by Calculated Risk on 1/06/2013 09:18:00 PM

Sunday, January 06, 2013

Sunday Night Futures

From the NY Times: Deal in Foreclosure Case Is Imminent, Officials Say

A $10 billion settlement to resolve claims of foreclosure abuses by 14 major lenders is expected to be announced as early as Monday, several people with knowledge of the discussions said on Sunday.This agreement ends the foreclosure review process that was apparently not effective. This is an addition to the settlement last year.

The settlement comes after weeks of negotiations between federal regulators and the banks, and covers abuses like flawed paperwork and botched loan modifications ...

An estimated $3.75 billion of the $10 billion is to be distributed in cash relief to Americans who went through foreclosure in 2009 and 2010, these people said. An additional $6 billion is to be directed toward homeowners in danger of losing their homes after falling behind on their monthly payments.

Monday economic release:

• Reis Q4 2012 Office survey of rents and vacancy rates. In Q3 Reis reported the office vacancy rate declined to 17.1%, from 17.2% in Q2. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

Weekend:

• Summary for Week Ending Jan 4th

• Schedule for Week of Jan 6th

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

The Asian markets are mixed tonight; the Shanghai Composite index is up slightly, and the Nikkei is down 0.4%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 20.

Oil prices have moved up a recently with WTI futures at $92.97 per barrel and Brent at $111.32 per barrel. Gasoline prices have also increased a little recently.

Question #9 for 2013: How much will Residential Investment increase?

by Calculated Risk on 1/06/2013 06:26:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Note: Here is a review of my 2012 Forecasts

9) Residential Investment: Residential investment (RI) picked up in 2012, with new home sales and housing starts increasing 20% or so. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. This still leaves RI at a historical low level. How much will RI increase in 2013?

First a graph of RI as a percent of Gross Domestic Product (GDP) through Q3 2012.

Click on graph for larger image.

Click on graph for larger image.

Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish so far. Residential investment finally turned positive during 2011 and made a positive contribution to GDP in 2012.

Residential investment as a percent of GDP is just above the record low, and it seems likely that residential investment as a percent of GDP will increase further in 2013.

The second graph shows total and single family housing starts through November 2012.

The second graph shows total and single family housing starts through November 2012.

Housing starts are on pace to increase about 25% in 2012. And even after the sharp increase last year, the approximately 770 thousand housing starts in 2012 will still be the 4th lowest on an annual basis since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011).

Here is a table showing housing starts over the last few years. No one should expect an increase to 2005 levels, however demographics and household formation suggest starts will return to close to the 1.5 million per year average from 1959 through 2000. That means starts will come close to doubling over the next few years from the 2012 level.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 770.0 | 26% | 535.0 | 24% |

| 12012 estimated | ||||

The third graph shows New Home Sales since 1963 through November 2012. The dashed line is the current sales rate.

The third graph shows New Home Sales since 1963 through November 2012. The dashed line is the current sales rate.Just like for RI as a percent of GDP, and housing starts, new home sales were up in 2012, but are still near the low historically.

New home sales will still be competing with distressed sales (short sales and foreclosures) in many areas in 2013 - and probably even more foreclosures in some judicial states. Also I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline). Both of these factors could slow the growth of residential investment, but I expect another solid year of growth.

Here are some recent forecasts for housing in 2013. I expect growth for new home sales and housing starts in the 20% to 25% range in 2013 compared to 2012. That would still make 2013 the sixth weakest year on record for housing starts (behind 2008 through 2012), and the seventh or eight weakest for new home sales. So I expect further growth in 2014 too.

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Question #10 for 2013: Europe and the Euro

by Calculated Risk on 1/06/2013 02:44:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2013. I'll try to add some thoughts, and maybe some predictions for each question.

Mostly I focus on the US, but like everyone I've been watching Europe a little more closely over the last few years. Unfortunately the situation in Europe remains grim, with high unemployment - especially in Greece and Spain - and most of the eurozone in recession.

However the crisis has eased a bit. There are several reasons - one key is the the ECB's longer-term refinancing operations (LTROs) that was offered in December 2011. These have a 36 month maturity, and the LTROs have helped lower borrowing costs in Europe.

This graph, from the Atlanta Fed, shows the 10-year bond spreads for a few European countries (this is the difference between the 10-year bond of each country to the 10-year of Germany).

By this measure, the financial crisis has eased recently (the recent agreements with Greece have helped too).

With a Greek deal in place, and Germany's Merkel motivated by the election later this year to keep the eurozone together, and a strong commitment by other policymakers to the euro, I think there is a good chance that the eurozone and the euro will make it through 2013 intact.

Even though I've been pessimistic on Europe (In 2011, I argued that the eurozone was heading into recession), I was less pessimistic than many others. Each of the last two years, I argued the eurozone would stay together (2011: Europe and the Euro and 2012: Europe and the Euro). My guess is the eurozone makes it through another year without losing any countries or a serious collapse. Obviously several countries are near the edge, and the key will be to return to expansion soon.

Note: unless the eurozone "implodes", I don't think Europe poses a large downside risk to the US. If there is a breakup of the euro (something I do not expect in 2013), then the impact on the US could be significant due to financial tightening.

Here are the ten questions for 2013 and a few predictions:

• Question #1 for 2013: US Fiscal Policy

• Question #2 for 2013: Will the U.S. economy grow in 2013?

• Question #3 for 2013: How many payroll jobs will be added in 2013?

• Question #4 for 2013: What will the unemployment rate be in December 2013?

• Question #5 for 2013: Will the inflation rate rise or fall in 2013?

• Question #6 for 2013: What will happen with Monetary Policy and QE3?

• Question #7 for 2013: What will happen with house prices in 2013?

• Question #8 for 2013: Will Housing inventory bottom in 2013?

• Question #9 for 2013: How much will Residential Investment increase?

• Question #10 for 2013: Europe and the Euro

Labor Force Participation Rate Update

by Calculated Risk on 1/06/2013 10:22:00 AM

I've written extensively about the participation rate, see: Understanding the Decline in the Participation Rate and Further Discussion on Labor Force Participation Rate.

In trying to forecast the change in the unemployment rate for 2013, it is important to forecast what will happen to the participation rate this year. The participation rate is the percentage of the working age population in the labor force. If more people join the workforce, then more jobs will be needed to push down the unemployment rate. However, if the participation rate stays flat in 2013 - or even declines further - then fewer jobs are needed to push down the unemployment rate.

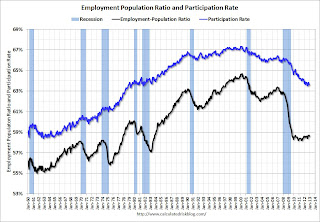

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Here is a repeat of a graph from the December employment report. The Labor Force Participation Rate was unchanged at 63.6% in December (blue line).

A key point: The recent decline in the participation rate was expected, and a large portion of the decline in the participation rate was due to changing demographics, as opposed to economic weakness.

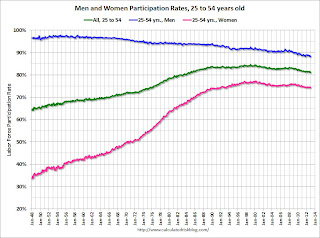

The second graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The second graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for prime working age women increased significantly from the mid 30s to the mid 70s and has mostly flattened out since then. The participation rate for women increased slightly in December to 74.5% and might increase a little in 2013.

The participation rate for prime working age men has been decreasing for decades - from the high 90s in the 1950s to just over 90% in 2005. In December, the participation rate for men increased slightly to 88.4% .

I still expect a little bounce back for both prime working age men and women - but not much.

There are other key demographic trends - younger people have been staying in school, so the participation rate for those under 25 has been falling - and older people have been staying in the work force longer, so the participation rate for older workers has been increasing.

Overall I've been expecting some small bounce back in the participation rate, but I don't think any bounce back will be huge - and that means it will take fewer jobs than some expect to lower the unemployment rate in 2013. This remains a key number to watch.

Saturday, January 05, 2013

Default Ceiling: Bluffing into the Nuts

by Calculated Risk on 1/05/2013 08:49:00 PM

I wrote several posts about the "debt ceiling" debate in 2011. The debate clearly scared many Americans and impacted the economy. Hopefully this time the "debt ceiling" will be raised well in advance of the deadline.

I prefer "default ceiling" because "debt ceiling" sounds like some sort of virtuous limit, when, in reality, the vote is about whether or not to the pay the bills - and voting for default is reckless and irresponsible.

Note: Several financial articles recently have used poker terms - and the title of this post is my contribution to this sad trend. "The Nuts" is the best possible poker hand in a given situation. Bluffing into the nuts is a losing play - and that is what the Congress is trying to do with the "debt ceiling". The sooner they fold, the better for the economy and the Congress.

From the WaPo: GOP dissension over debt-ceiling strategy

House Speaker John A. Boehner (R-Ohio) likewise insisted that Republicans hold the line, telling his members they must demand that every dollar they raise the debt limit be paired with commensurate spending cuts.It is a bluff. As Republican Senator Mitch McConnell noted in 2011, if the debt ceiling isn't raised the "Republican brand" would become toxic and synonymous with fiscal irresponsibility.

But other Republicans counseled caution, warning that pressure from the business community and the public to raise the $16.4 trillion federal borrowing limit renders untenable any threats not to do so and will weaken the GOP’s hand if their stance is perceived to be a bluff.

Part of the problem is some congressmen don't understand economics. Look at this quote from the WaPo article:

“It may be necessary to partially shut down the government in order to secure the long-term fiscal well being of our country, rather than plod along the path of Greece, Italy and Spain,” [Senate Minority Whip John Cornyn (R-Tex.)] wrote.First, hitting the default ceiling will not just "shut down the government", it will force the government to stop paying some bills (most of the bills are for Defense, Medicare, Social Security and interest payments on the debt).

Second, the US is not plodding along "the path of Greece, Italy and Spain". Geesh.

I reread some of my posts from 2011, as an example Debt Ceiling Charade: The Smart Options.

Option #1: Eliminate the debt ceiling. The debt ceiling is a joke. It serves no purpose except political posturing. It is not about the deficit - it is about paying the bills, and the U.S. will pay the bills.I still prefer Option #1, but one thing is clear, the Congress will fold and the debt ceiling will be raised. There might be some agreement with the "sequester" that gives Congress some cover, and if that is the approach, then Congress should look to settle this early.

...

Option #2: Pass a "clean" bill raising the debt ceiling enough to get through the next election (so the politicians don't have to embarrass themselves again). Congress could do this at any time. That is why voters would blame the party controlling the House if the debt ceiling is not raised.

In 2011, I started writing about the debt ceiling when it became clear the threat of default was impacting the economy. A couple of old posts: Debt Ceiling Charade impacting Short-Term Credit Markets and Random Thoughts. From July 30, 2011:

"I remain confident that Congress will raise the debt ceiling; however the circus in D.C. is clearly impacting the economy. This morning I spoke to a business owner who is negotiating a new lease to expand. His lawyer told him not to sign the lease until the debt ceiling issue is resolved. I believe similar caution has gripped business owners and consumers in many places - and impacting consumer and business confidence."This time I'm going to start criticizing Congress earlier in the process; 2011 was ridiculous and reckless.