by Calculated Risk on 1/04/2013 11:52:00 AM

Friday, January 04, 2013

Employment Report Comments and more Graphs

Here is a table of the change in payroll employment on an annual basis (before benchmark revisions - the revision through March 2012 will be released next month and will show more jobs added based on the preliminary estimate):

| Annual Change Payroll Employment (000s)

| |||

|---|---|---|---|

| Private | Public | Total | |

| 2006 | 1,859 | 209 | 2,068 |

| 2007 | 812 | 288 | 1,100 |

| 2008 | -3,782 | 179 | -3,603 |

| 2009 | -4,984 | -76 | -5,060 |

| 2010 | 1,248 | -221 | 1,027 |

| 2011 | 2,105 | -265 | 1,840 |

| 2012 | 1,903 | -68 | 1,835 |

Employment growth in 2012 was mostly in line with expectations. A little good news - it appears we are near the end of the state and local government layoffs (see last graph), but the Federal government layoffs are ongoing. Look at the table - four consecutive years of public sector job losses is unprecedented since the Depression.

The first graph below shows the employment-population ratio for the 25 to 54 age group. This has been moving sideways lately, and that shows the labor market is still weak. Also seasonal retail hiring slowed sharply in December (3rd graph) - but overall seasonal hiring suggests a decent holiday retail season.

Hopefully employment growth will pick up some in 2013, although austerity probably means another year of sluggish growth. Here are a several more graphs...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.Since the participation rate has declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio increased in December to 75.9% from 75.7% in November. This has generally been trending up - although the improvement stalled in 2012 - and the ratio is still very low.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers at a slow pace in December.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.This really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 88.3 thousand workers (NSA) net in December. The combined level for October, November is the highest since 2006. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers were initially optimistic about the holiday season, but sales might have slowed in December. There is a decent correlation between retail hiring and retail sales, see: Retail: Seasonal Hiring vs. Retail Sales, and the retail season was probably decent.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 7.9 million, changed little in December. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in December to 7.92 million from 8.14 million in November.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 14.4% in December.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.77 million workers who have been unemployed for more than 26 weeks and still want a job. This was down slightly from 4.78 million in November, and is at the lowest level since June 2009. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. In 2012, state and local government employment declined by 26,000 jobs.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing. Overall government employment has seen an unprecedented decline over the last 3+ years (not seen since the Depression).

ISM Non-Manufacturing Index increases in December

by Calculated Risk on 1/04/2013 10:00:00 AM

Note: I'll have more on the employment report soon.

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 36th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56.1 percent in December, 1.4 percentage points higher than the 54.7 percent registered in November. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 60.3 percent, which is 0.9 percentage point lower than the 61.2 percent reported in November, reflecting growth for the 41st consecutive month. The New Orders Index increased by 1.2 percentage points to 59.3 percent. The Employment Index increased by 6 percentage points to 56.3 percent, indicating growth in employment for the fifth consecutive month at a significantly faster rate. The Prices Index decreased 0.4 percentage point to 56.6 percent, indicating prices increased at a slightly slower rate in December when compared to November. According to the NMI™, 13 non-manufacturing industries reported growth in December. Respondents' comments remain mixed and are mostly positive about business conditions and the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in December than in November. The internals were strong with the employment index and new order up.

December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

by Calculated Risk on 1/04/2013 08:30:00 AM

From the BLS:

Nonfarm payroll employment rose by 155,000 in December, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised from +146,000 to +161,000.

Click on graph for larger image.

Click on graph for larger image.The headline number was at expectations of 157,000. Employment for October was revised down slightly, and November payroll growth was revised up.

The second graph shows the unemployment rate.

The unemployment rate was unchanged at 7.8% (The November unemployment rate was revised up from 7.7% as part of the annual household report revision).

The unemployment rate is from the household report and the household report showed only a small increase in employment.

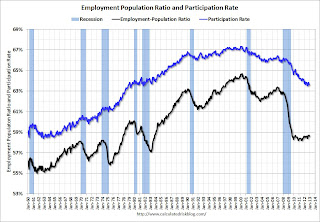

The unemployment rate is from the household report and the household report showed only a small increase in employment.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.6% in December (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio decreased to 58.6% in December (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was another sluggish growth employment report. I'll have much more later ...

Thursday, January 03, 2013

Friday: Employment Report

by Calculated Risk on 1/03/2013 09:20:00 PM

The key report of the week will be released Friday morning: the December Employment Report. The consensus (see below) increased today based on the better than expected ADP employment report. Here is a summary of recent data:

• The ADP employment report showed an increase of 215,000 private sector payroll jobs in December. This was above expectations. Historically the ADP report hasn't been very useful in predicting the BLS report for any one month, although the methodology changed three months ago and may be more useful in predicting the BLS report. In general this suggests employment growth was above expectations.

• The ISM manufacturing employment index increased in December to 52.7%, up from 48.4% in November.

• Initial weekly unemployment claims averaged about 362,000 in December. This was the low for the year. A positive for employment.

For the BLS reference week (includes the 12th of the month), initial claims were at 362,000; the lowest for a reference week this year.

• The small business index from Intuit showed 15,000 payroll jobs added, down from 25,000 in November.

• And on the unemployment rate from Gallup:

Gallup's seasonally unadjusted unemployment rate for the U.S. workforce was 7.7% for the month of December, statistically unchanged from 7.8% at the end of November. Gallup's seasonally adjusted unemployment rate is 7.9%, a 0.4-point decline over November.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution. So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate, but this does suggest little change in December from 7.7% in November.

This data suggests a stronger employment report for December than for November, and perhaps over 200 thousand jobs added.

Friday economic releases:

• At 8:30 AM, the Employment Report for December will be released. The consensus is for an increase of 157,000 non-farm payroll jobs in December; there were 146,000 jobs added in November. The consensus is for the unemployment rate to increase to 7.8% in December, up from 7.7% in November.

• At 10:00 AM, ISM non-Manufacturing Index for December. The consensus is for a decrease to 54.5 from 54.7 in November. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.3% increase in orders.

• At 3:00 PM, Speech by Fed Vice Chair Janet Yellen, "Systemic Risk", At the American Economic Association/American Finance Association Joint Luncheon, San Diego, California

U.S. Light Vehicle Sales at 15.3 million annual rate in December

by Calculated Risk on 1/03/2013 04:00:00 PM

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.

This was above the consensus forecast of 15.1 million SAAR (seasonally adjusted annual rate). Note: Some of the increase in November was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October, and sales might have been boosted slightly in December from some storm related bounce back.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 15.31 million SAAR from WardsAuto).

Click on graph for larger image.

Click on graph for larger image.

Sales in 2012 were just over 14.4 million, up from 12.7 million rate for the same period of 2011. Last year sales were depressed for several months (May through August) due to supply chain issues related to the tsunami in Japan.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

This shows the huge collapse in sales in the 2007 recession.

Sales were up over 13% in 2012, and auto sales have been a key contributor to the economy over the last three years. Sales will probably increase in 2013, but not at a double digit rate.