by Calculated Risk on 12/15/2012 08:24:00 AM

Saturday, December 15, 2012

Summary for Week ending Dec 14th

The key US economic story of the week was the FOMC announcement of thresholds for raising the Fed Funds rate based on the unemployment rate and inflation. Also the FOMC expanded QE3 by an additional $45 billion per month starting in January (some people are calling it QE4, but that isn't consistent - the FOMC expanded an earlier QE). This was a significant change in Fed communication, and the change allows the FOMC to drop the date language from the FOMC statement. If the economy improves quicker than the forecast, then investors will adjust their estimate of timing (or the opposite). The Fed also made it very clear they will tolerate a little more inflation in the near term.

The economic data showed some bounce back following Hurricane Sandy. The retail report increased 0.3% (less than forecast though), and industrial production increase 1.1% (more than forecast). And initial weekly unemployment claims continued to decline following the Sandy spike.

This bounce back shows the declines in October were storm related.

The austerity debate (aka "Fiscal cliff) still showing no signs of progress. But I don't expect agreement until early January (although it could happen sooner). Next week will be very busy with several key housing reports.

Here is a summary of last week in graphs:

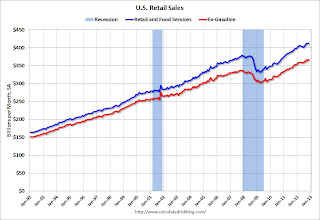

• Retail Sales increased 0.3% in November

Click on graph for larger image.

Click on graph for larger image.

On a monthly basis, retail sales increased 0.3% from October to November (seasonally adjusted), and sales were up 3.7% from November 2011. The change in sales for October was unrevised at a 0.3% decline.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 24.5% from the bottom, and now 8.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.0% on a YoY basis (3.7% for all retail sales).

This was at the consensus forecast of no change ex-autos, but below the consensus forecast for total retail sales of a 0.6% increase in November. Retail sales are still sluggish, but generally trending up.

• Trade Deficit increased in October to $42.2 Billion

The Dept of Commerce reported: "[T]otal October exports of $180.5 billion and imports of $222.8 billion resulted in a goods and services deficit of $42.2 billion, up from $40.3 billion in September, revised. October exports were $6.8 billion less than September exports of $187.3 billion. October imports were $4.9 billion less than September imports of $227.6 billion."

The Dept of Commerce reported: "[T]otal October exports of $180.5 billion and imports of $222.8 billion resulted in a goods and services deficit of $42.2 billion, up from $40.3 billion in September, revised. October exports were $6.8 billion less than September exports of $187.3 billion. October imports were $4.9 billion less than September imports of $227.6 billion."

Both exports and imports decreased in October. US trade has slowed recently.

Exports are 9% above the pre-recession peak and up 1.0% compared to October 2011; imports are 4% below the pre-recession peak, and down 0.8% compared to October 2011.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

Oil averaged $99.75 in October, up from $98.88 per barrel in September. The trade deficit with China increased to $29.5 billion in October, up from $28.1 billion in October 2011. Most of the trade deficit is still due to oil and China.

The trade deficit with the euro area was $8.9 billion in October, up from $7.1 billion in October 2011. It appears the eurozone recession is impacting trade.

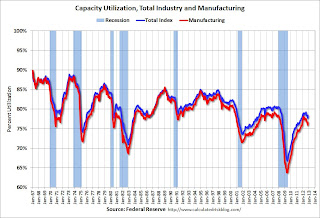

• Industrial Production increased 1.1% in November, Bounces back following Hurricane Sandy

From the Fed: "Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October."

From the Fed: "Industrial production increased 1.1 percent in November after having fallen 0.7 percent in October. The gain in November is estimated to have largely resulted from a recovery in production for industries that had been negatively affected by Hurricane Sandy, which hit the Northeast region in late October."

This graph shows Capacity Utilization. This series is up 11.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.4% is still 1.9 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.

Industrial production increased in November to 97.5. This is 17% above the recession low, but still 3.2% below the pre-recession peak.

IP was above expectations due to the bounce back following Hurricane Sandy. Overall IP has only up 2.5% year-over-year.

• Key Measures show low inflation in November

The Cleveland Fed released the median CPI and the trimmed-mean CPI.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.

This graph shows the year-over-year change for four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, the CPI rose 1.8%, and the CPI less food and energy rose 1.9%. Core PCE is for October and increased 1.7% year-over-year.On a monthly basis, median CPI was above the Fed's target at 2.3% annualized. However trimmed-mean CPI was at 1.6% annualized, and core CPI increased 1.4% annualized. Also core PCE for October increased 1.6% annualized. These measures suggest inflation is mostly below the Fed's target of 2% on a year-over-year basis.

The Fed's focus will probably be on core PCE and core CPI, and both are at or below the Fed's target on year-over-year basis. Also, the FOMC statement this week indicated the Fed will tolerate an inflation outlook "between one and two years ahead" of 2 1/2 percent. So, with this low level of inflation and the current high level of unemployment, the Fed will keep the "pedal to the metal".

• BLS: Job Openings "little changed" in October

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS. Notice that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 3.675 million, up from 3.547 million in September. The number of job openings (yellow) has generally been trending up, and openings are up about 8% year-over-year compared to October 2011.

Quits increased in October, and quits are up 4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits"). The trend suggests a gradually improving labor market.

• Weekly Initial Unemployment Claims decline to 343,000

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 381,500.The recent sharp increase in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is almost back to the pre-storm level.

Weekly claims were lower than the 370,000 consensus forecast.

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline next week to around 370,000 or so.

Friday, December 14, 2012

Some Bullish 2013 House Price Forecasts

by Calculated Risk on 12/14/2012 09:07:00 PM

From the WSJ: Home Prices Could Jump 9.7% in 2013, J.P. Morgan Says

J.P. Morgan Chase & Co. expects U.S. home prices to rise 3.4% in its base-case estimate and up to 9.7% in its most bullish scenario of economic growth. Standard & Poor’s, which rates private-issue mortgage bonds, on Friday said it expects a 5% rise in 2013.I think house prices will increase further in 2013 based on supply and demand (there is little supply, however I think it is possible that inventory will bottom in 2013), but I doubt we will see a 9.7% price increase next year on the repeat sales indexes.

The J.P. Morgan analysts boosted their base-case estimate from 1.5% ...

The WSJ's Nick Timiraos makes an amusing comment on Twitter: "All these analysts forecasting monster home price gains were forecasting moderate declines a few months ago."

At the beginning of the year, the consensus was that house prices would decline for at least another year. When I posted The Housing Bottom is Here in early February, many people were surprised. How views change!

Bank Failure #51: Community Bank of the Ozarks, Sunrise Beach, Missouri

by Calculated Risk on 12/14/2012 07:16:00 PM

From the FDIC: Bank of Sullivan, Sullivan, Missouri, Assumes All of the Deposits of Community Bank of the Ozarks, Sunrise Beach, Missouri

As of September 30, 2012, Community Bank of the Ozarks had approximately $42.8 million in total assets and $41.9 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10.4 million. ... Community Bank of the Ozarks is the 51st FDIC-insured institution to fail in the nation this year, and the fourth in Missouri.Another one bites the dust.

Lawler: Very Early Read on Existing Home Sales in November

by Calculated Risk on 12/14/2012 04:38:00 PM

From economist Tom Lawler:

While I normally wait for more data than I have before giving an “early read” on existing home sales, I’ve seen enough data to report that I expect a “healthy” gain in existing home sales in November, as estimated by the National Association of Realtors. Despite a significant decline in foreclosure sales from a year ago, overall existing home sales last month appear to have increased significantly from a year ago – implying, over of course, a sizable YOY increase in non-foreclosure sales. Based on the admittedly limited number of reports I’ve seen, I estimate that existing home sales as measured by the NAR ran at a seasonally adjusted annual rate of 5.05 million, up 5.4% from October’s pace.

On the median home sales front, the vast bulk of local realtor/MLS report showed noticeable YOY gain in median home sales prices in November, with several showing sizable gains – in large part because of significantly lower foreclosure/distressed sales shares, but also because, well, “typical” home prices were higher. Net, I expect the NAR’s median SF home sales price will show a YOY increase of around 11%.

Finally, my “best guess” for the NAR’x measure of the inventory of existing homes for sale is that November’s number will be down about 4.5% from October, and down about 22.1% from a year ago. The NAR’s inventory measure, however, often doesn’t track regional listings numbers. Moreover, of late there have been unusually large (and unexplained, even when asked) revisions (e.g., September’s preliminary inventory number was revised downward by an astonishingly large 6.5% in the October report.)

CR Note: The NAR will report November existing home sales on Thursday, Dec 20th. The consensus is the NAR will report sales of 4.85 million.

Based on Lawler's estimates, the NAR will report inventory around 2.05 million units for November, and months-of-supply might be under 5 months. This would be the lowest level of inventory in over 10 years, and the lowest months-of-supply since 2005.

Economic Outlook: Where are we?

by Calculated Risk on 12/14/2012 03:07:00 PM

Once again we are nearing a political event horizon that could significantly impact the economy - and we can't see beyond the horizon. My baseline assumption is an agreement will be reached, probably during the first few weeks of January, and the agreement will mean Federal fiscal drag next year at about the level of the CBO's alternative fiscal scenario. This would suggest modest GDP and employment growth next year, although probably better than in 2012.

Note: There is no clear drop dead date for the "fiscal cliff". Nothing horrible happens on January 1st, but the longer it takes to reach an agreement next year, the larger the negative impact on the economy.

With that assumption, there are two key drivers for additional growth next year. The first is residential investment (construction employment lags investment with a lag, so construction employment should pick up in 2013), and the second is the end of the state and local drag. I've discussed both of these before - see: Two Reasons to expect Economic Growth to Increase - but I think this is worth repeating.

Over the last 3+ years, state and local governments have lost over 700 thousand payroll jobs (including the preliminary estimate of the benchmark revision) and it appears these layoffs are coming to an end. I don't expect state and local government to add much to economic and employment growth next year, but just stopping the drag will help.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

However the drag from state and local governments is ongoing, although the drag in Q3 was small. State and local governments have been a drag on GDP for twelve consecutive quarters. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

Yesterday, the Rockefeller Institute put out an update on state government revenues: State Tax Revenues Showed Continued Yet Slow Growth in the Third Quarter of 2012

The Rockefeller Institute's compilation of preliminary data from 47 states shows that collections from major tax sources increased by 2.1 in nominal terms in the third quarter of 2012 compared to the same quarter of 2011. Tax collections have now risen for 11 straight quarters, beginning with the first quarter of 2010. This growth followed five quarters of declines brought on by the Great Recession.Revenues are not increasing sharply, but they are increasing enough to probably stop most of the layoffs.

...

Among 47 early reporting states, 38 states reported gains while nine states reported declines in total tax revenue collections during the third quarter of 2012.

....

Overall, state tax revenues are showing continued improvement, though the pace of growth has been much slower in the recent quarters compared to historic averages. While state tax revenues have now grown for 11 consecutive quarters, they are still far below where they would have been in the absence of the Great Recession. Nationwide, state tax revenues in fiscal 2012 were less than 1 percent higher than fiscal 2008 in nominal terms. After adjusting for inflation, state tax revenues declined 5 percent in fiscal 2012 compared to fiscal 2008.

And from the NY Times: As State Budgets Rebound, Federal Cuts Could Pose Danger

A fiscal survey of states released Friday by the National Governors Association and the National Association of State Budget Officers found that states expect to collect $692.8 billion in general fund revenues this fiscal year, which is more than they collected in 2008, the last fiscal year before the recession.So there are some reasons for a little optimism, but it is difficult to make projections without knowing the budget agreement.

That is good news, but perhaps not as good as it initially appears. Adjusted for inflation, this year’s revenues are still expected to be 7.9 percent below the 2008 levels.

...

“What we’re really seeing here is there is not enough money to make up for any federal cuts,” said Scott D. Pattison, the executive director of the state budget officers’ association. “What I’ve heard from the state budget people is that they’ve told departments and agencies in state government: Do not expect us to have the money available, even if we wanted to, to make up for federal cuts.”