by Calculated Risk on 12/06/2013 02:52:00 PM

Friday, December 06, 2013

Personal Income decreased 0.1% in October, Spending increased 0.3%

Still catching up ... the BEA released the Personal Income and Outlays report for October:

Personal income decreased $10.8 billion, or 0.1 percent ... in October, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $32.7 billion, or 0.3 percent.On inflation, the PCE price index decreased at a 0.4% annual rate in October, and core PCE prices increased at a 0.9% annual rate. This is very low and far below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in October, compared with an increase of 0.1 percent in September. ... The price index for PCE decreased less than 0.1 percent in October, in contrast to an increase of 0.1 percent in September. The PCE price index, excluding food and energy, increased 0.1 percent in October, the same increase as in September.

The following graph shows real Personal Consumption Expenditures (PCE) through October 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is just one month of Q4, but this suggests an increase in the PCE contribution to growth (compared to Q3). Also Q4 this year should be better than Q4 2012 (there was essentially no growth in Q4 2012).

I expect the change in private inventories to be a negative in Q4 2013 (inventories subtracted 2.0 percentage points in Q4 2012), but we won't see the large negative contribution from government this year (subtracted 1.3 percentage points in Q4 2012).

Preliminary December Consumer Sentiment increased to 82.5

by Calculated Risk on 12/06/2013 12:14:00 PM

Catching up ...

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for December was at 82.5, up from the November reading of 75.1.

This was well above the consensus forecast of 75.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. The decline in October and early November was probably also due to the government shutdown and another threat to "not pay the bills".

As usual sentiment rebounds fairly quickly following event driven declines, and I expect to see sentiment at post-recession highs very soon.

Employment Report: Decent Report, Solid Seasonal Retail Hiring

by Calculated Risk on 12/06/2013 10:13:00 AM

A few key points:

• Most of the employment impact from the government shutdown was reversed in the November report.

• Earlier I noted four items that the Fed would probably be looking at to taper in December. Here were the two related to employment:

1) "If the unemployment rate declines back to 7.2% or so in November (the September rate), then the FOMC might taper." Since the unemployment rate declined to 7.0%, this was met.

2) "If the year-over-year change in employment is still around 2.2 million for November, the FOMC might taper." Employment was up 2.293 million year-over-year in November.

The other two items for the Fed are inflation (core PCE is only up 1.1% year-over-year), and a budget agreement by next week (seems likely). At this point, inflation is the question mark for the Fed.

• Seasonal retail hiring remained solid. See the first graph below - this is a good sign for the holiday season ("Watch what they do, not what they say")

Seasonal Retail Hiring

Click on graph for larger image.

Click on graph for larger image.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

Retailers hired 471 thousand workers (NSA) net in November. This was just below the level in 2012, and suggests that retailers expect decent holiday sales. Note: this is NSA (Not Seasonally Adjusted).

Note: There is a decent correlation between seasonal retail hiring and holiday retail sales.

Employment-Population Ratio, 25 to 54 years old

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

These numbers declined sharply in October due to the government shutdown, and bounced back in the November report.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) fell by 331,000 to 7.7 million in November. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.This more than reversed the increase in part time workers that happened in October due to the government shutdown.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 13.2% in November from 13.8% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.066 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 4.063 million in October. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In November 2013, state and local governments added 14,000 jobs, and state and local employment is up 76 thousand so far in 2013.

I think state and local employment has bottomed. Of course Federal government layoffs are ongoing.

Overall this was a decent employment report.

November Employment Report: 203,000 Jobs, 7.0% Unemployment Rate

by Calculated Risk on 12/06/2013 08:30:00 AM

From the BLS:

The unemployment rate declined from 7.3 percent to 7.0 percent in November, and total nonfarm payroll employment rose by 203,000, the U.S. Bureau of Labor Statistics reported today. ...The headline number was above expectations of 180,000 payroll jobs added.

...

Both the number of unemployed persons, at 10.9 million, and the unemployment rate, at 7.0 percent, declined in November. Among the unemployed, the number who reported being on temporary layoff decreased by 377,000. This largely reflects the return to work of federal employees who were furloughed in October due to the partial government shutdown.

...

The civilian labor force rose by 455,000 in November, after declining by 720,000 in October. The labor force participation rate changed little (63.0 percent) in November. Total employment as measured by the household survey increased by 818,000 over the month, following a decline of 735,000 in the prior month. This over-the-month increase in employment partly reflected the return to work of furloughed federal government employees. The employment-population ratio increased by 0.3 percentage point to 58.6 percent in November, reversing a decline of the same size in the prior month.

...

The change in total nonfarm payroll employment for September was revised from +163,000 to +175,000, and the change for October was revised from +204,000 to +200,000. With these revisions, employment gains in September and October combined were 8,000 higher than previously reported.

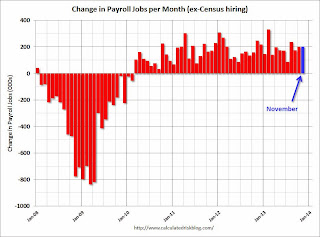

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

Employment is less than 1% below the pre-recession peak.

NOTE: The second graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

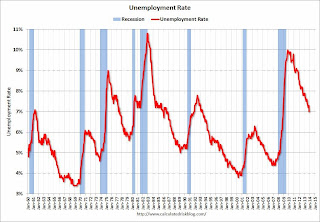

The third shows the unemployment rate.

The unemployment rate decreased in November to 7.0% from 7.3% in October.

This increase in the unemployment rate in October was related to the government shutdown - and was reversed in the November employment report.

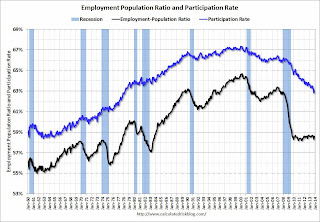

This increase in the unemployment rate in October was related to the government shutdown - and was reversed in the November employment report.The fourth graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in November to 63.0% from 62.8% in October (October decline was partially related to shutdown). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased in November to 58.6% from 58.3% in October (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

This was another solid employment report. Many of the negatives in the October report were related to the government shutdown and were mostly reversed in the November report. I'll have much more later ...

Thursday, December 05, 2013

Friday: Employment Report, Personal Income and Outlays

by Calculated Risk on 12/05/2013 06:57:00 PM

A couple more employment previews, first from David Mericle at Goldman Sachs:

We expect a 175k gain in both nonfarm payrolls and private payrolls in November, a bit below consensus expectations of 185k and a modest slowdown from the 204k gain seen in October. ... We expect that the unemployment rate will decline to 7.1% in November, reflecting both employment gains and the possibility that some of the decline in participation seen in October's distorted household survey will persist this month.And from Merrill Lynch:

We are looking for job growth of 175,000 in November, a slight slowdown from the 204,000 pace in October. The unemployment rate should fall to 7.2% from 7.3% while the workweek holds steady at 34.4 hours. ... Looking back at the recent history, when Thanksgiving is late in the month, there seems to be a downward bias in retail jobs in November and a reversal in December. The reverse is the case when the Thanksgiving holiday is early in the month, as it was last year. This could account for a swing of as many as 40,000 jobs. ... The household survey was distorted in the October report, leading to a sharp decline in the labor force and in the number of employed workers. This bias will be reversed in November as people returned to work after the shutdown. We therefore expect the participation rate to jump back to 63.1%, nearly returning to the September pace.Friday:

• At 8:30 AM ET, the Employment Report for November. The consensus is for an increase of 180,000 non-farm payroll jobs in November, down from the 204,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to decrease to 7.2% in November from 7.3% in October. A key will be if the participation rate increases too, reversing the sharp decline last month.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 75.5, up from 75.1 in November.

• At 3:00 PM, Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $15.0 billion in October.