by Calculated Risk on 12/17/2012 04:26:00 PM

Monday, December 17, 2012

Lawler: Foreclosure Share Way Down, But Not All-Cash Share; Suggests Investor Purchases of Non-REO Properties Up Sharply

From economist Tom Lawler:

While most areas have experienced a significant decline in the foreclosure share (as well as the overall “distressed-sales” share of home sales this year, it’s sorta interesting to note that the all-cash share of homes purchases has not fallen, at least in areas where data on financing are available. E.g., here is a table showing the “all-cash” share of home purchases this November compared to last November in selected markets. All data are based on realtor association/MLS reports, save for the Southern California, which are Dataquick’s tabulations based on property/mortgage records. Also shown are the foreclosure and short-sales shares of home sales. Note that for Sothern California the foreclosure and short-sales shares are share of resales, while the all-cash share is the share of total sales. Note also that I don’t have the foreclosure and short sales shares for the Baltimore and DC metro areas, but only for the whole area covered by MRIS. However, the Baltimore and DC metro areas account for about 77% of total home sales through MRIS, so ...

While in most of these areas the foreclosure sales share of resales in November was down considerably from last November, as was the overall “distressed” sales shares, the all-cash-financed share of home sales was actually higher this November than last November in many areas, and in other areas it was little changed from a year ago.

Most analysts (and realtors) believe that investors make up a substantial share of all-cash purchases. Given that the all-cash share of purchases is flat to higher while the foreclosure share of purchases is down considerably, it appears as if investors have considerably increased their purchases of non-foreclosure properties over the last year.

| All Cash Share | Foreclosure Share | Short-Sales Share | ||||

|---|---|---|---|---|---|---|

| Nov-12 | Nov-11 | Nov-12 | Nov-11 | Nov-12 | Nov-11 | |

| Las Vegas | 52.7% | 48.2% | 10.7% | 46.0% | 41.2% | 26.8% |

| Phoenix | 43.2% | 45.4% | 12.9% | 29.8% | 23.2% | 29.6% |

| Sacramento | 37.1% | 27.4% | 11.5% | 34.3% | 36.1% | 29.8% |

| Orlando | 54.0% | 49.9% | 20.9% | 22.8% | 29.0% | 37.2% |

| Baltimore Metro | 23.8% | 23.8% | ||||

| DC Metro | 18.8% | 20.4% | ||||

| MRIS (Mid Atl) | 8.7% | 14.2% | 11.9% | 13.7% | ||

| Toledo | 40.9% | 38.2% | ||||

| Southern CA | 33.0% | 29.5% | 15.3% | 31.6% | 26.3% | 24.9% |

Early: Housing Forecasts for 2013

by Calculated Risk on 12/17/2012 01:42:00 PM

Towards the end of each year I collect some housing forecasts for the following year. Here was a summary of forecasts for 2012. Right now it looks like new home sales will be around 365 thousand this year, and total starts around 750 thousand or so.

Here is one without details, from Hui Shan, Sven Jari Stehn, Jan Hatzius at Goldman Sachs:

We project housing starts to continue to rise, reaching an annual rate of 1.0 million by the end of 2013 and 1.5 million by the end of 2016.The table below shows several forecasts for 2013.

From Fannie Mae: Housing Forecast: November 2012

From NAHB: Housing and Interest Rate Forecast, 11/29/2012 (excel)

I'll add some more forecasts soon:

| Some Housing Forecasts for 2013 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | CS House Prices | |

| Fannie Mae | 452 | 659 | 936 | 1.6%1 |

| NAHB | 447 | 641 | 910 | |

| Wells Fargo | 460 | 680 | 990 | 2.6% |

| Merrill Lynch | 466 | 976 | 2.6% | |

| 2012 Estimate | 365 | 525 | 750 | 6.0% |

| 1FHFA Purchase-Only Index | ||||

LA area Port Traffic: Down in November due to Strike

by Calculated Risk on 12/17/2012 11:51:00 AM

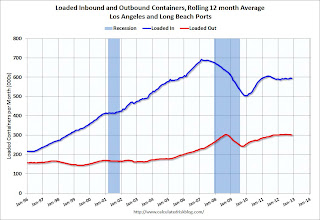

Note: Clerical workers at the ports of Long Beach and Los Angeles went on strike starting Nov 27th and ending Dec 5th. The strike impacted port traffic for November, but traffic is expected to bounce back in December. The strike happened after the holiday shipping period, so the slowdown isn't expected to impact holiday related shopping.

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for November. LA area ports handle about 40% of the nation's container port traffic. Some of the LA traffic was routed to other ports, so this data might not be very useful this month.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are down slightly compared to the 12 months ending in October.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of November, loaded outbound traffic was down 7.5% compared to November 2011, and loaded inbound traffic was down 3% compared to November 2011.

For the month of November, loaded outbound traffic was down 7.5% compared to November 2011, and loaded inbound traffic was down 3% compared to November 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, so some decline in November was expected.

Empire State Manufacturing index indicates further contraction

by Calculated Risk on 12/17/2012 08:40:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2012 Empire State Manufacturing Survey indicates that conditions for New York manufacturers continued to decline at a modest pace. The general business conditions index was negative for a fifth consecutive month, falling three points to -8.1. The new orders index dropped to -3.7, while the shipments index declined six points to 8.8. At 16.1, the prices paid index indicated that input prices continued to rise at a moderate pace, while the prices received index fell five points to 1.1, suggesting that selling prices were flat. Employment indexes pointed to weaker labor market conditions, with the indexes for both number of employees and the average workweek registering values below zero for a second consecutive month. Indexes for the six-month outlook were generally higher than last month, although the level of optimism remained at a level well below that seen earlier this year.The general business condition index declined from -5.22 in November to -8.1 in December - the fifth consecutive negative reading. This was another weak manufacturing index and below expectations of a reading of 0.0.

...

The index for number of employees rose five points to -9.7, while the average workweek index declined three points to -10.8.

emphasis added

Sunday, December 16, 2012

Sunday Night Futures

by Calculated Risk on 12/16/2012 08:47:00 PM

On Monday, at 8:30 AM ET, the NY Fed will release the Empire State Manufacturing Survey for December. The consensus is for a reading of 0, up from minus 5.2 in November (below zero is contraction).

Weekend:

• Summary for Week Ending Dec 14th

• Schedule for Week of Dec 16th

The Asian markets are mixed tonight, with the Nikkei up 1.5% following the election of the new government: Japan’s new government to get aggressive

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 7 and DOW futures are up 60.

Oil prices still moving sideways with WTI futures at $86.88 per barrel and Brent at $108.23 per barrel. Gasoline prices are now near the low for the year.

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Two more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).