by Calculated Risk on 12/14/2012 12:23:00 PM

Friday, December 14, 2012

Key Measures show low inflation in November

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.3% annualized rate) in November. The 16% trimmed-mean Consumer Price Index increased 0.1% (1.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for November here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.3% (-3.7% annualized rate) in November. The CPI less food and energy increased 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.

On a monthly basis, median CPI was above the Fed's target at 2.3% annualized. However trimmed-mean CPI was at 1.6% annualized, and core CPI increased 1.4% annualized. Also core PCE for October increased 1.6% annualized. These measures suggest inflation is mostly below the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis. Also, the FOMC statement this week indicated the Fed will tolerate an inflation outlook "between one and two years ahead" of 2 1/2 percent.

So, with this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

by Calculated Risk on 12/14/2012 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October. In November, manufacturing output increased 1.1 percent after having decreased 1.0 percent in October; in addition to the storm-related rebound, a sizable rise in the production of motor vehicles and parts boosted factory output in November. The output of utilities advanced 1.0 percent, and production at mines rose 0.8 percent. At 97.5 percent of its 2007 average, total industrial production in November was 2.5 percent above its year-earlier level. Capacity utilization for total industry increased 0.7 percentage point to 78.4 percent, a rate 1.9 percentage points below its long-run (1972--2011) average.

emphasis added

Click on graph for larger image.

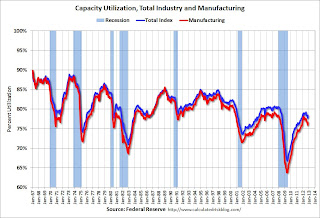

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

BLS: CPI declines 0.3% in November, Core CPI increases 0.1%

by Calculated Risk on 12/14/2012 08:40:00 AM

From the BLS: Consumer Price Index - November 2012

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.3 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment. The gasoline index fell 7.4 percent in November; this decrease more than offset increases in other indexes, resulting in the decline in the seasonally adjusted all items index.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was below the consensus forecast of a 0.2% decrease for CPI, and below the consensus for a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in November after a 0.2 percent increase in October. ... The index for all items less food and energy rose 1.9 percent over the last 12 months, slightly lower than the October figure of 2.0 percent. The food index has risen 1.8 percent over the last 12 months, and the energy index has risen 0.3 percent.

The decrease in CPI was mostly due to the recent decline in gasoline prices. On a year-over-year basis, CPI is up 1.8 percent, and core CPI is up 1.9 percent. Both below the Fed's target.

Thursday, December 13, 2012

Friday: CPI, Industrial Production

by Calculated Risk on 12/13/2012 08:27:00 PM

A couple of articles for light evening reading:

From Derek Thompson at the Atlantic: The Best Idea for the Debt Ceiling? Abolish It Forever. It really should be called the "default ceiling". I've been arguing for years - since Reagan demanded a clean bill from Congress in the '80s - that the default ceiling is just for political grandstanding.

From Suzy Khimm at the Wonkblog: New language, same findings: Tax hikes on the rich won’t cripple the economy. Here is the updated Congressional Research Service report. The data speaks.

Note: I still expect some sort of compromise to be reached on the "fiscal cliff", probably in early January.

Thursday economic releases:

• At 8:30 AM ET, the Consumer Price Index for November will be released. The consensus is for CPI to decrease 0.2% in November and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production in November, and for Capacity Utilization to increase to 78.0%.

Another question for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

CoStar: Commercial Real Estate prices decrease slightly in October, Up 6% Year-over-year

by Calculated Risk on 12/13/2012 05:30:00 PM

From CoStar: Commercial Property Prices Show Little Movement in October Amid Economic Uncertainty

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the equal-weighted U.S. Composite Index and the value-weighted U.S. Composite Index—saw very little change in the month of October 2012, dipping -0.1% and -0.8%, respectively, although both improved over quarter and year-ago levels. Recent pricing fluctuations likely signify a more cautious attitude among investors stemming from uncertainty over U.S. fiscal policy heading into 2013.

...

The number of distressed property trades in October fell to 14.8%, the lowest level witnessed since the first quarter of 2009. This reduction in distressed deal volume should result in higher, more consistent pricing, and lead to enhanced market liquidity, giving lenders more confidence to finance deals.

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 35.0% from the bottom (showing the demand for higher end properties) and up 6.1% year-over-year. However the Equal-Weighted index is only up 10.0% from the bottom, and up 5.9% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.