Exit Monti the Technocrat, Enter Monti the Politician?

Mr. Monti’s surprise announcement on Saturday raised the prospect of more political uncertainty and market turmoil for Italy, Europe’s fourth-largest economy, in what is expected to be a gloves-off political campaign. But it also increased the possibility that Mr. Monti might run as a candidate — a shift from the role of an apolitical leader — who is open to governing if no clear winner emerges from elections expected as soon as February.

Three years into Europe’s debt crisis, the new developments in Italy underscored the clash between the economically sound and the politically sustainable. While Mr. Monti, an economist and a former European commissioner, has reassured investors and helped keep Italian borrowing rates down, the tax increases and spending cuts passed by his Parliament have eroded lawmakers’ standing with voters.

Sunday, December 09, 2012

Sunday Night Futures

by Calculated Risk on 12/09/2012 08:30:00 PM

Weekend:

• Labor Force Participation Rate Update

• FOMC Projections Preview

• Summary for Week Ending Dec 7th

• Schedule for Week of Dec 9th

The Asian markets are mostly green tonight, with the Nikkei up 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up slightly and DOW futures are up 15.

Oil prices are mostly moving sideways with WTI futures at $86.26 per barrel and Brent at $107.41 per barrel. Gasoline prices are now near the low for the year.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Three more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Labor Force Participation Rate Update

by Calculated Risk on 12/09/2012 04:08:00 PM

I've written extensively about the participation rate, see: Understanding the Decline in the Participation Rate and Further Discussion on Labor Force Participation Rate.

A key point: The recent decline in the participation rate was expected, and most of the decline in the participation rate was due to changing demographics, as opposed to economic weakness.

Here is an update to a few graphs I've posted before. Tracking the participation rate for various age groups monthly is a little like watching grass grow, but the trends are important.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

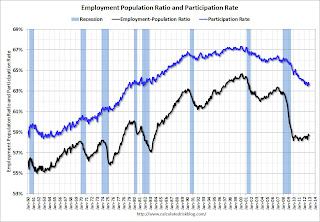

Here is a repeat of the graph I posted Friday showing the participation rate and employment-to-population ratio.

The Labor Force Participation Rate decreased to 63.6% in November (blue line. This is the percentage of the working age population in the labor force.

Here is a look at some of the long term trends (updating graphs through November 2012):

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s and has mostly flattened out. The participation rate for women was unchanged in November at 74.7%.

The participation rate for men decreased from the high 90s decades ago, to 88.2% in November 2012.

This is the lowest level recorded for prime working age men.

This graph shows that participation rates for several key age groups.

This graph shows that participation rates for several key age groups.

There are a few key long term trends:

• The participation rate for the '16 to 19' age group has been falling for some time (red). This was unchanged in November at 34.7%, up from the record low of 33.5% in February 2011.

• The participation rate for the 'over 55' age group has been rising since the mid '90s (purple), although this has stalled out a little recently.

• The participation rate for the '20 to 24' age group fell recently too (more education before joining the labor force). This appears to have stabilized.

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The third graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is generally trending up for all older age groups, and the 55 and over participation rate is at a record high.

The increase in participation of older cohorts might push up the '55 and over' participation rate over the next few years, however eventually the 'over 55' participation rate will start to decline as the oldest baby boomers move into even older age groups.

I've been expecting some small bounce back in the participation rate, but I don't think the bounce back will be huge - and that means it is taking fewer jobs than some expected to lower the unemployment rate. This will be a key number to watch over the next few years.

Earlier on employment:

• November Employment Report: 146,000 Jobs, 7.7% Unemployment Rate

• Employment Report: More Positives than Negatives

• All Employment Graphs

FOMC Projections Preview

by Calculated Risk on 12/09/2012 10:15:00 AM

There are two key topics for the FOMC meeting this week: 1) What action to take when Operation Twist concludes at the end of year, and 2) whether or not to adopt a threshold rule for the Feds Fund Rate based on inflation and unemployment, and remove the forward guidance sentence from the statement.

My expectation is the FOMC will announce additional security purchases starting in January after the conclusion of Operation Twist. This will probably be announced this week and will be funded with reserve creation that will expand the Fed balance sheet. Note: Operation Twist didn't increase the Fed's balance sheet, but changed the composition of their securities holdings by selling short-term Treasury securities and buying longer-term Treasury securities.

The key questions are: the size of the additional purchases (some FOMC members have argued for $45 billion per month), the composition and maturity of the assets (Treasuries and MBS), and how long the purchases will continue (along with QE3). Goldman Sachs estimates:

"Looking further ahead, based on our economic forecasts the Fed may purchase up to $2 trillion in Treasury securities and MBS under QE3, before the first fed funds rate hike in early 2016."On thresholds: Currently the Fed has been including projections of when participants think the first rate increase will happen, and the FOMC statement includes the sentence: "[the FOMC] currently anticipates that exceptionally low levels for the federal funds rate are likely to be warranted at least through mid-2015". The could be replaced with general rules based on the unemployment rate and inflation.

Here are a couple of excerpts from the FOMC minutes for the October meeting:

Participants generally favored the use of economic variables, in place of or in conjunction with a calendar date, in the Committee's forward guidance, but they offered different views on whether quantitative or qualitative thresholds would be most effective. Many participants were of the view that adopting quantitative thresholds could, under the right conditions, help the Committee more clearly communicate its thinking about how the likely timing of an eventual increase in the federal funds rate would shift in response to unanticipated changes in economic conditions and the outlook.So the FOMC is leaning towards changing to thresholds, but it appears there is more work to do. This communication change could happen at the meeting this week, but my feeling is the FOMC will wait until early 2013.

...

Participants generally agreed that the Committee would need to resolve a number of practical issues before deciding whether to adopt quantitative thresholds to communicate its thinking about the timing of the initial increase in the federal funds rate. These issues included whether to specify such thresholds in terms of realized or projected values of inflation and the unemployment rate and, in either case, what values for those thresholds would best balance the Committee's objectives of promoting maximum employment and price stability. Another open question was whether to supplement thresholds expressed in terms of the unemployment rate and inflation with additional indicators of economic and financial conditions that might signal a need either to raise the federal funds rate before a threshold is crossed or to delay until well afterward.

emphasis added

In advance of the meeting, here is a look back at the previous projections from the September meeting.

Click on graph for larger image.

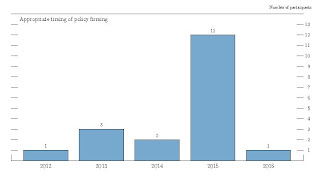

Click on graph for larger image.The first two charts are when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

If the FOMC moves to thresholds, this graph might be removed. However I expect the FOMC to wait until next year for thresholds, and the key will be to see if the views have shifted for when the first rate hike will occur.

"The dots represent individual policymakers’ projections of the appropriate federal funds rate target at the end of each of the next several years and in the longer run. Each dot in that chart represents one policymaker’s projection."

"The dots represent individual policymakers’ projections of the appropriate federal funds rate target at the end of each of the next several years and in the longer run. Each dot in that chart represents one policymaker’s projection."Most participants still think the Fed Funds rate will be in the current range through 2014.

On the projections, it looks like GDP and inflation will be close to the September FOMC projections. However the unemployment rate will be lower than projected. The key will be to look for changes in the 2013 and 2014 forecasts.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 2.0 | 2.5 to 3.0 | 3.0 to 3.8 |

Fiscal policy uncertainty makes it even more difficult to forecast GDP for 2013, but I expect the FOMC will revise down their 2013 forecasts.

The unemployment rate was at 7.9% in October and 7.7% in November (average of 7.8%). This is below the September projections, and suggests the unemployment rate projections for 2013 and 2014 will be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 8.0 to 8.2 | 7.6 to 7.9 | 6.7 to 7.3 |

Both measures of inflation will be close to the September projections, and I expect the forecasts for inflation will show the FOMC is still not concerned about inflation going forward.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.8 | 1.6 to 2.0 | 1.6 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| Sept 2012 Projections | 1.7 to 1.9 | 1.7 to 2.0 | 1.8 to 2.0 |

Conclusion: I expect the FOMC to announce additional asset purchases at the meeting this week (to start at the conclusion of Operation Twist). It seems the FOMC will move to thresholds, but probably not until next year. On projections, I expect GDP to be revised down for 2013, and the unemployment rate to be revised lower for 2013 and 2014.