by Calculated Risk on 12/20/2012 03:34:00 PM

Thursday, December 20, 2012

Existing Home Sales: The Increase in Conventional Sales

There are two keys to the existing home sales report: 1) inventory, and 2) the number of conventional sales. I've written extensively about the decline in inventory, but here is more data on conventional sales. First, on distressed sales from the NAR (the inverse of conventional):

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 22 percent of November sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in October and 29 percent in November 2011.Unfortunately the NAR uses an unscientific survey to estimate distressed sales. However CoreLogic estimates the percent of distressed sales each month - and they were kind enough to send me their series. The first graph below shows CoreLogic's estimate of the distressed share starting in October 2007.

Note that the percent distressed increases every winter. This is because distressed sales happen all year, and conventional sales follow the normal seasonal pattern of stronger in the spring and summer, and weaker in the winter.

Click on graph for larger image.

Click on graph for larger image.The seasonal impact of distressed sales is why the Case-Shiller seasonal adjustment increased in recent years.

Also note that the percent of distressed sales over the last 6 months is at the lowest level since mid-2008, but still very high. This is the lowest percent of distressed sales for November since 2007.

The second graph shows the NAR existing home series using the CoreLogic share of distressed sales.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.

If we just look at conventional sales (blue), sales declined from over 7 million in 2005 (graph starts in 2007) to a low of under 2.5 million.Using this method (NAR's estimate for sales, CoreLogic estimate of share), conventional sales have recovered significantly. The NAR reported total sales were up 14.5% year-over-year in November, but using this method, conventional sales were up almost 20.9% year-over-year.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales: Another Solid Report

• Existing Home Sales graphs

Misc: Philly Fed Mfg Shows Expansion, Q3 GDP Revised Up, FHFA House Prices increase

by Calculated Risk on 12/20/2012 01:30:00 PM

Here are a few more releases from this morning:

• From the Philly Fed: December Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‑10.7 in November to 8.1 this month. This is the highest reading since April and is slightly above the reading before the post-storm decline in November.

Labor market conditions at the reporting firms improved marginally this month. The current employment index, at 3.6, registered its first positive reading in six months ...

The survey’s future indicators suggest improved optimism among the reporting manufacturers. The future general activity index increased from 20.0 to 30.9, its highest reading in three months. emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys increased in December, but is just back to 0. This is the highest combined level since May, but still suggests another weak reading for the ISM manufacturing index.

• Earlier this morning the BEA reported Q3 GDP increased at a 3.1% annualized rate, higher than the 2.7% estimated earlier. The upward revision was due to increases in the estimate of personal consumption expenditures (PCE), trade, and state and local governments. Although the revision for state and local governments was small, it moved to a positive contribution for the first time since Q3 2009.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).The red bars are for state and local governments. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending.

I don't expect state and local governments will contribute much to GDP growth in 2013, but just stopping the drag will help.

• From the FHFA: FHFA House Price Index Up 0.5 Percent in October

U.S. house prices rose 0.5 percent on a seasonally adjusted basis from September to October, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). The previously reported 0.2 percent increase in September was revised downward to a 0.0 percent change. For the 12 months ending in October, U.S. prices rose 5.6 percent. The U.S. index is 15.7 percent below its April 2007 peak and is roughly the same as the July 2004 index level.

Existing Home Sales: Another Solid Report

by Calculated Risk on 12/20/2012 11:29:00 AM

This was another solid report. Based on historical turnover rates, I think "normal" sales would be close to 5.0 million, so existing home sales at 5.04 million are pretty close to normal.

However a "normal" market would have very few distressed sales, so there is still a long ways to go. One key to returning to "normal" are more conventional sales and fewer distressed sales. Not all areas report the percentage of distressed sales, but the areas that do have shown a sharp decline in distressed sales, and a sharp increase in conventional sales.

The NAR reported total sales were up 14.5% from November 2011, but conventional sales are probably up more than 20% from November 2011 (and distressed sales down).

And what matters the most in the NAR's existing home sales report is inventory. It is active inventory that impacts prices (although the "shadow" inventory will keep prices from rising). For existing home sales, look at inventory first and then at the percent of conventional sales.

The NAR reported inventory decreased to 2.03 million units in November, down from 2.11 million in October. This is down 22.5% from November 2011, and down 30% from the inventory level in November 2005 (mid-2005 was when inventory started increasing sharply). This is the lowest level for the month of November since 2000. Inventory will be even lower in December and January - the normal seasonal pattern - and then start increasing in February.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Click on graph for larger image.

Click on graph for larger image.

This graph shows inventory by month since 2004. In 2005 (dark blue columns), inventory kept rising all year - and that was a clear sign that the housing bubble was ending.

This year (dark red for 2012) inventory is at the lowest level for the month of November since 2000, and inventory is sharply below the level in November 2005 (not counting contingent sales). The months-of-supply has fallen to 4.8 months. Since months-of-supply uses Not Seasonally Adjusted (NSA) inventory, and Seasonally Adjusted (SA) sales, I expect months-of-supply to fall further over the next couple of months before increasing in February.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Sales NSA in November (red column) are above last year. Sales are well below the bubble years of 2005 and 2006.

Earlier:

• Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

• Existing Home Sales graphs

Existing Home Sales in November: 5.04 million SAAR, 4.8 months of supply

by Calculated Risk on 12/20/2012 10:00:00 AM

The NAR reports: November Existing-Home Sales and Prices Maintain Uptrend

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 5.9 percent to a seasonally adjusted annual rate of 5.04 million in November from a downwardly revised 4.76 million in October, and are 14.5 percent higher than the 4.40 million-unit pace in November 2011. Sales are at the highest level since November 2009 when the annual pace spiked at 5.44 million.

...

Total housing inventory at the end of November fell 3.8 percent to 2.03 million existing homes available for sale, which represents a 4.8-month supply 4 at the current sales pace; it was 5.3 months in October, and is the lowest housing supply since September of 2005 when it was 4.6 months.

Listed inventory is 22.5 percent below a year ago when there was a 7.1-month supply. Raw unsold inventory is now at the lowest level since December 2001 when there were 1.89 million homes on the market.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November 2012 (5.04 million SAAR) were 5.9% higher than last month, and were 14.5% above the November 2011 rate.

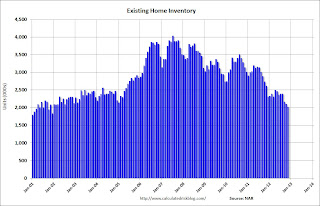

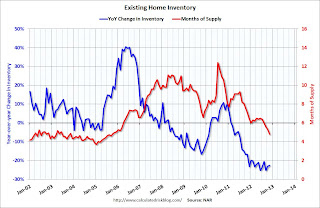

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.

According to the NAR, inventory declined to 2.03 million in November down from 2.11 million in October. This is the lowest level of inventory since December 2001. Inventory is not seasonally adjusted, and usually inventory decreases from the seasonal high in mid-summer to the seasonal lows in December and January.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.

Inventory decreased 22.5% year-over-year in November from November 2011. This is the 21st consecutive month with a YoY decrease in inventory.Months of supply declined to 4.8 months in November.

This was above expectations of sales of 4.90 million. For existing home sales, the key number is inventory - and the sharp year-over-year decline in inventory is a positive for housing. I'll have more later ...

Weekly Initial Unemployment Claims at 361,000

by Calculated Risk on 12/20/2012 08:30:00 AM

The DOL reports:

In the week ending December 15, the advance figure for seasonally adjusted initial claims was 361,000, an increase of 17,000 from the previous week's revised figure of 344,000. The 4-week moving average was 367,750, a decrease of 13,750 from the previous week's unrevised average of 381,500.The previous week was revised up from 343,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 367,750.

The recent spike in the 4 week average was due to Hurricane Sandy as claims increased significantly in NY, NJ and other impacted areas. Now, as expected, the 4-week average is back to the pre-storm level.

Weekly claims were slightly higher than the 359,000 consensus forecast.

And here is a long term graph of weekly claims:

Note: We use the 4-week average to smooth out noise, but following an event like Hurricane Sandy, the 4-week average lags the event. It looks like the average should decline again next week, perhaps to a new low for the year. The low for the year is 363,000.