by Calculated Risk on 1/15/2013 08:44:00 AM

Tuesday, January 15, 2013

Retail Sales increased 0.5% in December

On a monthly basis, retail sales increased 0.5% from November to December (seasonally adjusted), and sales were up 4.7% from December 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for for December, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $415.7 billion, an increase of 0.5 percent from the previous month and 4.7 percent above December 2011. ... The October to November 2012 percent change was revised from +0.3 percent to +0.4 percent.

Click on graph for larger image.

Click on graph for larger image.Sales for November were revised up to a 0.4% gain.

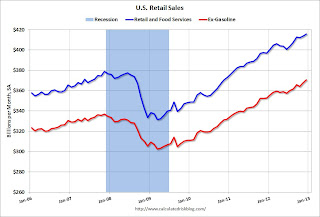

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 25.4% from the bottom, and now 9.7% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data, but just since 2006 (to show the recent changes).

The second graph shows the same data, but just since 2006 (to show the recent changes). Retail sales ex-autos increased 0.3%.

Excluding gasoline, retail sales are up 22.5% from the bottom, and now 10.0% above the pre-recession peak (not inflation adjusted).

The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 5.1% on a YoY basis (4.7% for all retail sales).

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

This was above the consensus forecast of a 0.3% increase, and suggests the initial "soft" reports for December were too pessimistic.

Monday, January 14, 2013

Tuesday: Retail Sales, PPI, Empire State Mfg Survey

by Calculated Risk on 1/14/2013 09:03:00 PM

From the NY Times: Obama Says G.O.P. Won’t Get ‘Ransom’ to Lift Debt Limit

“They will not collect a ransom in exchange for not crashing the American economy,” Mr. Obama vowed in the East Room, a week before his second inauguration. “The financial well-being of the American people is not leverage to be used. The full faith and credit of the United States of America is not a bargaining chip.”CR note: The "debt limit" is not about spending - it is about paying the bills.

The key in the short term is to NOT reduce the deficit too quickly (the fiscal agreement will probably add a 1.5% drag to the economy in 2013). The key in the long term is put the debt on a sustainable path. These are not contradictory, and right now we are on a path to reduce the deficit to about 3% of GDP in 2015. That is about the right pace following the financial crisis. That gives policymakers time to address the long run issues.

Tuesday economic releases:

• At 8:30 AM ET, Retail sales for December will be released. There have been a number of reports of "soft" holiday retail sales. The consensus is for retail sales to increase 0.2% in December, and to increase 0.3% ex-autos..

• Also at 8:30 AM, the BLS will release the Producer Price Index for December. The consensus is for a 0.1% decrease in producer prices (0.2% increase in core).

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for January will be released. The consensus is for a reading of 0.0, up from minus 8.1 in December (below zero is contraction).

• Also at 8:30 AM, Corelogic will release their House Price Index for November 2012.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report will be released.

Bernanke to Congress: Do your job, Pay the Bills

by Calculated Risk on 1/14/2013 05:35:00 PM

Fed Chairman Ben Bernanke was very clear. The "debt ceiling" is about paying the bills, not about new spending. He urged congress to do their job, raise the debt ceiling, and pay the bills. His preference was to abolish the "debt ceiling" since it is redundant.

From the WSJ: Bernanke Calls on Congress to Raise Debt Ceiling

"It’s very, very important that Congress take the necessary action to raise the debt ceiling to avoid the situation where the government doesn’t pay its bills,” said Mr. Bernanke ... “Raising the debt ceiling gives the government the ability to pay its existing bills–it doesn’t create new spending,” he said.At another point, Bernanke said the "debt ceiling" has "symbolic value", but he prefers eliminating it. He was very clear that Congress should do their job and raise the debt ceiling.

Bernanke also expressed concern about the long run sustainability of the debt (over decades), but that we also shouldn't cut the deficit too quickly and impact the "fragile recovery". He thought the fiscal cliff deal would subtract about 1.5% from GDP this year.

CR Note: As I've noted before, the "debt ceiling" sounds virtuous, but it is really just about paying the bills. Not paying the bills is reckless and irresponsible.

By stalling, Congress is scaring people and is probably already negatively impacting the economy. Congress should do their job. Today. I remain confident Congress will authorize paying the bills, but this delaying is embarrassing.

At 4 PM, Bernanke on "Monetary policy, recovery from the global financial crisis, and long-term challenges facing the U.S. economy

by Calculated Risk on 1/14/2013 03:35:00 PM

At 4 PM ET, Fed Chairman Ben Bernanke will speak at the University of Michigan's Rackham Auditorium.

The event will be streamed live here, and Bernanke will take questions on Twitter: #fordschoolbernanke

Note: Also streaming here.

If there are prepared remarks, I'll post the text at 4 PM.

Fed's Williams expects growth to pickup, Concerned about policy "uncertainty"

by Calculated Risk on 1/14/2013 01:30:00 PM

From San Francisco Fed President John Williams: The Economy and Monetary Policy in Uncertain Times. On the economic outlook:

As far as my outlook is concerned, I expect the economic expansion to gain momentum over the next few years. When final numbers come in, I expect growth in real gross domestic product—the nation’s total output of goods and services—to register about 1¾ percent in 2012. My forecast calls for GDP growth to rise to about 2½ percent this year and a little under 3½ percent in 2014. That pace is sufficient to bring the unemployment rate down gradually over the next few years. Specifically, I anticipate that the unemployment rate will stay at or above 7 percent at least through the end of 2014. And I expect inflation to remain somewhat below the Fed’s 2 percent target for the next few years as labor costs and import prices remain subdued. My forecast takes into account both the fiscal cliff agreement and the various stimulus measures the Fed has put in place.And on uncertainty:

emphasis added

The economy has been growing in fits and starts for the past three-and-a-half years. Every time economic growth appears to be picking up steam, something happens that brings it back down again. Sometimes the barriers to growth are natural, like the tsunami of 2011, and the drought and Superstorm Sandy last year. Other times they are man-made, like the crisis in Europe and our own fiscal cliff drama. ...CR comment: I think the main reason businesses aren't investing more is lack of demand, as opposed to "uncertainty". But it doesn't help having these self-inflicted wounds.

But the direct hangover from the financial crisis is not the only reason for sluggish growth. Most banks and other financial institutions have largely returned to health, and many nonfinancial businesses have been piling up cash. Their balance sheets look exceptionally strong. For businesses that can get credit, interest rates have rarely, if ever, been lower. You would think this is a great time to expand your business. Yet, many businesspeople appear to be locked in a paralyzing state of anxiety. As one of my business contacts said recently, “They’re just not willing to stick their necks out.”

What’s going on? The terrifying financial crisis followed by a bumpy recovery, the crisis and recession in Europe, the budget mess in the United States, questions about taxes and health-care reform—these and other factors have combined to undermine the confidence of Americans and make them suspicious about the durability of the economic recovery. Indeed, an index of policy uncertainty developed by academic economists recently soared to the highest level recorded in over 25 years. In a pattern reminiscent of the debt ceiling debate in the summer of 2011, the recent rise in uncertainty has been accompanied by a sharp drop-off in business and consumer confidence.