by Calculated Risk on 12/04/2013 02:00:00 PM

Wednesday, December 04, 2013

Fed's Beige Book: Economic activity increased "at a modest to moderate pace"

Fed's Beige Book "Prepared at the Federal Reserve Bank of Cleveland and based on information collected on or before November 22, 2013. This document summarizes comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials."

Reports from the twelve Federal Reserve Districts indicated that the economy continued to expand at a modest to moderate pace from early October through mid-November. Activity in the New York, Cleveland, Richmond, Atlanta, St. Louis, Minneapolis, and Dallas Districts grew at a moderate pace, while Philadelphia, Chicago, Kansas City, and San Francisco cited modest growth. Boston reported that economic activity continued to expand.And on real estate:

Residential real estate activity improved in Boston, Philadelphia, Chicago, St. Louis, Minneapolis, and San Francisco, while remaining steady or softening in other Districts. Some slowing in single-family home sales was attributed to seasonal factors. Nonetheless, sales remain largely above year-ago levels. Increasing demand, low to declining levels of inventory, and slowly rising new-home construction were cited by almost all Districts as reasons for a continued rise in home prices, but at a slower pace than was observed earlier in 2013. Historically low inventories of unsold homes were reported in Philadelphia, Richmond, Chicago, Kansas City, and Dallas. Chicago noted that the inventory of homes for sale is at a record low. In the Philadelphia, Cleveland, Kansas City, and San Francisco Districts, builders continued to face a scarcity of high-skilled trade workers. Boston, New York, Philadelphia, Cleveland, Richmond, and Chicago indicated that multifamily construction continued to experience moderate to strong growth, with strength concentrated in the apartment segment. Vacancy rates declined across most Districts.Overall this was similar to the previous beige book with economic activity increasing at a "modest to moderate" pace.

Commercial real estate activity remained stable or improved slightly across many Districts. Philadelphia, Cleveland, Richmond, Chicago, St. Louis, and Minneapolis all saw gains in industrial construction, while Boston, Chicago, and St. Louis cited a rise in hotel construction. The technology sector drove demand for commercial real estate in the San Francisco District, and Cleveland saw gains in affordable housing and shale-gas-related activity. The outlook of market participants is for continued improvement in the Philadelphia, Atlanta, Kansas City, and Dallas Districts, while contacts were cautiously optimistic in Boston and Cleveland.

emphasis added

ISM Non-Manufacturing Index at 53.9 indicates slower expansion in November

by Calculated Risk on 12/04/2013 11:35:00 AM

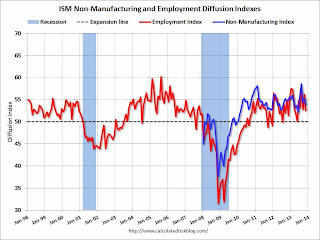

Catching up ... the November ISM Non-manufacturing index was at 53.9%, down from 55.4% in October. The employment index decreased in October to 52.5%, down from 56.2% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 47th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI® registered 53.9 percent in November, 1.5 percentage points lower than October's reading of 55.4 percent. This indicates continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 55.5 percent, which is 4.2 percentage points lower than the 59.7 percent reported in October, reflecting growth for the 52nd consecutive month, but at a slower rate. The New Orders Index decreased slightly by 0.4 percentage point to 56.4 percent, and the Employment Index decreased 3.7 percentage points to 52.5 percent, indicating growth in employment for the 16th consecutive month, but at a slower rate. The Prices Index decreased 3.9 percentage points to 52.2 percent, indicating prices increased at a slower rate in November when compared to October. According to the NMI®, 11 non-manufacturing industries reported growth in November. Respondents' comments for the most part indicate the non-manufacturing sector is maintaining a steady course of incremental growth and a positive outlook for the upcoming months."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.5% and indicates slower expansion in November than in October.

New Home Sales increased to 444,000 Annual Rate in October

by Calculated Risk on 12/04/2013 10:00:00 AM

Note: The New Home sales reports for September and October were both released today (delayed due to government shutdown).

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 444 thousand, and sales in September were at a 354 thousand SAAR.

August sales were revised down from 421 thousand to 379 thousand, and July sales were revised down from 390 thousand to 373 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in October 2013 were at a seasonally adjusted annual rate of 444,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 25.4 percent above the revised September rate of 354,000 and is 21.6 percent above the October 2012 estimate of 365,000."

Click on graph for larger image in graph gallery.

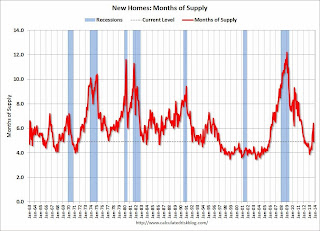

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply decreased in October to 4.9 months from 6.4 months in September.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of October was 183,000. This represents a supply of 4.9 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is near the record low. The combined total of completed and under construction is increasing, but still very low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In October 2013 (red column), 35 thousand new homes were sold (NSA). Last year 29 thousand homes were sold in October. The high for October was 105 thousand in 2005, and the low for October was 23 thousand in 2010.

This was above expectations of 425,000 sales in October, but there were significant downward revisions to prior months (as expected based on builder reports).

I'll have more later today - but no worries - the housing recovery will continue!

Trade Deficit decreased in October to $40.6 Billion

by Calculated Risk on 12/04/2013 08:30:00 AM

The Department of Commerce reported this morning:

[T]otal October exports of $192.7 billion and imports of $233.3 billion resulted in a goods and services deficit of $40.6 billion, down from $43.0 billion in September, revised. October exports were $3.4 billion more than September exports of $189.3 billion. October imports were $1.0 billion more than September imports of $232.3 billion.The trade deficit was close to the consensus forecast of $40.2 billion.

The first graph shows the monthly U.S. exports and imports in dollars through October 2013.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports increased in October.

Exports are 16% above the pre-recession peak and up 5% compared to October 2012; imports are just above the pre-recession peak, and up about 4% compared to October 2012.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $99.96 in October, down from $102.00 in September, and up slightly from $99.76 in October 2012. Prices will probably decline further in November. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $28.9 billion in October, down from $29.4 billion in October 2012. A majority of the trade deficit is related to China.

Overall it appears trade is picking up a little again.

ADP: Private Employment increased 215,000 in November

by Calculated Risk on 12/04/2013 08:19:00 AM

Private sector employment increased by 215,000 jobs from October to November, according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 185,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market remained surprisingly resilient to the government shutdown and brinkmanship over the treasury debt limit. Employers across all industries and company sizes looked through the political battle in Washington. If anything, job growth appears to be picking up.”

Note: ADP hasn't been very useful in predicting the BLS report on a monthly basis. The BLS report for November will be released on Friday.