by Calculated Risk on 1/05/2013 01:27:00 PM

Saturday, January 05, 2013

Summary for Week Ending January 4th

Happy New Year to all!

The key story of the week was the fiscal agreement. Unfortunately the media did an excellent job of confusing most people.

Remember - the "fiscal cliff" was about too much austerity too quickly (about reducing the deficit too quickly). The "fiscal cliff" included expiring tax cuts (income, payroll), expiring spending (unemployment insurance, etc.) and the "sequester" (a combination of defense and other spending cuts). The sequester has been delayed for two months, so we don't know the size of the cuts yet, but it appears the amount of austerity will not be large enough to drag the economy into a new recession. Still, austerity will be a drag in 2013 and that probably means another year of sluggish growth.

I would have argued for a different mix of policies, but reducing the amount of austerity was achieved - and this was a key goal for the fiscal agreement. Long term debt sustainability is still an issue (not part of the "fiscal cliff"), but the deficit is declining right now, and will decline further in 2013. This agreement contained some short term deficit reduction (just the end of the payroll tax cut will reduce the deficit by around $120 billion in 2013 compared to 2012).

The economic data was mixed. The employment report indicated sluggish payroll growth with the unemployment rate still very high at 7.8%. Auto sales were down from November, but still solid. Construction spending was down in November, but residential construction spending was up (non-residential and public spending was down). And the ISM manufacturing and service indexes increased in December, suggesting some improvement.

It appears 2012 ended with sluggish growth. There are reasons for optimism for 2013, but the austerity at the Federal level will be a significant drag all year.

Here is a summary of last week in graphs:

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

From the BLS:

Nonfarm payroll employment rose by 155,000 in December, and the unemployment rate was unchanged at 7.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for October was revised from +138,000 to +137,000, and the change for November was revised from +146,000 to +161,000.

Click on graph for larger image.

Click on graph for larger image.The headline number was at expectations of 157,000. Employment for October was revised down slightly, and November payroll growth was revised up.

The second graph shows the unemployment rate.

The unemployment rate was unchanged at 7.8% (The November unemployment rate was revised up from 7.7% as part of the annual household report revision).

The unemployment rate is from the household report and the household report showed only a small increase in employment.

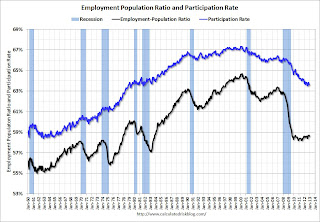

The unemployment rate is from the household report and the household report showed only a small increase in employment.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.6% in December (blue line. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio decreased to 58.6% in December (black line). I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Here is a table of the change in payroll employment on an annual basis (before benchmark revisions - the revision through March 2012 will be released next month and will show more jobs added based on the preliminary estimate):

| Annual Change Payroll Employment (000s) | |||

|---|---|---|---|

| Private | Public | Total | |

| 2006 | 1,859 | 209 | 2,068 |

| 2007 | 812 | 288 | 1,100 |

| 2008 | -3,782 | 179 | -3,603 |

| 2009 | -4,984 | -76 | -5,060 |

| 2010 | 1,248 | -221 | 1,027 |

| 2011 | 2,105 | -265 | 1,840 |

| 2012 | 1,903 | -68 | 1,835 |

Employment growth in 2012 was mostly in line with expectations. A little good news - it appears we are near the end of the state and local government layoffs, but the Federal government layoffs are ongoing. Look at the table - four consecutive years of public sector job losses is unprecedented since the Depression.

• U.S. Light Vehicle Sales at 15.3 million annual rate in December

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.

Based on an estimate from WardsAuto, light vehicle sales were at a 15.31 million SAAR in December. That is up 13% from December 2011, and down 1% from the sales rate last month.This was above the consensus forecast of 15.1 million SAAR (seasonally adjusted annual rate). Note: Some of the increase in November was a bounce back from Hurricane Sandy that negatively impacted sales at the end of October, and sales might have been boosted slightly in December from some storm related bounce back.

Sales were up over 13% in 2012, and auto sales have been a key contributor to the economy over the last three years. Sales will probably increase in 2013, but not at a double digit rate.

• ISM Manufacturing index increased in December to 50.7

The ISM manufacturing index indicated expansion in December. PMI was at 50.7% in December, up from 49.5% in November. The employment index was at 52.7%, up from 48.4%, and the new orders index was at 50.3%, unchanged from November.

The ISM manufacturing index indicated expansion in December. PMI was at 50.7% in December, up from 49.5% in November. The employment index was at 52.7%, up from 48.4%, and the new orders index was at 50.3%, unchanged from November.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 50.5% and suggests manufacturing expanded in December.

• ISM Non-Manufacturing Index increases in December

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction.

The December ISM Non-manufacturing index was at 56.1%, up from 54.7% in November. The employment index increased in December to 56.3%, up sharply from 50.3% in November. Note: Above 50 indicates expansion, below 50 contraction. This graph shows the ISM non-manufacturing (Service) index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 54.5% and indicates faster expansion in December than in November. The internals were strong with both the employment index and new order index up.

• Construction Spending declined in November

The Census Bureau reported that overall construction spending decreased in November:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2012 was estimated at a seasonally adjusted annual rate of $866.0 billion, 0.3 percent below the revised October estimate of $868.2 billion. The November figure is 7.7 percent above the November 2011 estimate of $804.0 billion.

In November 2012, private residential construction spending was the largest category for the first time since 2007 - but spending is still very low (at 1998 levels not adjusted for inflation). Note: Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected).

In November 2012, private residential construction spending was the largest category for the first time since 2007 - but spending is still very low (at 1998 levels not adjusted for inflation). Note: Residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.

Private residential spending is 56% below the peak in early 2006, and up 33% from the post-bubble low. Non-residential spending is 29% below the peak in January 2008, and up about 30% from the recent low.Public construction spending is now 15% below the peak in March 2009 and just above the post-bubble low.

The second graph shows the year-over-year change in construction spending.

On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is up 8% year-over-year mostly due to energy spending (power and electric). Public spending is down 3% year-over-year.

• Weekly Initial Unemployment Claims increase to 372,000

The DOL reports:

The DOL reports:In the week ending December 29, the advance figure for seasonally adjusted initial claims was 372,000, an increase of 10,000 from the previous week's revised figure of 362,000.Weekly claims were above the 363,000 consensus forecast.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 360,000.

Weekly claims are very volatile during the holiday season, but the 4-week average finished 2012 near the low for the year.

Schedule for Week of Jan 6th

by Calculated Risk on 1/05/2013 08:06:00 AM

Note: I'll post a summary for last week later today.

This will be a light week for economic data. The key report for this week will be the November trade balance report on Friday.

Also Reis will release their Q4 Office, Mall and Apartment vacancy rate surveys this week. Last quarter Reis reported falling vacancy rates for apartments, malls, and offices.

Early: Reis Q4 2012 Office survey of rents and vacancy rates.

Early: Reis Q4 2012 Apartment survey of rents and vacancy rates.

7:30 AM ET: NFIB Small Business Optimism Index for December. The consensus is for an increase to 87.9 from 87.5 in November.

3:00 PM: Consumer Credit for November from the Federal Reserve. The consensus is for credit to increase $13.2 billion in November.

Early: Reis Q4 2012 Mall Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 362 thousand from 372 thousand last week.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in October to 3.675 million, up from 3.547 million in September. The number of job openings (yellow) has generally been trending up, and openings are up about 8% year-over-year compared to October 2011.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for November. The consensus is for a 0.3% increase in inventories.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. Both exports and imports decreased in October. US trade has slowed recently.

The consensus is for the U.S. trade deficit to decrease to $41.1 billion in November from $42.2 billion in October. Export activity to Europe will be closely watched due to economic weakness. Note: the strike at the ports of Long Beach and Los Angeles started in late November and impacted this report.

8:30 AM: Import and Export Prices for December. The consensus is a 0.1% increase in import prices.

Friday, January 04, 2013

Unofficial Problem Bank list declines to 834 Institutions

by Calculated Risk on 1/04/2013 09:22:00 PM

Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 4, 2012.

Changes and comments from surferdude808:

Quiet start to the new year for the Unofficial Problem Bank List as there were only four removals this week. The removals push the list count down to 834 institutions with assets of $311.6 billion. A year ago, the list held 970 institutions with assets of $391.2 billion.Earlier on employment:

Actions were terminated against CommerceWest Bank, N.A., Irvine, CA ($340 million) and Farmers State Bank, Victor, MT ($315 million). The Savannah Bank, National Association, Savannah, GA ($672 million) and Bryan Bank & Trust, Richmond Hill, GA merged into SCBT, Columbia, SC during December 2012. Next week will likely be as quiet; however, the FDIC may have a pent-up closing or two that have been on ice through the holidays they need to get done.

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

• Employment Report Comments and more Graphs

• Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

AAR: Rail Traffic "mixed" in December

by Calculated Risk on 1/04/2013 06:20:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Annual and Monthly Traffic for December

The Association of American Railroads (AAR) today reported mixed 2012 rail traffic compared with 2011. U.S. rail intermodal volume totaled 12.3 million containers and trailers in 2012, up 3.2 percent or 374,918 units, over 2011. Carloads totaled 14.7 million in 2012, down 3.1 percent or 476,322 carloads, from 2011. Intermodal volume in 2012 was the second highest on record, down 0.1 percent or 14,885 containers and trailers, from the record high totals of 2006.

...

“Coal and grain typically account for around half of U.S. rail carloads, so when they’re down, chances are good that overall rail carloads are down too, as we saw in 2012,” said AAR Senior Vice President John T. Gray. “That said, a number of key rail carload categories showed solid improvement in 2012, including categories like autos and lumber that are most highly correlated with economic growth. Meanwhile, intermodal just missed setting a new volume record in 2012.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows U.S. average weekly rail carloads (NSA).

U.S. railroads originated 1,086,990 carloads in December 2012, down 4.2% (48,071 carloads) from December 2011 and an average of 271,748 carloads per week. Except for a tiny increase in January, year-over-year total U.S. rail carloads fell each month in 2012 compared with the same month in 2011 ...Note that building related commodities were up.

In December 2012, as in every prior month in 2012, year-over-year U.S. rail carloads would have increased if not for a decline in coal carloadings. Coal carloads totaled 446,233 in December 2012, down 13.3% (68,372 carloads) from December 2011.

Grain carloads totaled 72,422 in December 2012, down 13.9% (11,708 carloads) from December 2011. December 2012’s average weekly grain carloads of 18,106 were the lowest for any December on record.

...

Other commodities showing carload increases on U.S. railroads in December 2012 compared with December 2011 include motor vehicles and parts (up 7,252 carloads, or 13.9%) and crushed stone, gravel, and sand (up 5,419 carloads, or 9.1%. Carloads of stone, clay and glass products were up 1,902, or 7.8%, in December 2012, while carloads of lumber and wood products were 1,673, or 16.3%, higher for the month.

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs reprinted with permission.

Graphs reprinted with permission.Intermodal traffic is near peak levels (black line).

U.S. rail intermodal traffic totaled 888,002 containers and trailers in December 2012, up 1.7% (14,690 intermodal units) over December 2011 and an average of 222,001 per week ... For all of 2012, U.S. rail intermodal volume totaled 12,267,336 containers and trailers, up 3.2% (374,918 units) over 2011 and just 0.1% (14,885 units) off 2006’s record. A new record almost certainly would have been set in 2012 if not for the strike by harbor clerks at the Ports of Los Angeles and Long Beach beginning in late November, and/or Hurricane Sandy, which severely disrupted rail and port operations on the East Coast beginning in late October.Intermodal will probably set a new record in 2013.

Earlier on employment:

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

• Employment Report Comments and more Graphs

• Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

• Employment graph gallery

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 1/04/2013 02:31:00 PM

Here are the earlier employment posts (with graphs):

• December Employment Report: 155,000 Jobs, 7.8% Unemployment Rate

• Employment Report Comments and more Graphs

• Employment graph gallery

And a few more graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels.

The the long term unemployed is at 3.1% of the labor force - and the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 63.2 in December, up from 56.6 in November. For manufacturing, the diffusion index increased to 59.3, up from 51.2 in November.

This is a little more technical. The BLS diffusion index for total private employment was at 63.2 in December, up from 56.6 in November. For manufacturing, the diffusion index increased to 59.3, up from 51.2 in November. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Even though the headline number was similar for November and December, it appears job growth was spread across more industries in December, and that is good news.